Increasing Cybersecurity Threats

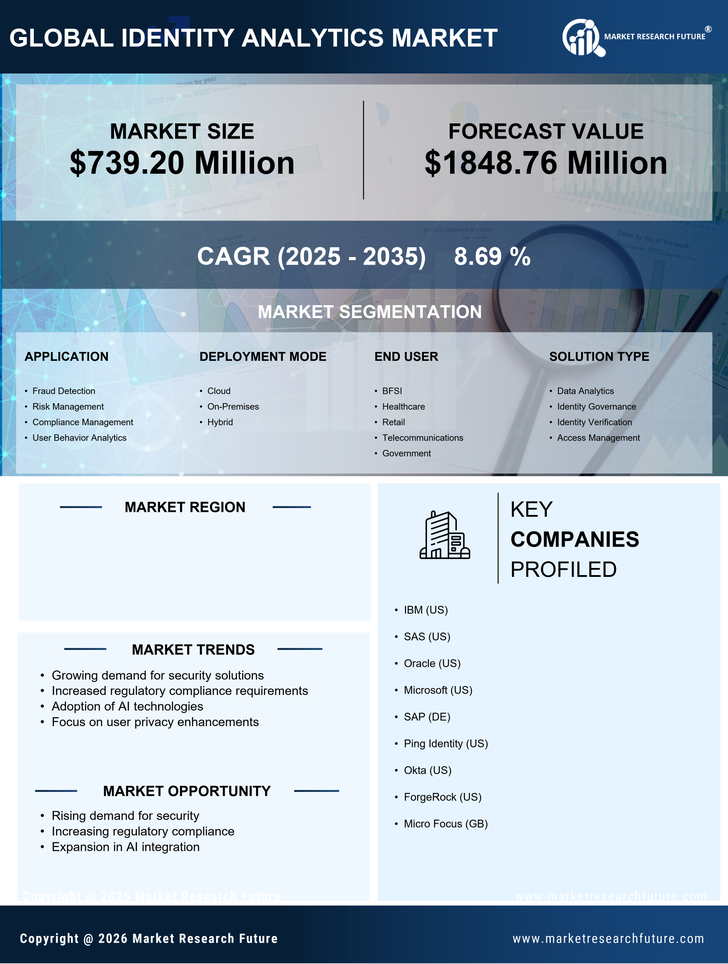

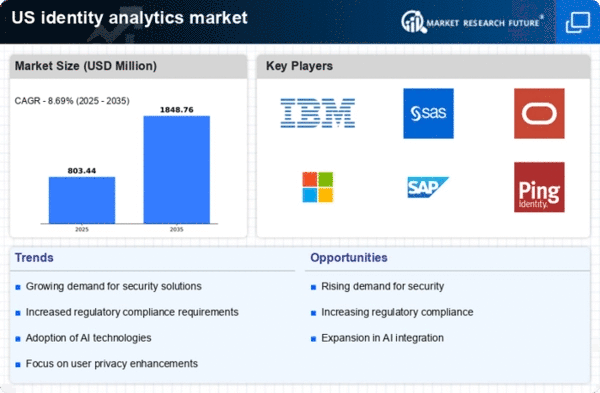

The identity analytics market is experiencing growth due to the escalating threats posed by cybercriminals. Organizations are increasingly recognizing the necessity of robust identity verification systems to safeguard sensitive data. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a surge in demand for identity analytics solutions. These solutions enable organizations to detect and respond to identity-related threats in real-time, thereby enhancing their overall security posture. As data breaches become more frequent, the identity analytics market is likely to expand as companies invest in advanced technologies to protect their assets and comply with regulatory requirements. This trend indicates a strong correlation between the rise in cyber threats and the growth of the identity analytics market, as businesses seek to mitigate risks and ensure the integrity of their operations.

Advancements in Technology and Infrastructure

Technological advancements are propelling the identity analytics market forward, as organizations adopt innovative solutions to enhance their identity management capabilities. The integration of cloud computing, big data analytics, and machine learning is transforming how businesses approach identity verification and fraud detection. By 2025, it is projected that the market for cloud-based identity analytics solutions will grow by 30%, reflecting the shift towards more scalable and efficient systems. This trend indicates that organizations are increasingly investing in modern infrastructure to support their identity analytics initiatives. As technology continues to evolve, the identity analytics market is likely to see further growth driven by the need for sophisticated tools that can handle complex identity challenges.

Rise of Remote Work and Digital Transformation

The identity analytics market is being shaped by the rise of remote work and the ongoing digital transformation across industries. As organizations adapt to flexible work environments, the need for secure identity verification processes has become paramount. In 2025, it is estimated that 70% of organizations will implement identity analytics solutions to manage remote access and ensure secure user authentication. This shift underscores the importance of identity analytics in maintaining security in a distributed workforce. As businesses continue to embrace digital transformation, the identity analytics market is likely to expand, driven by the demand for solutions that facilitate secure and efficient identity management in an increasingly digital landscape.

Regulatory Pressures and Compliance Requirements

The identity analytics market is significantly influenced by the increasing regulatory pressures faced by organizations. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) necessitates robust identity management solutions. In 2025, it is anticipated that non-compliance costs could reach up to $4 million per incident, prompting organizations to invest in identity analytics to ensure adherence to these regulations. This market driver highlights the critical role of identity analytics in helping businesses navigate complex compliance landscapes while protecting consumer data. As regulatory scrutiny intensifies, the identity analytics market is expected to grow as organizations prioritize compliance and risk management.

Growing Demand for Customer Experience Enhancement

In the identity analytics market, there is a notable shift towards enhancing customer experience through personalized services. Organizations are leveraging identity analytics to gain insights into customer behavior and preferences, which allows for tailored offerings. By 2025, it is projected that companies utilizing identity analytics for customer engagement will see a 20% increase in customer satisfaction rates. This trend is particularly relevant in sectors such as retail and finance, where understanding customer identity is crucial for delivering seamless experiences. As businesses strive to differentiate themselves in competitive markets, the identity analytics market is likely to benefit from this focus on customer-centric strategies, driving innovation and investment in analytics solutions that enhance user interactions.