US E-Waste Management Market Overview

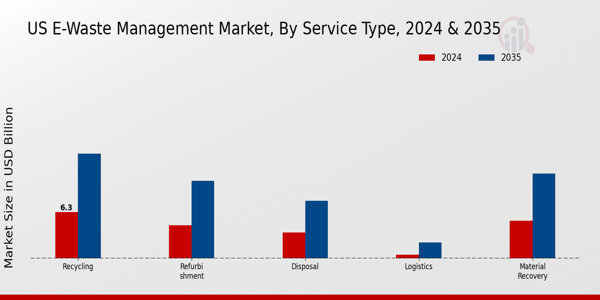

As per MRFR analysis, the US E-Waste Management Market Size was estimated at 19.13 (USD Billion) in 2023. The US E-Waste Management Market is expected to grow from 20.4 (USD Billion) in 2024 to 46.2 (USD Billion) by 2035. The US E-Waste Management Market CAGR (growth rate) is expected to be around 7.714% during the forecast period (2025 - 2035).

Key US E-Waste Management Market Trends Highlighted

Growing consumer awareness of environmental concerns and the necessity of safe disposal of electronic trash are driving the considerable expansion of the US e-waste management market. Effective recycling procedures are in high demand due to federal and state regulations, including the Responsible Recycling (R2) Certification and different e-waste legislation.

As electronics become more commonplace in daily life, more e-waste is produced, which forces businesses to embrace sustainable practices and cutting-edge recycling solutions. Given that consumers are become more aware of the sustainability of e-waste and are looking for responsible disposal solutions, there are opportunities to expand collection programs and take-back schemes.

Manufacturers and recycling companies are increasingly collaborating to develop closed-loop electronics systems, according to recent developments. By encouraging the use of recycled materials in new gadgets and facilitating the creation of goods that are easier to recycle, these partnerships help to lower the overall carbon footprint.

Companies' approaches to product design and lifecycle management are also changing as a result of several states enacting extended producer responsibility (EPR) laws, which mandate that manufacturers return their goods at the end of their useful lives.

Improved public awareness efforts regarding the value of recycling e-waste are also becoming more popular, which encourages more people to join recycling programs and raises recycling rates. The continuous transition to a circular economy offers this industry a significant chance for expansion and innovation, fostering new recovery and reuse-oriented business models.

Fig 1: US E-Waste Management Market Overview

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

US E-Waste Management Market Drivers

Increasing Government Regulations on E-Waste Disposal

In the United States, increasing government regulations concerning the disposal of electronic waste are significantly driving the US E-Waste Management Market. States like California have implemented stringent laws that ban e-waste from landfills, compelling companies and consumers to seek proper recycling and disposal methods.

According to the California Department of Resources Recycling and Recovery (CalRecycle), over 1.2 million tons of e-waste were documented during the past years, indicating a pressing need for efficient e-waste management solutions.

With the U.S. Environmental Protection Agency (EPA) promoting the Responsible Recycling (R2) Certification, a growing number of e-waste recyclers are adhering to standards to ensure aware disposal practices.

These regulatory changes not only promote responsible disposal practices but also enhance the industry's growth, as companies are now obligated to allocate resources toward compliant e-waste management strategies.

Rising Consumer Electronics Usage

The escalation in consumer electronics usage creates a substantial amount of electronic waste in the US, fueling growth in the US E-Waste Management Market. The Consumer Technology Association (CTA) reported that in 2022, approximately 6.5 billion devices were sold, contributing significantly to e-waste generation.

As electronic devices become obsolete, the need for proper disposal and recycling solutions grows. This rise in production and consumption of electronics is propelling market demand for efficient e-waste management solutions, especially as consumers become more eco-conscious and seek responsible recycling options to mitigate environmental impact.

Growing Awareness of Environmental Impact

In the US, there is a growing awareness regarding the environmental impact of electronic waste, which is driving the US E-Waste Management Market. According to a 2023 Gallup poll, around 70% of Americans express concern about environmental problems linked to improper e-waste disposal, including soil and water contamination from hazardous materials.

