Rising Fuel Prices

The hybrid system-automotive market is experiencing a notable surge in demand due to rising fuel prices in the US. As consumers face escalating costs at the pump, the appeal of hybrid vehicles, which offer improved fuel efficiency, becomes increasingly attractive. In 2025, the average price of gasoline has reached approximately $4.00 per gallon, prompting consumers to seek alternatives that can mitigate fuel expenses. This trend is likely to drive more individuals towards hybrid vehicles, which can provide fuel savings of up to 30% compared to traditional gasoline-powered cars. Consequently, the hybrid system-automotive market is poised for growth as consumers prioritize cost-effective transportation solutions.

Environmental Regulations

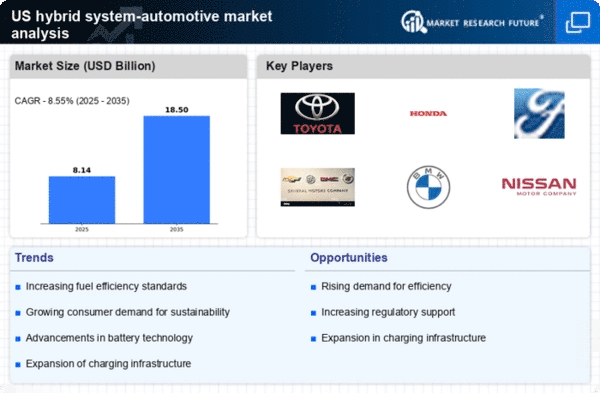

The hybrid system-automotive market is significantly influenced by stringent environmental regulations imposed by federal and state governments in the US. These regulations aim to reduce greenhouse gas emissions and promote cleaner air quality. In 2025, the US government has set ambitious targets to cut emissions from vehicles by 50% by 2030. As a result, automakers are increasingly investing in hybrid technologies to comply with these regulations. The hybrid system-automotive market is likely to benefit from this shift, as manufacturers develop more eco-friendly vehicles to meet regulatory standards. This regulatory landscape not only encourages innovation but also positions hybrid vehicles as a viable solution for environmentally conscious consumers.

Technological Integration

The hybrid system-automotive market is witnessing a transformative phase driven by the integration of advanced technologies. Innovations such as regenerative braking, improved battery systems, and enhanced electric motors are becoming commonplace in hybrid vehicles. In 2025, the market is expected to see a 15% increase in the adoption of hybrid systems that incorporate cutting-edge technology, enhancing performance and efficiency. This technological evolution not only improves the driving experience but also addresses consumer concerns regarding reliability and maintenance. As automakers continue to innovate, the hybrid system-automotive market is likely to expand, attracting tech-savvy consumers who seek modern and efficient transportation options.

Infrastructure Development

The hybrid system-automotive market is benefiting from ongoing infrastructure development across the US. Investments in charging stations and maintenance facilities for hybrid vehicles are becoming more prevalent, enhancing the overall appeal of hybrid systems. In 2025, the US government has allocated $1 billion towards expanding electric vehicle infrastructure, which indirectly supports the hybrid market by improving accessibility and convenience for consumers. This development is likely to encourage more individuals to consider hybrid vehicles as a practical option, knowing that the necessary support systems are in place. As infrastructure continues to evolve, the hybrid system-automotive market is expected to gain traction among a broader audience.

Consumer Demand for Sustainability

The hybrid system-automotive market is increasingly shaped by a growing consumer demand for sustainable transportation solutions. In 2025, surveys indicate that approximately 70% of consumers prioritize eco-friendly vehicles when making purchasing decisions. This shift in consumer preferences is prompting automakers to expand their hybrid offerings, catering to environmentally conscious buyers. The hybrid system-automotive market is likely to thrive as manufacturers respond to this demand by developing models that emphasize sustainability without compromising performance. This trend not only reflects a broader societal shift towards sustainability but also positions hybrid vehicles as a key player in the future of transportation.