US Distributed Edge Cloud Market Overview

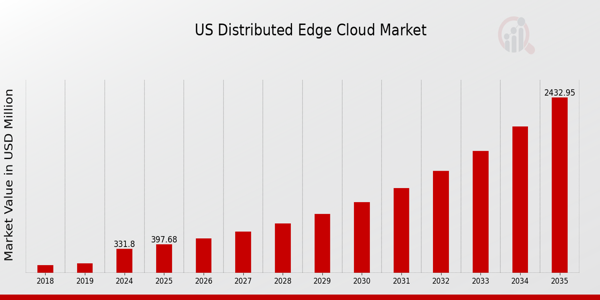

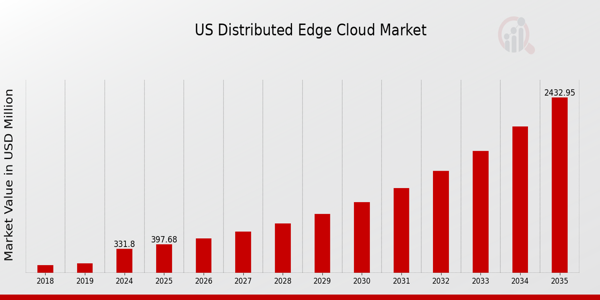

As per MRFR analysis, the US Distributed Edge Cloud Market Size was estimated at 271.97 (USD Million) in 2023. The US Distributed Edge Cloud Market Industry is expected to grow from 331.8 (USD Million) in 2024 to 2,432.87 (USD Million) by 2035. The US Distributed Edge Cloud Market CAGR (growth rate) is expected to be around 19.856% during the forecast period (2025 - 2035).

Key US Distributed Edge Cloud Market Trends Highlighted

The US Distributed Edge Cloud Market is undergoing substantial changes that are influenced by evolving consumer demands and technological advancements. Increasing demand for quicker data processing is a significant market driver, particularly in sectors such as retail, healthcare, and manufacturing. Businesses are progressively implementing peripheral computing solutions to mitigate latency and bandwidth concerns as they endeavor to improve the customer experience and optimize operational efficiency. The demand for distributed peripheral cloud infrastructure is further fueled by the increasing prevalence of Internet of Things (IoT) devices, which generate substantial volumes of data that necessitate immediate processing.

There are opportunities for companies to create innovative edge computing solutions that are tailored to a variety of industries, such as autonomous vehicles and smart cities. The investment in 5G networks throughout the United States also fosters a favorable environment for the expansion of distributed edge cloud services, which can facilitate real-time data processing by facilitating quicker and more reliable connections. Subsequently, the significance of edge computing in the United States market is underscored by the government's advocacy for digital transformation and improved cybersecurity measures in critical infrastructure.

The recent trends underscore the growing emphasis on energy-efficient and sustainable edge solutions, which is being driven by the growing awareness of environmental impact and regulatory pressures. The demand for eco-friendly peripheral cloud technologies is increasing as organizations strive to achieve sustainability objectives. Technology providers, telecom operators, and cloud service vendors are increasingly collaborating to capitalize on the advantages of distributed edge computing while simultaneously addressing security and regulatory compliance concerns. The US Distributed Edge Cloud Market is undergoing a rapid evolution, adapting to market demands and technological advancements in real time.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

US Distributed Edge Cloud Market Drivers

Growing Demand for Low Latency Services

The increasing need for low-latency services is a major driver for growth in the US Distributed Edge Cloud Market Industry. Industries such as gaming, autonomous vehicles, and IoT applications require real-time data processing. As per the Federal Communications Commission (FCC), broadband services with low latency are essential for the burgeoning 5G networks, which are projected to see a significant uptick in deployment across the US.

Furthermore, as per a report by Cisco, by 2025, it is estimated that there will be 15 billion connected devices in the US, and 75% of enterprise-generated data will be processed at the edge.Major companies like Amazon and Microsoft are investing heavily in their Edge Cloud services, striving to minimize latency further, thereby fostering a burgeoning Distributed Edge Cloud ecosystem in the US.