Prominent organizations, such as the Environmental Protection Agency (EPA) and Green Electronics Council, are actively promoting recycling initiatives and raising public awareness about the responsible disposal of electronic waste.

This heightened awareness has led consumers to prioritize e-waste recycling, thereby stimulating market growth and pushing companies to incorporate sustainable practices in their e-waste management strategies.

US E-Waste Management Market Segment Insights

E-Waste Management Market Service Type Insights

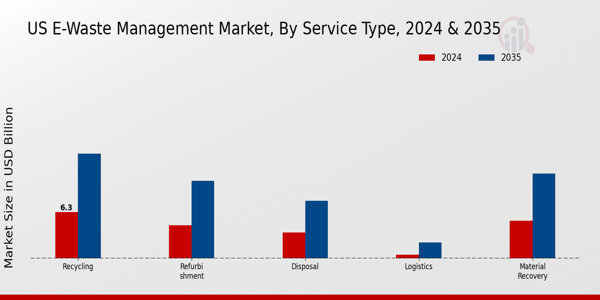

The US E-Waste Management Market is increasingly focusing on diverse service types to effectively manage electronic waste. This has resulted in a structured service type segmentation comprising Material Recovery, Refurbishment, Recycling, Disposal, and Logistics.

Each of these service types plays a crucial role in addressing the growing challenges associated with e-waste, which has been propelled by rapid technological advancements and a surge in consumer electronic products within the US.

Material Recovery is particularly significant as it involves extracting valuable materials from discarded electronics, thereby reducing the need for virgin materials and minimizing environmental impact. Refurbishment also holds importance, as it allows functioning electronic devices to be repaired and reused, extending their lifecycle and conserving resources.

Meanwhile, Recycling is critical for processing non-reusable waste in an environmentally responsible manner, allowing it to be transformed into new products. The Disposal service ensures that hazardous materials are managed safely to prevent environmental contamination.

Logistics encompasses the transportation and collection of e-waste, streamlining the movement from consumers to recycling centers or refurbishing facilities. Given the current regulatory landscape and rising public awareness about e-waste impacts, these service types are not only essential but are witnessing growing demand.

The complexity of managing e-waste effectively stimulates innovation across all service types, leading to improved efficiency and sustainability practices in the industry. Emphasizing recycling and refurbishment as primary strategies could yield significant environmental and economic benefits, aligning with the increasing focus on circular economy principles.

Fig 2: US E-Waste Management Market Insights

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

E-Waste Management Market Source of E-Waste Insights

The Source of E-Waste segment plays a crucial role in understanding the dynamics of the US E-Waste Management Market. This segment encompasses various sources through which electronic waste is generated, including Household Appliances, Consumer Electronics, IT Equipment, Telecommunications, and Industrial Equipment.

Household Appliances generate significant amounts of e-waste, particularly as consumers frequently upgrade to newer models, pushing older units out of circulation. Consumer Electronics, including smartphones and laptops, contribute heavily to e-waste, driven by rapid technological advancements and short product lifecycles.

IT Equipment from businesses also represents a substantial source, as companies regularly refresh their technology to remain competitive. Telecommunications equipment, with ongoing advancements in network technology, further adds to the e-waste burden as outdated devices are discarded.

Lastly, Industrial Equipment also generates distinct challenges for e-waste management due to its specialized materials and compliance requirements for recycling.

Each of these sources presents unique hurdles for recycling and waste management, emphasizing the need for effective solutions that address not only the increasing volume of e-waste but also the complexities involved in processing different types of electronic materials.

The growing awareness regarding environmental impacts and regulatory pressures are driving innovation and improvements in the US E-Waste Management Market, allowing for better resource recovery and waste reduction strategies.

