Innovation in Food Products

Innovation within the food industry is propelling the dietary fiber-market forward. Manufacturers are increasingly incorporating dietary fiber into a variety of products, ranging from snacks to beverages, to cater to the evolving preferences of health-conscious consumers. The introduction of novel fiber sources, such as inulin and resistant starch, is expanding the range of available options. This innovation not only enhances the nutritional profile of products but also improves taste and texture, making fiber more appealing to a broader audience. As a result, the dietary fiber-market is likely to see a diversification of product offerings, which could attract new consumers and drive overall market growth.

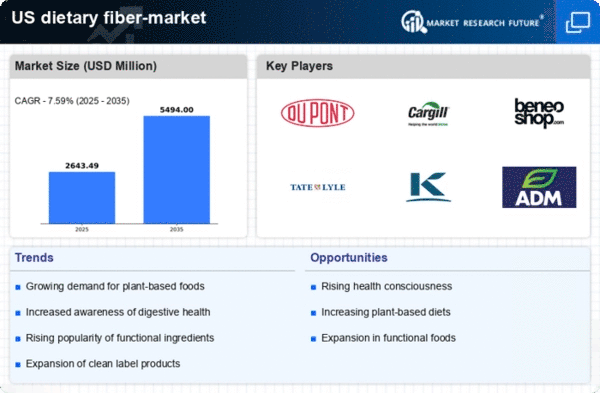

Growing Health Consciousness

The increasing awareness of health and wellness among consumers is a primary driver for the dietary fiber-market. As individuals become more informed about the benefits of dietary fiber, including its role in digestive health and weight management, demand for fiber-rich products is likely to rise. According to recent surveys, approximately 70% of consumers in the US actively seek out foods high in fiber. This trend is reflected in the growing sales of fiber supplements and fortified foods, which have seen a notable increase of 15% in the past year. The dietary fiber-market is thus positioned to benefit from this heightened health consciousness, as manufacturers innovate to meet consumer preferences for healthier options.

Rising Incidence of Lifestyle Diseases

The growing prevalence of lifestyle-related diseases, such as obesity and diabetes, is a critical driver for the dietary fiber-market. Research indicates that a high-fiber diet can help mitigate these health issues by promoting satiety and regulating blood sugar levels. In the US, the Centers for Disease Control and Prevention (CDC) reports that over 40% of adults are classified as obese, highlighting the urgent need for dietary interventions. Consequently, consumers are increasingly turning to fiber-rich foods as part of their health management strategies. This shift is reflected in the market, where products labeled as high in fiber are experiencing a surge in demand, potentially leading to a market growth rate of 10% annually.

Increased Availability of Fiber Supplements

The rising popularity of dietary supplements is another significant driver for the dietary fiber-market. As consumers seek convenient ways to enhance their fiber intake, the demand for fiber supplements has surged. The market for these supplements is projected to grow by 12% annually, reflecting a shift towards more accessible health solutions. Retailers are expanding their product lines to include a variety of fiber supplements, such as powders, capsules, and gummies, catering to different consumer preferences. This increased availability not only meets the needs of those who struggle to consume adequate fiber through food alone but also reinforces the dietary fiber-market's position as a vital component of modern nutrition.

Regulatory Support for Nutritional Guidelines

Government initiatives aimed at promoting healthier eating habits are significantly influencing the dietary fiber-market. The US Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have established dietary guidelines that emphasize the importance of fiber in daily nutrition. These guidelines recommend that adults consume at least 25g of fiber daily, which has led to increased public awareness and demand for fiber-rich foods. As a result, food manufacturers are reformulating products to enhance fiber content, thereby expanding their market offerings. This regulatory support not only encourages consumers to prioritize fiber intake but also drives innovation within the dietary fiber-market, as companies strive to comply with these guidelines.

Leave a Comment