Government Initiatives and Investments

Government initiatives aimed at improving infrastructure and public services are significantly influencing the geospatial analytics market. Federal and state agencies are increasingly investing in geospatial technologies to enhance urban planning, disaster management, and environmental monitoring. For example, the U.S. government has allocated substantial funding for projects that utilize geospatial analytics to improve transportation systems and public safety. The National Oceanic and Atmospheric Administration (NOAA) has also emphasized the use of geospatial data for climate monitoring and disaster response. Such investments not only enhance the capabilities of government agencies but also stimulate demand for geospatial analytics solutions in the private sector, thereby driving market growth.

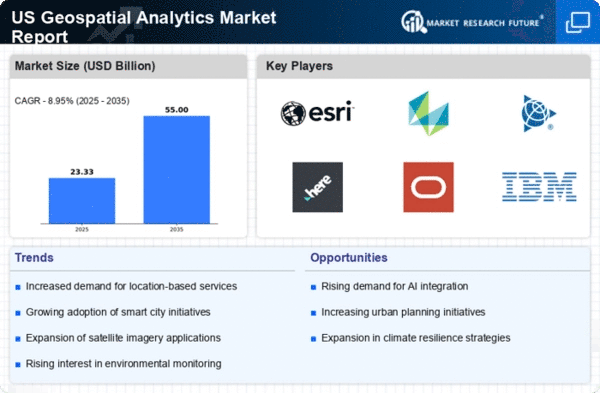

Rising Demand for Location-Based Services

The increasing reliance on location-based services is a primary driver for the geospatial analytics market. Businesses across various sectors, including retail, logistics, and healthcare, are leveraging geospatial data to enhance operational efficiency and customer engagement. For instance, the retail sector utilizes geospatial analytics to optimize store locations and tailor marketing strategies based on consumer behavior patterns. According to recent data, the market for location-based services is projected to grow at a CAGR of approximately 25% over the next five years, indicating a robust demand for geospatial analytics solutions. This trend underscores the importance of accurate geospatial data in decision-making processes, thereby propelling the growth of the geospatial analytics market.

Emergence of Smart Infrastructure Solutions

The emergence of smart infrastructure solutions is driving innovation within the geospatial analytics market. As cities evolve into smart cities, the integration of geospatial analytics into infrastructure planning and management becomes increasingly vital. Smart infrastructure leverages geospatial data to optimize resource allocation, enhance transportation systems, and improve public services. For instance, smart traffic management systems utilize geospatial analytics to monitor traffic patterns and reduce congestion. The increasing adoption of smart infrastructure initiatives is anticipated to create new opportunities for geospatial analytics providers, as municipalities seek to implement data-driven solutions that enhance urban living and sustainability.

Advancements in Data Collection Technologies

Technological advancements in data collection methods are reshaping the geospatial analytics market. Innovations such as drones, satellite imagery, and IoT devices are enabling the acquisition of high-resolution geospatial data at unprecedented scales. These technologies facilitate real-time data collection and analysis, which is crucial for industries like agriculture, urban planning, and environmental management. For instance, the agricultural sector is increasingly adopting precision farming techniques that rely on geospatial analytics to optimize crop yields and resource management. The integration of these advanced data collection technologies is expected to enhance the accuracy and efficiency of geospatial analytics, thereby expanding its applications across various industries.

Growing Importance of Data-Driven Decision Making

The shift to data-driven decision-making is a significant factor propelling the geospatial analytics market. Organizations are increasingly recognizing the value of data in informing strategic decisions, leading to a heightened demand for analytical tools that can process and visualize geospatial information. This trend is particularly evident in sectors such as real estate, where companies utilize geospatial analytics to assess property values and market trends. As businesses strive to gain a competitive edge, the need for sophisticated geospatial analytics solutions that can provide actionable insights is likely to grow. This growing emphasis on data-driven strategies is expected to further fuel the expansion of the geospatial analytics market.