Increasing Regulatory Scrutiny

The drilling waste-management market is experiencing heightened regulatory scrutiny as environmental agencies enforce stricter compliance measures. This trend is driven by the need to mitigate the environmental impact of drilling activities. In the US, regulations are evolving to address the disposal and treatment of drilling waste, which includes cuttings, fluids, and other byproducts. The Environmental Protection Agency (EPA) has implemented guidelines that require operators to adopt best practices in waste management. As a result, companies are investing in advanced waste management solutions to ensure compliance, which is projected to drive market growth. the market is expected to reach a valuation of approximately $5 billion by 2026, reflecting the increasing importance of regulatory adherence..

Rising Environmental Awareness

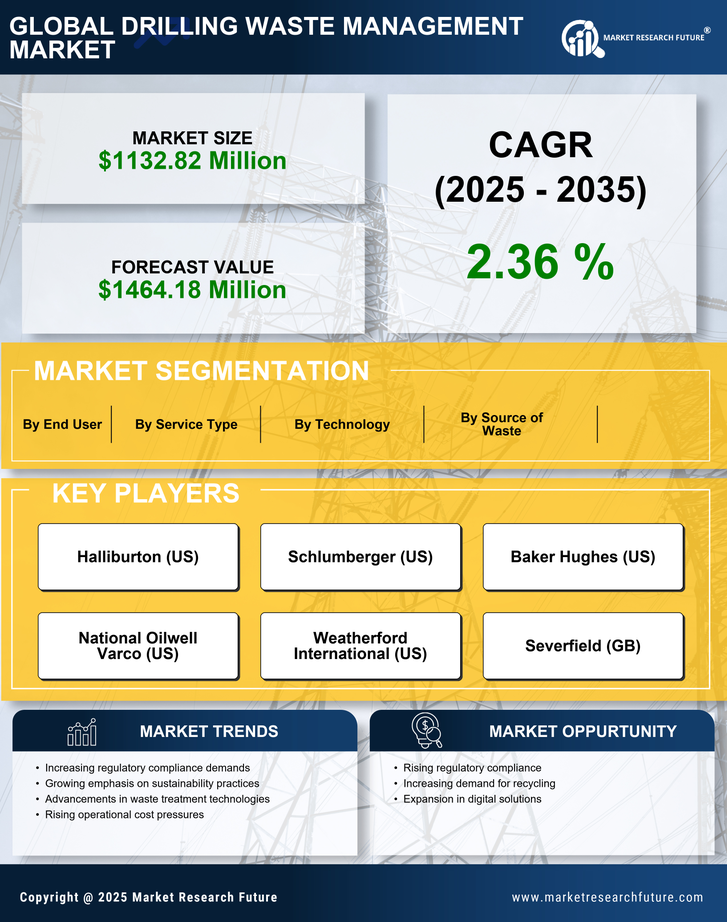

Growing environmental awareness among stakeholders is significantly influencing the drilling waste-management market. Public concern regarding the ecological impact of drilling operations has prompted companies to adopt more sustainable waste management practices. This shift is not merely a response to consumer demand but also a proactive approach to corporate responsibility. As a result, firms are increasingly investing in technologies that minimize waste generation and enhance recycling efforts. The market is projected to grow at a CAGR of 6% over the next five years, driven by the need for environmentally friendly solutions. This trend indicates that companies in the drilling waste-management market are likely to prioritize sustainability in their operational strategies.

Investment in Sustainable Practices

Investment in sustainable practices is becoming a pivotal driver in the drilling waste-management market. Companies are increasingly recognizing the long-term benefits of adopting sustainable waste management strategies, which not only comply with regulations but also enhance their corporate image. This trend is reflected in the growing allocation of resources towards research and development of eco-friendly waste management technologies. The market is witnessing a shift towards practices that promote waste reduction, recycling, and resource recovery. As a result, the drilling waste-management market is expected to see a compound annual growth rate of 5% over the next five years.. This investment trend indicates a broader commitment to sustainability within the industry.

Economic Growth in the Energy Sector

The economic growth in the energy sector is a crucial driver for the drilling waste-management market. As the demand for energy continues to rise, drilling activities are expected to increase, leading to a corresponding rise in drilling waste generation. The US energy sector is projected to grow by 4% annually, which will likely result in increased drilling operations and, consequently, more waste. This growth necessitates effective waste management strategies to handle the byproducts of drilling. Companies are thus compelled to invest in waste management solutions to ensure operational efficiency and compliance with environmental regulations. The drilling waste-management market is poised to benefit from this economic expansion, with a projected market size of $6 billion by 2027.

Technological Innovations in Waste Treatment

Technological innovations are reshaping the drilling waste-management market, offering new solutions for waste treatment and disposal. Advanced technologies such as thermal desorption, bioremediation, and solidification/stabilization are gaining traction. These methods not only enhance the efficiency of waste processing but also reduce the environmental footprint of drilling operations. The integration of automation and data analytics into waste management processes is also becoming prevalent, allowing for real-time monitoring and optimization. As these technologies become more accessible, the market is expected to expand, with an estimated growth rate of 7% annually. This trend suggests that companies are increasingly recognizing the value of investing in innovative solutions within the drilling waste-management market.