E-Waste Management Market End-user Insights

The End-user segment of the US E-Waste Management Market plays a crucial role in determining the dynamics of the industry as it encompasses diverse entities such as residential, commercial, industrial, and government organizations. Each segment contributes uniquely to the demand for efficient e-waste solutions.

The residential sector is notably significant, as households continuously upgrade electronics, leading to an increasing amount of e-waste that requires proper disposal and recycling. In the commercial realm, businesses are often mandated to adhere to stringent regulations regarding e-waste disposal, thus driving the need for effective management solutions.

The industrial sector generates a substantial volume of e-waste, making it critical for industries to implement sustainable practices to mitigate environmental impacts. Government initiatives also influence the market as various programs are established to promote responsible e-waste management, ensuring both compliance and environmental safety.

With increasing awareness of e-waste issues and rising regulatory measures, all segments present substantial opportunities for growth in e-waste management operations across the US. The emphasis on recycling and resource recovery also positions these segments as vital players in promoting a circular economy through better e-waste practices and innovations.

E-Waste Management Market Material Type Insights

The Material Type segment of the US E-Waste Management Market plays a crucial role in the overall industry dynamics, reflecting the diverse components involved in electronic waste. This segment encompasses various materials, such as metals, plastics, glass, and circuit boards, each contributing significantly to the recycling and recovery processes.

Metals, known for their high recyclability and demand in manufacturing new products, dominate this segment, as they can be effectively reclaimed from discarded electronics. Plastics represent another vital component, often requiring specialized recycling methods due to their varied compositions, while glass recycling is essential for reducing environmental impact and conserving resources.

Circuit boards, containing valuable metals and components, also require focused attention for efficient recycling. The increasing emphasis on sustainable practices, driven by federal regulations and growing consumer awareness in the US, presents both opportunities and challenges within this segmentation.

The need for improved recycling technologies and infrastructure remains paramount, as environmental policies push for greater recovery rates of these materials, highlighting their significance in the overall US E-Waste Management Market data and industry trends. As these materials continue to evolve, they will shape the future of e-waste recycling and management efforts in the region.

US E-Waste Management Market Key Players and Competitive Insights

The US E-Waste Management Market is increasingly becoming a critical focus for environmental sustainability as electronic waste continues to grow significantly, driven by rapid technological advancements and consumer tendencies towards frequent upgrades.

The competitive landscape in this market is characterized by numerous players offering a variety of services aimed at the responsible disposal and recycling of electronic waste. Companies in this sector are investing in advanced technologies and innovative processes to enhance recycling efficiency, reduce hazardous waste, and ensure compliance with environmental regulations.

As the market evolves, competition has intensified, pushing companies to differentiate themselves through quality of service, technological integration, and market outreach, while also navigating the challenges posed by changing regulations and consumer awareness.

Clean Harbors stands out in the US E-Waste Management Market thanks to its extensive service portfolio that encompasses environmental services and industrial waste management. The company's strengths lie in its robust infrastructure, widespread geographic presence, and operational expertise.

With numerous facilities across the United States, Clean Harbors is well-positioned to handle large volumes of electronic waste, ensuring efficient processing and sustainable recycling methods. The company has established a reputation for reliability and quality service, making it a key player in the market.

Additionally, Clean Harbors places a strong emphasis on compliance with environmental regulations, enhancing its standing among clients who prioritize sustainability in their disposal practices. The firm continuously invests in technology to improve its operational efficiency and meet the evolving needs of its clientele, strengthening its competitive position within the industry.

EcoTech Recycling has carved a niche for itself in the US E-Waste Management Market through its commitment to sustainability and innovation in recycling processes. The company offers a range of services, including e-waste recycling, data destruction, and asset recovery, which cater to both individual consumers and large corporations.

EcoTech Recycling is recognized for its environmentally responsible methods and focuses on maximizing the recovery of valuable materials from electronic waste. The company has built a strong presence in the US through strategic partnerships and regional operations, allowing it to serve diverse customer bases effectively.

