Integration with IoT Technologies

The integration of RFID technology with Internet of Things (IoT) systems is emerging as a key driver for the data center-rfid market. This convergence allows for seamless communication between devices, enhancing data collection and analysis. In the US, the IoT market is expected to grow to $1.1 trillion by 2026, creating opportunities for RFID solutions to play a pivotal role in data centers. By leveraging IoT capabilities, organizations can optimize their operations, improve asset utilization, and enhance decision-making processes. The synergy between RFID and IoT technologies is likely to propel the data center-rfid market forward, as businesses seek to harness the power of interconnected devices for improved efficiency and productivity.

Regulatory Compliance and Standards

Regulatory compliance is becoming increasingly critical for organizations operating in the data center-rfid market. As data privacy and security regulations tighten, companies are compelled to adopt RFID solutions that ensure compliance with industry standards. In the US, the implementation of regulations such as the GDPR and CCPA has heightened the focus on data protection. This has led to a growing demand for RFID systems that can provide secure tracking and management of sensitive information. the data center-RFID market is expected to see increased investment in compliance-driven solutions., as organizations prioritize adherence to regulations while maintaining operational efficiency.

Enhanced Data Analytics Capabilities

The advancement of data analytics capabilities is driving growth in the data center-rfid market. Organizations are increasingly leveraging RFID technology to gather and analyze data related to asset utilization, inventory levels, and operational performance. This data-driven approach enables businesses to make informed decisions and optimize their operations. In the US, the market for data analytics is projected to reach $274 billion by 2026, indicating a strong demand for solutions that can provide actionable insights. The integration of RFID with advanced analytics tools is likely to enhance the value proposition of the data center-rfid market, as organizations seek to harness data for competitive advantage.

Growing Demand for Real-Time Asset Tracking

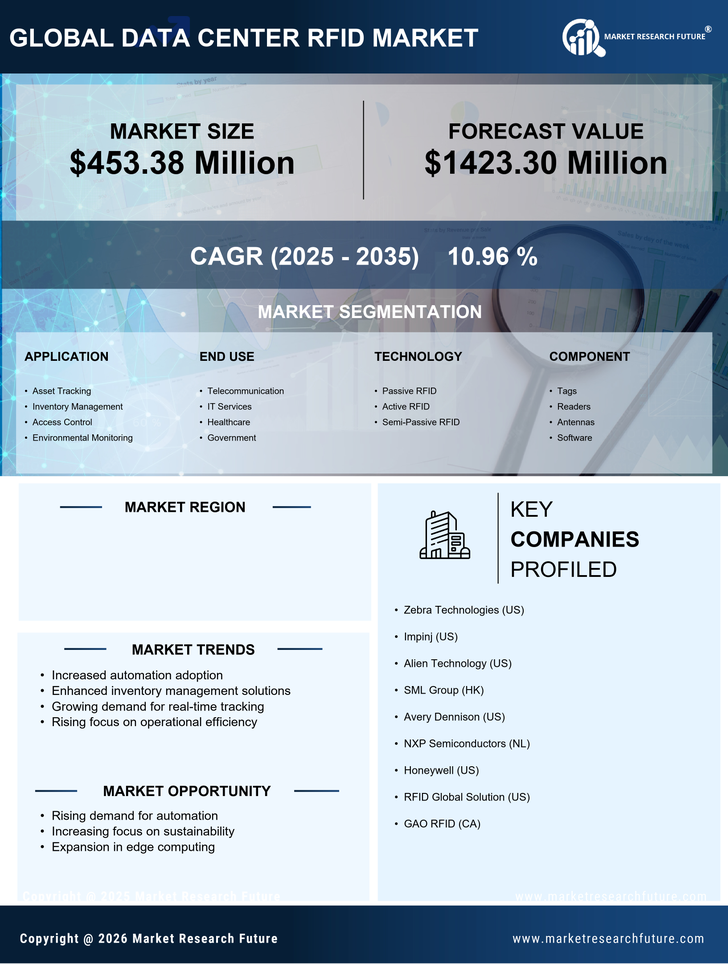

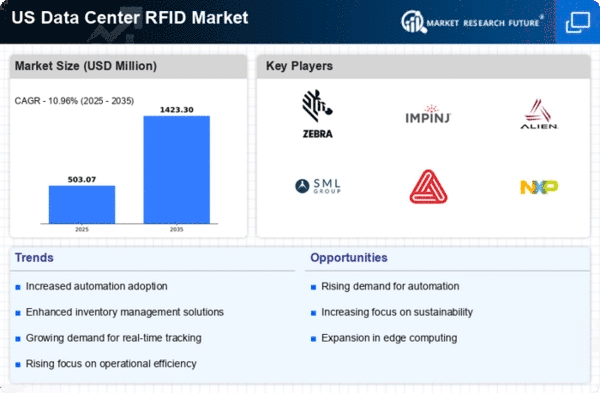

The data center-rfid market is experiencing a surge in demand for real-time asset tracking solutions. Organizations are increasingly recognizing the need for efficient inventory management and operational visibility. RFID technology enables precise tracking of assets, reducing the risk of loss and improving resource allocation. In the US, the market for RFID solutions is projected to reach approximately $10 billion by 2026, driven by the need for enhanced operational efficiency. This trend is particularly evident in data centers, where the ability to monitor equipment and inventory in real-time can lead to significant cost savings and improved service delivery. As businesses strive for greater efficiency, the data center-rfid market is likely to benefit from this growing demand for real-time tracking capabilities.

Rising Labor Costs and Workforce Challenges

the data center-RFID market is influenced by rising labor costs and challenges in workforce management.. As labor expenses continue to escalate, organizations are seeking automation solutions to reduce reliance on manual processes. RFID technology offers a means to streamline operations, minimize human error, and enhance productivity. In the US, labor costs have increased by approximately 3% annually, prompting businesses to explore innovative solutions. The adoption of RFID systems in data centers can lead to significant cost savings and improved operational efficiency, making it a compelling choice for organizations facing workforce challenges.