Expansion of the Snack Food Sector

The snack food sector in the US is expanding rapidly, contributing significantly to the growth of the food inclusions market. With consumers seeking convenient and on-the-go options, snacks that incorporate inclusions such as chocolate chips, dried fruits, and granola are gaining traction. Market analysis suggests that the snack food segment is projected to grow at a CAGR of 6% through 2026, thereby driving the demand for innovative inclusions. The food inclusions market is responding by developing new products that cater to this trend, offering unique flavor combinations and textures that appeal to a diverse consumer base.

Increased Focus on Functional Foods

The food inclusions market is witnessing a growing emphasis on functional foods, which are designed to provide health benefits beyond basic nutrition. Ingredients such as probiotics, fiber, and protein-rich inclusions are becoming increasingly popular among consumers looking to enhance their diets. Recent studies indicate that the functional food market is expected to reach $275 billion by 2025, with a significant portion attributed to innovative inclusions. The food inclusions market is capitalizing on this trend by incorporating functional ingredients into various products, thereby appealing to health-oriented consumers seeking added value in their food choices.

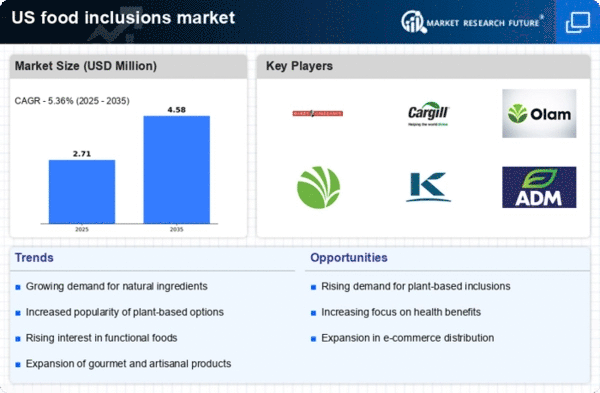

Rising Demand for Natural Ingredients

The food inclusions market is experiencing a notable shift towards natural ingredients, driven by consumer preferences for clean label products. As health-conscious consumers increasingly scrutinize ingredient lists, manufacturers are compelled to innovate with natural inclusions such as fruits, nuts, and seeds. This trend is reflected in market data, indicating that the demand for natural food inclusions has surged by approximately 25% over the past year. The food inclusions market is adapting to this demand by sourcing high-quality, organic ingredients, which not only enhance product appeal but also align with consumer values regarding sustainability and health.

Growing Popularity of Plant-Based Products

The rise of plant-based diets is significantly influencing the food inclusions market, as consumers increasingly seek alternatives to animal-derived ingredients. This trend is evident in the growing demand for plant-based inclusions such as nut butters, coconut flakes, and plant-derived proteins. Market Research Future indicates that the plant-based food sector is projected to reach $74 billion by 2027, with inclusions playing a pivotal role in this growth. The food inclusions market is responding by expanding its offerings to include a wider variety of plant-based options, catering to the evolving dietary preferences of consumers.

Adoption of Innovative Processing Technologies

Technological advancements in food processing are playing a crucial role in the evolution of the food inclusions market. Innovations such as freeze-drying, extrusion, and encapsulation are enabling manufacturers to create high-quality inclusions that retain flavor and nutritional value. These technologies not only enhance product quality but also improve shelf life, which is vital for the competitive snack market. The food inclusions market is likely to benefit from these advancements, as they allow for greater creativity in product development and the ability to meet diverse consumer preferences.