Rise of Subscription-Based Models

The rise of subscription-based models is significantly influencing the direct carrier-billing market. As consumers gravitate towards services that offer recurring payments for content and services, the convenience of direct carrier-billing becomes increasingly appealing. This model allows users to subscribe to various services, such as music streaming or online gaming, with charges conveniently added to their mobile bills. Data indicates that subscription revenues in the digital content sector are expected to surpass $100 billion by 2025, highlighting the potential for direct carrier-billing to capture a substantial share of this market. This trend underscores the importance of adaptable payment solutions in the evolving landscape of consumer preferences.

Increased Focus on Consumer Privacy

Consumer privacy is increasingly shaping the direct carrier-billing market. As data breaches and privacy concerns become more prevalent, consumers are more cautious about sharing personal and financial information. Direct carrier-billing offers a level of anonymity that traditional payment methods do not, as it allows users to make purchases without disclosing sensitive information. This aspect is particularly appealing to privacy-conscious consumers, potentially driving adoption rates. Recent surveys indicate that over 70% of consumers express concerns about their online privacy, suggesting that payment solutions that prioritize security and anonymity, such as direct carrier-billing, may see increased traction in the market.

Growing Demand for Seamless Transactions

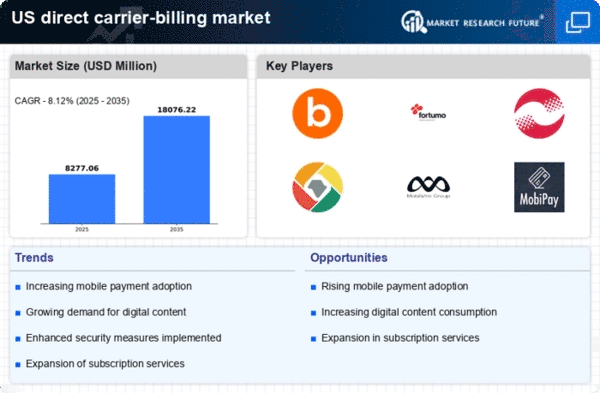

The direct carrier-billing market is experiencing a notable surge in demand for seamless transaction processes. Consumers increasingly prefer payment methods that eliminate the need for credit cards or bank accounts, favoring the convenience of charging purchases directly to their mobile phone bills. This trend is particularly pronounced among younger demographics, who are more inclined to utilize mobile devices for various transactions. According to recent data, mobile payment transactions in the US are projected to reach $1 trillion by 2025, indicating a robust growth trajectory. As a result, service providers are enhancing their offerings to cater to this demand, thereby driving the expansion of the direct carrier-billing market.

Integration with Digital Content Services

The integration of direct carrier-billing with digital content services is a pivotal driver in the direct carrier-billing market. As streaming platforms, gaming services, and app stores continue to proliferate, the need for efficient payment solutions becomes increasingly critical. This integration allows users to access content without the friction of traditional payment methods, thus enhancing user experience. Reports suggest that the gaming industry alone is expected to generate over $200 billion in revenue by 2025, with a significant portion of this revenue likely to be facilitated through direct carrier-billing. Consequently, this synergy between content providers and payment solutions is propelling the growth of the direct carrier-billing market.

Enhanced User Experience through Mobile Technology

The direct carrier-billing market is benefiting from advancements in mobile technology that enhance user experience. With the proliferation of smartphones and mobile applications, consumers are seeking quick and efficient payment methods that align with their on-the-go lifestyles. Direct carrier-billing offers a frictionless payment experience, allowing users to complete transactions with minimal effort. As mobile app usage continues to rise, particularly in sectors like e-commerce and entertainment, the demand for integrated payment solutions is likely to grow. Current estimates suggest that mobile app revenues in the US could reach $200 billion by 2025, further solidifying the role of direct carrier-billing in facilitating these transactions.