The strengths of EcoTech Recycling lie in its advanced recycling technology, a dedicated focus on customer service, and an adaptive business model that allows it to respond quickly to market trends and regulatory changes.

EcoTech Recycling has also engaged in strategic mergers and acquisitions to enhance its capabilities and expand its market share, further solidifying its role as a significant contender in the e-waste management landscape in the United States.

Key Companies in the US E-Waste Management Market Include

- Clean Harbors

- EcoTech Recycling

- Electronic Recyclers International

- GEEP

- Dell Technologies

- Sims Limited

- Republic Services

- Waste Management

US E-Waste Management Market Developments

Clean Harbors reported $1.43 billion in Q1 2025 revenues, up 4% year over year, driven by high demand for environmental services, such as recycling e-waste. With 870 stations for both hazardous and non-hazardous household recycling activities, it continues to be in a good position.

In July 2025, Electronic Recyclers International (ERI) released its fifth annual impact report, highlighting advancements in circularity and transparency throughout its countrywide facilities and reaffirming its status as the first carbon-neutral electronics recycler in the United States.

To improve compliance, logistics, and ecologically friendly solutions, EcoTech Recycling (previously E-Solutions USA) joined 4THBIN's network in late May 2025 to establish a nationwide electronics recycling and secure data destruction service

In order to better meet demand, ERI consolidated operations and relocated facilities, such as from Colorado to a bigger location in Arizona, and established three new IT asset disposal (ITAD) and recycling factories in September 2023.

E-Waste Management Market Segmentation Insights

E-Waste Management Market Service Type Outlook

- Material Recovery

- Refurbishment

- Recycling

- Disposal

- Logistics

E-Waste Management Market Source of E-Waste Outlook

- Household Appliances

- Consumer Electronics

- IT Equipment

- Telecommunications

- Industrial Equipment

E-Waste Management Market End-user Outlook

- Residential

- Commercial

- Industrial

- Government

E-Waste Management Market Material Type Outlook

- Metals

- Plastics

- Glass

- Circuit Boards

| Report Attribute/Metric |

Details |

| Market Size 2023 |

19.13(USD Billion) |

| Market Size 2024 |

20.4(USD Billion) |

| Market Size 2035 |

46.2(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

7.714% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Clean Harbors, EcoTech Recycling, Electronic Recyclers International, GEEP, Dell Technologies, Sims Limited, Republic Services, Waste Management |

| Segments Covered |

Service Type, Source of E-Waste, End-user, Material Type |

| Key Market Opportunities |

Growing demand for recycling services, Government regulations driving compliance solutions, Innovations in e-waste recovery technologies, Expansion of collection infrastructure, Awareness campaigns for consumer education |

| Key Market Dynamics |

increasing e-waste generation, stringent regulations and laws, rising consumer awareness, technological advancements in recycling, growth of corporate responsibility initiatives |

| Countries Covered |

US |

Frequently Asked Questions (FAQ):

The US E-Waste Management Market was valued at 20.4 billion USD in 2024.

By 2035, the US E-Waste Management Market is expected to reach a valuation of 46.2 billion USD.

The expected CAGR for the US E-Waste Management Market from 2025 to 2035 is 7.714%.

The Material Recovery segment is valued at 5.1 billion USD in the US E-Waste Management Market for the year 2024.

The Recycling segment is projected to reach 14.2 billion USD in the US E-Waste Management Market by 2035.

Major players in the US E-Waste Management Market include Clean Harbors, EcoTech Recycling, and Dell Technologies, among others.

The Refurbishment segment was valued at 4.5 billion USD in the US E-Waste Management Market for the year 2024.

The Disposal segment is expected to be valued at 7.8 billion USD in the US E-Waste Management Market by the year 2035.

Increased electronic consumption and stricter regulations on e-waste disposal drive growth in the US E-Waste Management Market.

The Logistics segment is projected to contribute 2.2 billion USD to the US E-Waste Management Market by 2035.