Increased Adoption of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices in the United States is a crucial driver for the US Distributed Edge Cloud Market Industry. The US Department of Commerce has noted that there were more than 7 billion IoT devices in operation in 2022, with that number expected to double by 2025.

This boom in IoT is leading to an increase in data generation at the edge, necessitating localized processing solutions that the Distributed Edge Cloud offers.Leading tech corporations such as Google and IBM are already partnering with various sectors to create IoT solutions that leverage edge computing, substantially highlighting the need for Distributed Edge Cloud solutions.

Growth in Data Privacy Regulations

The rise in data privacy regulations in the United States is significantly impacting the US Distributed Edge Cloud Market Industry. With events like California's Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) demanding stringent data compliance, organizations are seeking edge computing solutions that allow for localized data processing. This decentralized approach not only enhances security but also ensures compliance with regulations.

As per the International Association of Privacy Professionals (IAPP), there are currently over 50 data privacy regulations in effect across the US, creating an urgent need for distributed cloud services that adhere to these guidelines.

US Distributed Edge Cloud Market Segment Insights

Distributed Edge Cloud Market Service Insights

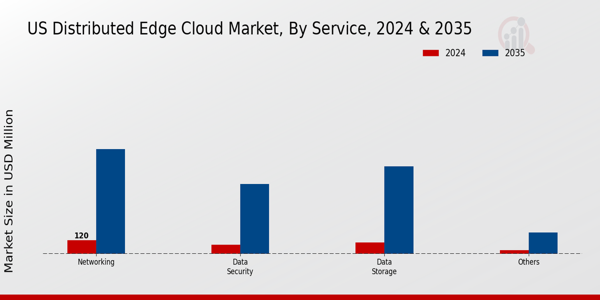

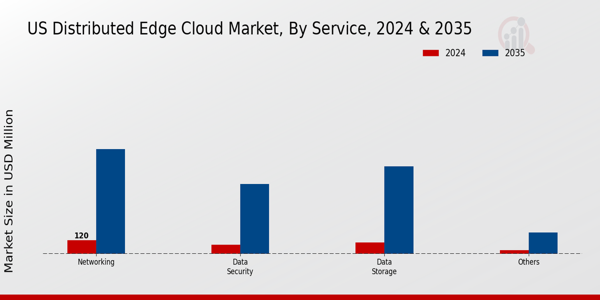

The service segment within the US Distributed Edge Cloud Market plays a crucial role in enhancing the overall efficiency and effectiveness of digital operations. This segment encompasses various crucial components such as Data Security, Data Storage, and Networking, collectively contributing to the market's robustness. The increasing reliance on cloud-based solutions is primarily driven by the need for rapid data processing and real-time analytics.

Data Security has emerged as a significant priority in the digital landscape, especially with the increasing number of data breaches and cyber threats that US organizations face.As a result, businesses are investing in advanced security measures to protect sensitive information, maintain customer trust, and ensure compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Data Storage solutions are also vital, as the exponential growth of data generated by users and devices drives the need for efficient and scalable storage solutions.

Organizations are increasingly adopting distributed storage architectures to ensure enhanced data accessibility and reliability.Furthermore, the Networking aspect of this segment is essential in facilitating seamless connectivity and communication between edge devices and centralized cloud platforms, significantly impacting the efficiency of IoT applications. As edge computing continues to gain traction, Networking services are becoming increasingly vital in providing low-latency connections that are necessary for real-time data processing.

Additionally, various other services, including edge analytics and application delivery, support organizations in optimizing operations and improving service delivery.Overall, the service segment within the US Distributed Edge Cloud Market reflects the growing demand for innovative solutions and infrastructure that can support the rapid advancements in technology and a data-driven economy. Achieving operational excellence in this segment is essential for businesses looking to leverage distributed edge cloud capabilities, ensuring they remain competitive and responsive to market demands. As the market continues to evolve, these services will be indispensable in driving further growth and innovation within the industry.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Distributed Edge Cloud Market Enterprise Size Insights

The US Distributed Edge Cloud Market presents valuable insights within the Enterprise Size segment, highlighting the diverse needs and dynamics of different organizations. Small and Medium-sized Enterprises (SMEs) are increasingly adopting distributed edge cloud technologies, primarily driven by their demand for scalability and cost-efficiency. This segment is vital as it allows SMEs to enhance their operational capabilities without the burden of heavy infrastructure costs.

