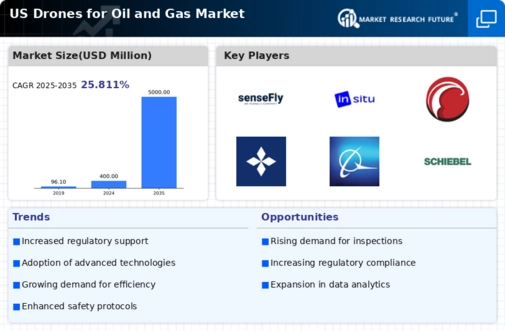

The competitive landscape of the US Drones for Oil and Gas Market is rapidly evolving as companies innovate to address the specific needs of this vital sector. Driven by the increasing demand for efficient and effective monitoring, mapping, and survey solutions within oil and gas operations, various drone manufacturers are vying for market share by offering advanced aerial technologies tailored to the unique challenges of this industry. The integration of drones into oil and gas operations enhances everything from routine inspections to emergency response scenarios, allowing for improved data collection and analysis.

Companies are focusing not only on cutting-edge technology but also on enhancing service offerings to meet regulatory standards and customer expectations, thereby solidifying their positions in a constantly changing market.senseFly has established a notable presence in the US Drones for Oil and Gas Market through its pioneering solutions designed for aerial mapping and surveying.

The company’s strong reputation for durable and reliable drones is seen as a key strength, particularly in harsh environments typical of oil and gas operations. senseFly’s products, known for their ease of use and precision, allow operators to conduct comprehensive site surveys and monitor infrastructure with high efficiency. Their drones can collect extensive data from large areas quickly, minimizing operational downtime for oil and gas companies.

The growing partnership ecosystem and successful collaborations with key stakeholders in the US further enhance senseFly’s market position, enabling them to respond adeptly to industry-specific requirements and contribute to the advancement of drone technology in this sector.Insitu operates with a commanding presence in the US Drones for Oil and Gas Market by delivering tailored aerial solutions aimed at improving operational efficiencies and safety in energy exploration and extraction. The company's portfolio includes key products that specialize in long-range reconnaissance and data collection, making them instrumental in planning and monitoring pipeline integrity and environmental assessments.

Insitu's ability to integrate with existing oil and gas systems provides a competitive edge, allowing for seamless data utilization across multiple platforms. The company has significantly bolstered its position through strategic mergers and acquisitions that enhance its technology foundation and broaden its analytical capabilities. With a commitment to innovation, Insitu remains focused on developing customized solutions that meet the evolving demands of the US oil and gas market, establishing itself as a formidable player in the industry.