Innovations in Product Formulation

Innovations in product formulation are playing a crucial role in shaping the essential oils-plant-extracts-livestock market. Manufacturers are increasingly developing new blends and formulations that enhance the efficacy of essential oils and plant extracts in livestock health. These innovations may include the incorporation of synergistic ingredients that improve absorption and effectiveness. As a result, the market is witnessing a diversification of product offerings, catering to various livestock needs. This trend is likely to attract a broader customer base, as farmers seek effective and natural solutions for their livestock. The essential oils-plant-extracts-livestock market is expected to see a rise in demand for these innovative products, potentially leading to increased sales and market growth.

Sustainability Trends in Agriculture

Sustainability is becoming a pivotal focus in agriculture, influencing the essential oils-plant-extracts-livestock market. As consumers demand more environmentally friendly practices, livestock producers are increasingly adopting sustainable methods, including the use of essential oils and plant extracts. These natural products are perceived as eco-friendly alternatives to synthetic additives, aligning with the growing trend of sustainable farming. The market for essential oils in livestock is projected to reach $1 billion by 2027, driven by this shift towards sustainability. This trend not only supports environmental goals but also enhances the market appeal of essential oils and plant extracts, as consumers are more likely to support brands that prioritize sustainability.

Regulatory Support for Natural Products

Regulatory frameworks in the US are increasingly supportive of natural products, which positively impacts the essential oils-plant-extracts-livestock market. Agencies such as the FDA and USDA have established guidelines that promote the use of natural ingredients in livestock feed and health products. This regulatory support not only enhances consumer confidence but also encourages manufacturers to invest in the development of essential oils and plant extracts. The market is expected to benefit from this trend, as compliance with regulations can lead to increased market access and growth opportunities. Furthermore, the essential oils-plant-extracts-livestock market may see a rise in certifications for organic and natural products, further driving consumer interest and sales.

Rising Interest in Holistic Animal Care

The essential oils-plant-extracts-livestock market is benefiting from a rising interest in holistic animal care practices. Farmers and livestock owners are increasingly recognizing the value of integrating natural remedies into their animal care routines. This shift towards holistic approaches is driven by a desire to improve animal welfare and reduce reliance on pharmaceuticals. Essential oils and plant extracts are being utilized for their therapeutic properties, which may enhance overall animal health. The market is likely to see a growing demand for products that promote holistic care, as consumers become more informed about the benefits of natural alternatives. This trend could lead to a significant expansion of the essential oils-plant-extracts-livestock market in the coming years.

Growing Consumer Awareness of Health Benefits

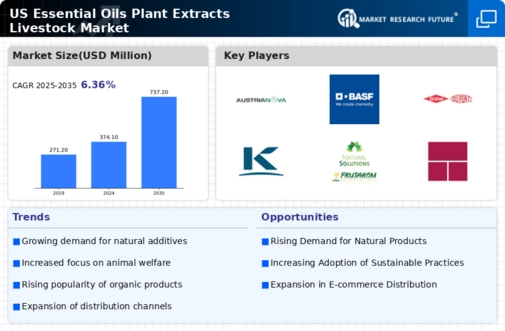

The essential oils-plant-extracts-livestock market is experiencing a surge in consumer awareness regarding the health benefits associated with natural products. As individuals increasingly seek alternatives to synthetic chemicals, the demand for essential oils and plant extracts has risen. This trend is particularly evident in the livestock sector, where farmers are exploring natural solutions to enhance animal health and productivity. Reports indicate that the market for essential oils in livestock is projected to grow at a CAGR of approximately 8% over the next five years. This growing awareness is likely to drive innovation and product development within the essential oils-plant-extracts-livestock market, as companies strive to meet the evolving preferences of health-conscious consumers.