Innovations in Material Science

Advancements in material science significantly influence the flexible lid-stock-packaging market. The development of new polymers and composites enhances the functionality and sustainability of packaging solutions. For instance, the introduction of biodegradable materials and recyclable options aligns with consumer demand for environmentally friendly products. This innovation not only reduces waste but also appeals to a growing segment of eco-conscious consumers. The flexible lid-stock-packaging market is likely to see a shift towards these advanced materials, with a projected increase in market share of sustainable packaging solutions by 15% over the next five years.

Growth of the Food Delivery Sector

The expansion of the food delivery sector plays a crucial role in shaping the flexible lid-stock-packaging market. As more consumers opt for delivery services, the need for packaging that maintains food quality and safety becomes paramount. Flexible lid-stock-packaging solutions provide an effective means to preserve freshness and prevent contamination during transit. Recent statistics suggest that the food delivery market is expected to reach $200 billion by 2026, driving demand for innovative packaging solutions. Consequently, the flexible lid-stock-packaging market is poised to capitalize on this growth, offering products that cater to the specific needs of food delivery services.

Consumer Preference for Customization

The flexible lid-stock-packaging market is witnessing a shift towards customization as consumers seek personalized packaging solutions. Brands are increasingly offering tailored packaging designs that reflect individual preferences and enhance brand identity. This trend is particularly prominent in the beverage and snack industries, where unique packaging can differentiate products in a crowded marketplace. Market analysis indicates that customized packaging can lead to a 20% increase in consumer engagement and brand loyalty. As a result, the flexible lid-stock-packaging market is likely to invest more in customization technologies to meet this growing demand.

Rising Demand for Convenience Packaging

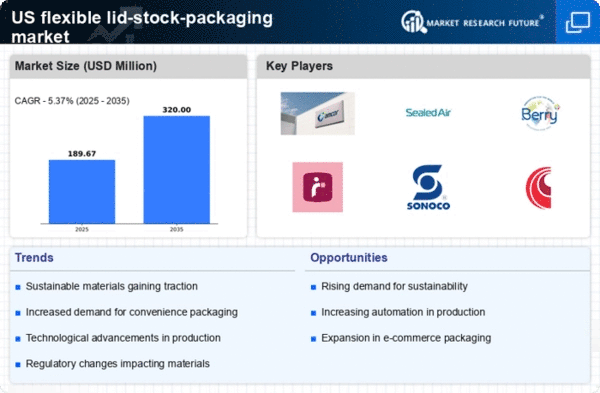

The flexible lid-stock-packaging market experiences a notable surge in demand driven by consumer preferences for convenience. As lifestyles become increasingly fast-paced, consumers favor packaging that offers easy access and resealability. This trend is particularly evident in the food and beverage sector, where products such as ready-to-eat meals and snacks benefit from flexible lid-stock solutions. Market data indicates that the convenience segment is projected to grow at a CAGR of 5.2% through 2027, reflecting a shift towards on-the-go consumption. The flexible lid-stock-packaging market is thus adapting to meet these evolving consumer needs, ensuring that products remain fresh and accessible.

Regulatory Compliance and Safety Standards

The flexible lid-stock-packaging market is increasingly influenced by stringent regulatory compliance and safety standards. Government regulations regarding food safety and packaging materials necessitate that manufacturers adhere to specific guidelines to ensure consumer protection. This has led to a heightened focus on quality control and material safety in the flexible lid-stock-packaging market. Companies are investing in research and development to meet these standards, which may result in increased operational costs but ultimately enhances consumer trust. The market is expected to see a 10% increase in compliance-related investments over the next few years.