Growth of the Organic Food Sector

The organic food sector is witnessing robust growth in the United States, which is positively influencing the US Food Colorants Market. As consumers increasingly prioritize organic products, the demand for organic colorants is also on the rise. This trend is supported by the USDA's National Organic Program, which sets standards for organic labeling and production. The organic food market is projected to reach over $70 billion by 2026, creating significant opportunities for colorant manufacturers to develop organic-certified products. This alignment with organic trends is likely to enhance the market presence of natural colorants, further driving growth in the industry.

Regulatory Standards and Compliance

The regulatory landscape plays a crucial role in shaping the US Food Colorants Market. The Food and Drug Administration (FDA) has established stringent guidelines regarding the use of food colorants, particularly synthetic ones. Compliance with these regulations is essential for manufacturers to ensure product safety and consumer trust. As regulations evolve, companies are compelled to adapt their formulations, which may lead to a shift towards more natural colorants. This regulatory influence is likely to drive innovation and reformulation efforts within the industry, as businesses strive to align with consumer expectations and legal requirements.

Rising Popularity of Plant-Based Foods

The rising popularity of plant-based foods is reshaping the US Food Colorants Market. As more consumers adopt vegetarian and vegan diets, there is an increasing demand for plant-derived colorants that align with these dietary preferences. This trend is prompting manufacturers to explore innovative sources for natural colorants, such as fruits, vegetables, and spices. The plant-based food market is expected to grow substantially, with projections indicating a potential market size of over $30 billion by 2026. This shift not only reflects changing consumer habits but also presents opportunities for colorant producers to diversify their offerings and cater to a broader audience.

Consumer Demand for Clean Label Products

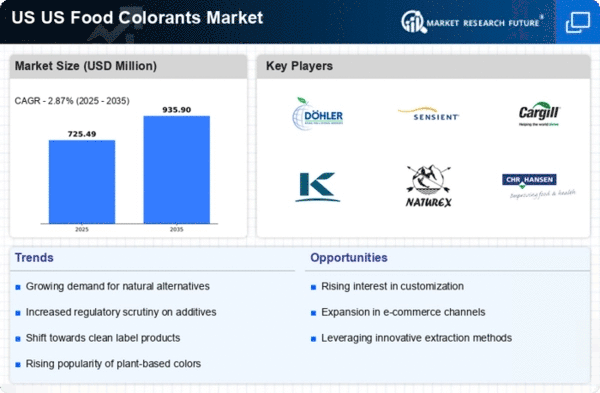

The US Food Colorants Market is experiencing a notable shift towards clean label products, driven by consumer preferences for transparency and natural ingredients. As consumers become increasingly health-conscious, they are seeking products that do not contain artificial additives. This trend is reflected in the growing demand for natural colorants, which are perceived as safer and healthier alternatives. According to recent data, the market for natural food colorants is projected to grow at a compound annual growth rate of over 5% through 2026. This shift is prompting manufacturers to reformulate their products, thereby influencing the overall dynamics of the US Food Colorants Market.

Innovation in Food Processing Technologies

Advancements in food processing technologies are significantly impacting the US Food Colorants Market. Innovations such as microencapsulation and nanotechnology are enabling the development of more stable and vibrant colorants. These technologies not only enhance the visual appeal of food products but also improve their shelf life and stability. As a result, manufacturers are increasingly adopting these technologies to meet consumer expectations for quality and aesthetics. The integration of such innovations is expected to drive the market for food colorants, with projections indicating a potential increase in market value by approximately 10% over the next few years.