Regulatory Compliance and Standards

The exterior wall-system market is increasingly influenced by stringent building codes and regulations aimed at enhancing energy efficiency and safety. In the US, the adoption of the International Energy Conservation Code (IECC) has mandated higher performance standards for building envelopes. This regulatory environment compels manufacturers to innovate and develop wall systems that not only comply with these standards but also exceed them. As a result, the market is witnessing a shift towards advanced materials and construction techniques that improve thermal performance and reduce energy consumption. The demand for compliant products is expected to grow, with projections indicating a potential increase in market value by 15% over the next five years as builders and developers seek to meet these evolving requirements.

Rising Demand for Energy Efficiency

Energy efficiency remains a pivotal driver in the exterior wall-system market, as consumers and businesses alike prioritize sustainability. The US market is experiencing a notable shift towards energy-efficient building solutions, with a significant portion of new constructions incorporating advanced insulation and wall systems designed to minimize energy loss. According to recent data, energy-efficient buildings can reduce energy consumption by up to 30%, making them highly attractive to both developers and end-users. This trend is further supported by various incentive programs and rebates offered by government entities, which encourage the adoption of energy-efficient technologies. Consequently, the exterior wall-system market is likely to expand as stakeholders increasingly recognize the long-term cost savings associated with energy-efficient designs.

Consumer Preferences for Aesthetic Appeal

The exterior wall-system market is also being shaped by evolving consumer preferences for aesthetic appeal in building designs. Homeowners and commercial property developers are increasingly seeking wall systems that not only provide functional benefits but also enhance the visual attractiveness of structures. This trend is evident in the rising popularity of diverse materials, colors, and finishes that allow for greater customization. Industry expert's indicates that aesthetic considerations can influence purchasing decisions by as much as 40%, underscoring the importance of design in the exterior wall-system market. As a result, manufacturers are focusing on developing products that meet these aesthetic demands while maintaining performance standards, thereby driving market growth.

Technological Integration in Construction

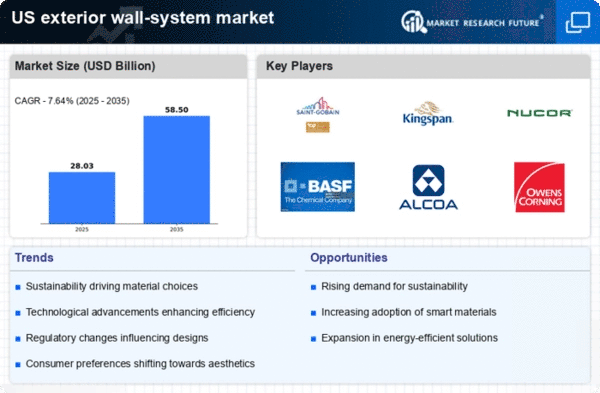

The integration of technology into construction processes is reshaping the exterior wall-system market. Innovations such as Building Information Modeling (BIM) and advanced manufacturing techniques are streamlining the design and installation of wall systems. These technologies enhance precision, reduce waste, and improve overall project timelines. In the US, the adoption of smart building technologies is also gaining traction, with exterior wall systems being designed to accommodate sensors and automation features. This trend not only enhances the functionality of buildings but also aligns with the growing consumer preference for smart, connected environments. As a result, the market is expected to see a compound annual growth rate (CAGR) of approximately 10% over the next few years, driven by the demand for technologically advanced solutions.

Urbanization and Infrastructure Development

Urbanization continues to be a significant driver for the exterior wall-system market, particularly in metropolitan areas across the US. As cities expand and populations grow, there is an increasing need for new residential and commercial buildings. This surge in construction activity is prompting developers to seek innovative wall systems that offer durability, aesthetic appeal, and energy efficiency. The US Census Bureau projects that urban areas will see a population increase of over 20 million by 2030, further fueling demand for modern building solutions. Consequently, the exterior wall-system market is poised for growth, as stakeholders respond to the challenges and opportunities presented by rapid urban development.