Growing Interest in Off-Grid Applications

The gel battery market is witnessing a surge in interest for off-grid applications, particularly in remote areas where traditional power sources are unavailable. Gel batteries are increasingly being utilized in off-grid solar systems, providing a reliable energy storage solution for households and businesses. The off-grid solar market is expected to grow significantly, with projections indicating a potential increase of 15% annually through 2025. This trend suggests that the gel battery market is well-positioned to capitalize on the growing demand for off-grid energy solutions, as consumers seek sustainable and independent energy sources.

Increased Demand for Backup Power Solutions

The gel battery market is experiencing growth driven by the rising demand for backup power solutions across various sectors. Businesses and residential users are increasingly seeking reliable power sources to mitigate the risks associated with power outages. Gel batteries, with their maintenance-free operation and safety features, are well-suited for applications requiring uninterrupted power supply. The market for uninterruptible power supplies (UPS) is expected to grow at a CAGR of 8% through 2025, further enhancing the prospects for the gel battery market. This demand is particularly pronounced in critical sectors such as healthcare, telecommunications, and data centers, where power reliability is crucial.

Technological Innovations in Battery Design

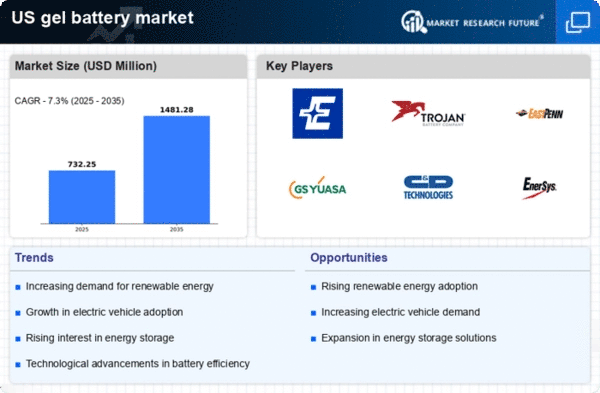

Innovations in battery technology are significantly impacting the gel battery market. Advances in materials and manufacturing processes are enhancing the performance characteristics of gel batteries, making them more efficient and cost-effective. For instance, improvements in gel electrolyte formulations are leading to better charge retention and faster charging times. The gel battery market is likely to benefit from these technological advancements, as manufacturers strive to meet the evolving needs of consumers. As of 2025, the market is projected to grow by 6% annually, driven by these innovations that enhance the appeal of gel batteries in various applications, including renewable energy storage and electric vehicles.

Rising Adoption of Renewable Energy Solutions

The increasing emphasis on renewable energy sources in the US is driving the gel battery market. As solar and wind energy installations proliferate, the need for efficient energy storage solutions becomes paramount. Gel batteries, known for their reliability and longevity, are emerging as a preferred choice for storing energy generated from renewable sources. In 2025, the market for energy storage systems is projected to reach approximately $10 billion, with gel batteries capturing a notable share due to their ability to withstand deep discharges and high cycle life. This trend indicates a growing recognition of gel batteries as essential components in the transition to sustainable energy systems, thereby bolstering the gel battery market.

Regulatory Support for Energy Storage Solutions

Government policies and regulations aimed at promoting energy storage solutions are positively influencing the gel battery market. Incentives for renewable energy adoption and energy efficiency programs are encouraging the use of gel batteries in residential and commercial applications. The US government has introduced various tax credits and grants to support energy storage technologies, which could potentially increase the market size of gel batteries. By 2025, it is anticipated that regulatory frameworks will further evolve, creating a more favorable environment for the gel battery market. This support is likely to enhance consumer confidence and drive investments in gel battery technologies.