Meanwhile, Large Enterprises are recognized for leveraging these technologies to optimize their data processing and improve efficiency across their operations.This segment significantly influences the overall US Distributed Edge Cloud Market due to its ability to support extensive applications in real time, enhancing service delivery and customer satisfaction. The rapid digital transformation across various industries in the US propels both SMEs and Large Enterprises to explore edge computing solutions, further emphasizing the need for reliable and high-performance cloud infrastructure.

As the demand for low-latency applications grows, the focus on distributed edge cloud solutions within these enterprise sizes is expected to drive robust advancements and intricate developments in the market space, ultimately shaping the future landscape of cloud computing in the US.

Distributed Edge Cloud Market End-Use Insights

The End-Use segment of the US Distributed Edge Cloud Market encompasses various industries, each contributing to the market's dynamic growth. The Banking, Financial Services, and Insurance (BFSI) sector’s adoption of distributed edge cloud technologies enhances transaction speeds and security, thereby improving customer satisfaction and operational efficiency. In Healthcare, data processing at the edge supports real-time patient monitoring and telemedicine consultations, which have seen substantial growth, especially during public health emergencies.The Retail and E-Commerce sector leverages distributed edge solutions for better supply chain management and enhanced customer experiences through personalized services.

Manufacturing utilizes these technologies to boost automation and predictive maintenance, directly impacting productivity and cost savings. The IT and Telecom sectors are critical as they form the backbone of cloud infrastructure, ensuring widespread connectivity required for seamless edge computing. Energy and Utilities benefit from faster data analysis to optimize resource management and reduce costs.The Media and Entertainment industry thrives on edge capabilities for delivering high-quality streaming experiences, responding to user demand for instant content access. Government and Defense applications require robust and secure edge solutions for data integrity and national security applications.

This market segmentation reflects the broad applicability and strategic importance of distributed edge cloud technologies across various industries in the US, driving significant advancement and transformation potential.

US Distributed Edge Cloud Market Key Players and Competitive Insights

The US Distributed Edge Cloud Market is experiencing significant growth as companies increasingly seek to optimize their operations and reduce latency by leveraging edge computing technologies. This market is characterized by a diverse array of players, each vying for a competitive advantage through innovation, strategic partnerships, and tailored solutions that meet the specific needs of their clients. The demand for low-latency data processing, enhanced connectivity, and robust security measures is driving companies to invest in distributed cloud infrastructures that support edge computing initiatives.

As organizations transition toward a more decentralized architecture, understanding the competitive landscape and the key players shaping this market is essential for stakeholders looking to capitalize on new opportunities and gain insights into best practices and emerging trends.Hewlett Packard Enterprise has established a formidable presence in the US Distributed Edge Cloud Market, leveraging its extensive portfolio of IT solutions and services. The company is known for its hybrid cloud offerings, which enable businesses to seamlessly integrate edge computing into their existing infrastructure, facilitating improved data management and processing at the edge.

With a focus on innovation and adaptability, Hewlett Packard Enterprise has developed solutions that cater specifically to the demands of industries such as healthcare, manufacturing, and transportation. The company's strength lies in its commitment to customer-centricity, providing tailored solutions that deliver scalability and performance.

Hewlett Packard Enterprise's strategic partnerships and collaborations with technology providers further enhance its capability to deliver comprehensive edge cloud solutions, ensuring it maintains a competitive edge in this rapidly evolving market.Cisco continues to solidify its position in the US Distributed Edge Cloud Market through its robust suite of networking and cloud solutions designed for edge computing environments. The company focuses on delivering secure and efficient networking infrastructures that enable the deployment of distributed applications at the edge. Cisco's key products and services, including edge routers, IoT solutions, and application performance optimization tools, are integral to its market presence.

The strength of Cisco lies in its ability to provide integrated solutions that encompass both hardware and software, allowing organizations to enhance connectivity, security, and data processing capabilities at the edge. With a history of strategic acquisitions and partnerships, Cisco has continually expanded its portfolio and expertise in the edge cloud domain, fortifying its competitive advantage and enabling it to meet the diverse needs of US businesses in the ever-evolving digital landscape.

