Growth in Renewable Energy Sector

The growth in the renewable energy sector is significantly impacting the high speed-motor market. As the U.S. transitions towards sustainable energy sources, the demand for high speed motors in applications such as wind turbines and solar energy systems is on the rise. These motors are essential for optimizing energy conversion and improving overall system efficiency. The renewable energy market is projected to expand at a rate of 8% annually, which is likely to drive the high speed-motor market as well. This synergy between renewable energy and high speed motors not only fosters innovation but also aligns with national goals for energy independence and sustainability.

Rising Demand for Energy Efficiency

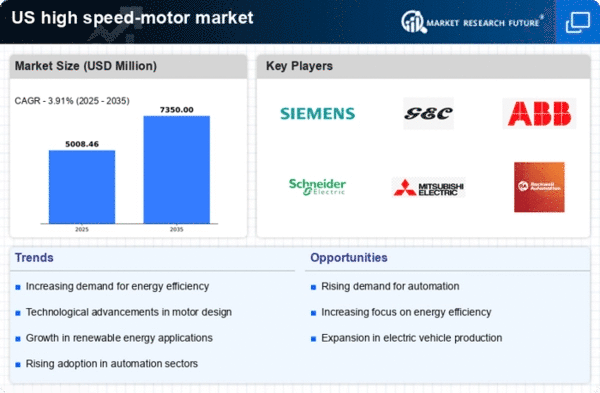

There is a notable surge in demand for energy-efficient solutions in the high speed-motor market. As industries strive to reduce operational costs and minimize environmental impact, high speed motors are increasingly favored for their superior efficiency. According to recent data, energy-efficient motors can reduce energy consumption by up to 30%, which is particularly appealing in sectors such as manufacturing and HVAC. This trend is further supported by initiatives aimed at promoting sustainable practices, leading to a projected growth rate of 5% annually in the high speed-motor market. The emphasis on energy efficiency not only aligns with regulatory standards but also enhances the competitive edge of businesses, thereby driving the market forward.

Expansion of Electric Vehicle Market

The expansion of the electric vehicle (EV) market is a critical driver for the high speed-motor market. As the automotive industry shifts towards electrification, the demand for high performance electric motors is escalating. High speed motors are integral to the efficiency and performance of EVs, contributing to longer ranges and faster acceleration. Recent projections indicate that the EV market could grow by over 20% annually, which directly correlates with the increasing need for high speed motors. This trend not only supports the automotive sector but also stimulates advancements in motor technology, thereby enhancing the overall high speed-motor market.

Technological Innovations in Motor Design

Innovations in motor design are significantly influencing the high speed-motor market. Advances in materials and engineering techniques have led to the development of lighter, more durable motors that can operate at higher speeds without compromising performance. For instance, the introduction of advanced magnetic materials has improved efficiency and reduced heat generation. This technological evolution is expected to propel the market, with estimates suggesting a growth of approximately 6% over the next five years. Furthermore, the integration of smart technologies, such as IoT capabilities, allows for real-time monitoring and optimization of motor performance, which is becoming increasingly essential in various applications, including robotics and automation.

Increased Automation in Manufacturing Processes

The trend towards increased automation in manufacturing processes is a significant driver for the high speed-motor market. As industries adopt advanced manufacturing technologies, the need for high speed motors that can deliver precise and rapid performance is becoming more pronounced. High speed motors are crucial in applications such as CNC machines and robotic arms, where speed and accuracy are paramount. The manufacturing sector is expected to grow by approximately 4% annually, which will likely enhance the demand for high speed motors. This shift towards automation not only improves productivity but also necessitates the development of more sophisticated motor technologies, thereby propelling the high speed-motor market.