Increased Cyber Threats

The US Defense Cybersecurity Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Cyberattacks targeting defense infrastructure have surged, with the Department of Defense reporting a significant rise in incidents over the past few years. This escalation necessitates robust cybersecurity measures to protect sensitive data and systems. The market is projected to grow as defense agencies invest in advanced technologies to counteract these threats. In 2025, the US defense cybersecurity spending reached approximately $17 billion, reflecting a commitment to enhancing national security against cyber adversaries. As threats evolve, the industry must adapt, leading to innovations in cybersecurity solutions.

Technological Advancements

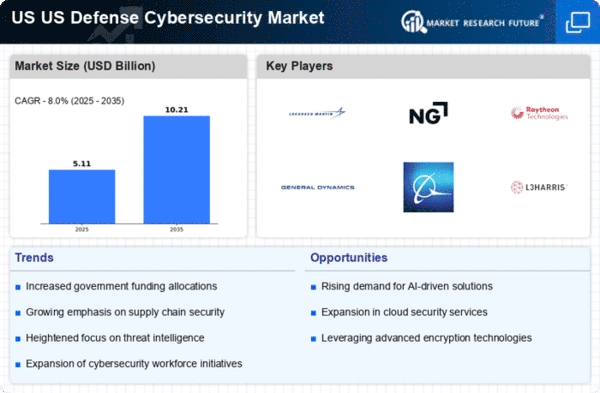

Technological advancements play a pivotal role in shaping the US Defense Cybersecurity Market. The integration of artificial intelligence, machine learning, and advanced analytics into cybersecurity solutions enhances threat detection and response capabilities. These technologies enable defense agencies to proactively identify vulnerabilities and mitigate risks. In 2025, the market for AI-driven cybersecurity solutions is projected to reach $5 billion, reflecting the growing reliance on technology to safeguard national security. As defense organizations seek to modernize their cybersecurity frameworks, the demand for innovative solutions is expected to rise, driving growth in the industry.

Public-Private Partnerships

Public-private partnerships are emerging as a crucial driver in the US Defense Cybersecurity Market. Collaboration between government agencies and private sector companies facilitates the sharing of information, resources, and expertise to combat cyber threats effectively. These partnerships enable the development of innovative cybersecurity solutions tailored to the unique needs of defense organizations. In 2025, the market is expected to witness increased investment in joint initiatives aimed at enhancing cybersecurity capabilities. By leveraging the strengths of both sectors, the industry can address complex cybersecurity challenges more efficiently, ultimately contributing to a more resilient national defense posture.

Evolving Regulatory Landscape

The evolving regulatory landscape significantly impacts the US Defense Cybersecurity Market. New regulations and compliance requirements are being introduced to address the increasing cyber threats faced by defense organizations. The Department of Defense has implemented stricter cybersecurity standards, compelling contractors and suppliers to enhance their security measures. This regulatory shift creates a demand for compliance solutions and services, driving growth in the market. As organizations strive to meet these requirements, the industry is likely to see an uptick in investments in cybersecurity technologies and services, fostering a more secure defense environment.

Government Initiatives and Funding

The US Defense Cybersecurity Market benefits from substantial government initiatives and funding aimed at bolstering national cybersecurity. The federal budget for cybersecurity has seen consistent increases, with the Department of Defense allocating a significant portion of its budget to cybersecurity measures. In 2025, funding for cybersecurity initiatives was estimated at $17 billion, underscoring the government's commitment to enhancing defense capabilities. This financial support fosters innovation and encourages private sector collaboration, driving the development of cutting-edge cybersecurity technologies. As the government prioritizes cybersecurity, the market is likely to expand, creating opportunities for companies specializing in defense cybersecurity solutions.