Key Companies in the US Distributed Edge Cloud Market Include:

- Hewlett Packard Enterprise

- Cisco

- Intel

- Lumen Technologies

- Dell Technologies

- Fastly

- Cloudflare

- Amazon

- Google

- Microsoft

- Oracle

- IBM

- EdgeConneX

US Distributed Edge Cloud Market Industry Developments

In February 2024, Hewlett Packard Enterprise (HPE) collaborated with Equinix to introduce a new iteration of its GreenLake edge-to-cloud platform. This platform offers enhanced distributed edge cloud services through Equinix's colocation data centers in significant U.S. metros. The solution is intended to facilitate hybrid AI deployments, low-latency enterprise applications, and data sovereignty.Lumen Technologies expanded its Edge Bare Metal and Edge Orchestrator services to over 50 edge nodes in North America in January 2024.

This expansion enables enterprises to deploy low-latency applications directly at the network interface, thereby substantially reducing backhaul time and improving performance for latency-sensitive applications such as IoT and AR/VR.Fastly announced the availability of GPU support for Fastly Compute@Edge in April 2024. This feature enables the execution of AI workloads, such as image recognition, video processing, and inference models, on edge nodes.

The new service was initially implemented in critical locations throughout the United States, with the objective of optimizing real-time applications for industries such as media, e-commerce, and financing.Amazon Web Services (AWS) announced the expansion of AWS Local Zones in Las Vegas, Minneapolis, and Phoenix in June 2024. These zones offer improved services for ultra-low-latency edge computing. Real-time analytics, gaming, AI inferencing, and hybrid cloud architectures are all supported by these deployments for regional enterprises.

Distributed Edge Cloud Market Segmentation Insights

Distributed Edge Cloud Market Service Outlook

- Data Security

- Data Storage

- Networking

- Others

Distributed Edge Cloud Market Enterprise Size Outlook

Distributed Edge Cloud Market End-Use Outlook

- BFSI

- Healthcare

- Retail & E-Commerce

- Manufacturing

- IT & Telecom

- Energy & Utilities

- Media & Entertainment

- Government & Defense

- Others

| Report Attribute/Metric |

Details |

| Market Size 2023 |

271.97 (USD Million) |

| Market Size 2024 |

331.8 (USD Million) |

| Market Size 2035 |

2432.87 (USD Million) |

| Compound Annual Growth Rate (CAGR) |

19.856% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Million |

| Key Companies Profiled |

Hewlett Packard Enterprise, Cisco, Intel, Lumen Technologies, Dell Technologies, Fastly, Cloudflare, Amazon, Google, Microsoft, Oracle, IBM, EdgeConneX |

| Segments Covered |

Service, Enterprise Size, End-Use |

| Key Market Opportunities |

5G network expansion, IoT growth acceleration, Edge AI applications development, Enhanced data security solutions, Remote work infrastructure enhancement |

| Key Market Dynamics |

growing demand for low latency, increasing IoT deployment, edge computing adoption, enhanced network security, and real-time data processing |

| Countries Covered |

US |

Frequently Asked Questions (FAQ):

The US Distributed Edge Cloud Market was valued at 331.8 million USD in 2024.

By 2035, the US Distributed Edge Cloud Market is projected to reach a value of 2432.87 million USD.

The expected compound annual growth rate (CAGR) for the US Distributed Edge Cloud Market from 2025 to 2035 is 19.856%.

In 2024, the market was dominated by Data Security, Data Storage, and Networking services.

The Data Security service is expected to be valued at 600.0 million USD by 2035.

The Networking service is projected to reach 900.0 million USD in 2035.

Key players include Hewlett Packard Enterprise, Cisco, Intel, Lumen Technologies, and Dell Technologies, among others.

The Data Storage service was valued at 100.0 million USD in 2024.

The market faces challenges such as data security concerns, while presenting opportunities with the increasing demand for edge computing.

The Networking segment is expected to grow significantly, contributing to the overall market growth rate of 19.856% from 2025 to 2035.