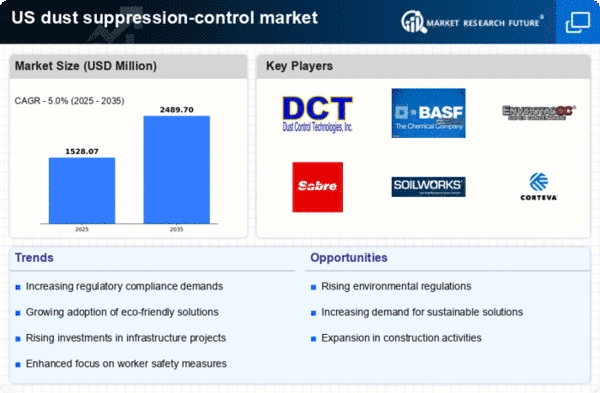

The dust suppression-control market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Dust Control Technology (US), BASF SE (DE), and Envirotac (US) are actively pursuing strategies that enhance their market positioning. Dust Control Technology (US) focuses on developing environmentally friendly solutions, which aligns with the growing demand for sustainable practices. BASF SE (DE), on the other hand, leverages its extensive research capabilities to innovate new products that meet stringent regulatory standards, thereby reinforcing its competitive edge. Meanwhile, Envirotac (US) emphasizes regional expansion and customer-centric solutions, which allows it to cater effectively to diverse market needs. Collectively, these strategies contribute to a dynamic competitive environment where innovation and sustainability are paramount.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several players vying for market share. This fragmentation is indicative of a landscape where smaller firms can thrive alongside larger corporations, each contributing to the overall competitive dynamics. The collective influence of these key players fosters a robust ecosystem that encourages innovation and responsiveness to market demands.

In October Dust Control Technology (US) announced a partnership with a leading environmental organization to develop new dust suppression products that utilize biodegradable materials. This strategic move not only enhances the company's product portfolio but also positions it as a leader in sustainable practices within the industry. The collaboration is expected to attract environmentally conscious customers, thereby expanding its market reach.

In September BASF SE (DE) launched a new line of dust control agents designed specifically for the construction sector, which are reported to reduce airborne particulate matter by up to 30%. This initiative underscores BASF's commitment to innovation and regulatory compliance, potentially setting new industry standards. The introduction of these products is likely to strengthen BASF's market position and appeal to clients seeking effective solutions to meet environmental regulations.

In August Envirotac (US) expanded its operations into the Midwest region, establishing a new distribution center aimed at improving service delivery and reducing lead times for customers. This strategic expansion is anticipated to enhance the company's competitive advantage by providing localized support and faster access to products. Such moves reflect a broader trend of companies seeking to optimize their supply chains and improve customer satisfaction.

As of November the competitive trends in the dust suppression-control market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing product offerings. Looking ahead, it is likely that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may redefine market dynamics, compelling companies to invest in research and development to maintain their competitive edge.