Regulatory Compliance and Standards

The instrument transformer market is significantly influenced by stringent regulatory requirements in the US. Government agencies and industry standards organizations have established guidelines to ensure the safety and reliability of electrical systems. Compliance with these regulations necessitates the use of high-quality instrument transformers for accurate measurement and protection. The market is expected to witness growth as manufacturers innovate to meet these standards. For instance, the National Electrical Manufacturers Association (NEMA) has set forth standards that impact the design and performance of instrument transformers. As industries strive to adhere to these regulations, the instrument transformer market is likely to see increased demand for compliant products, thereby driving market expansion.

Rising Demand for Energy Efficiency

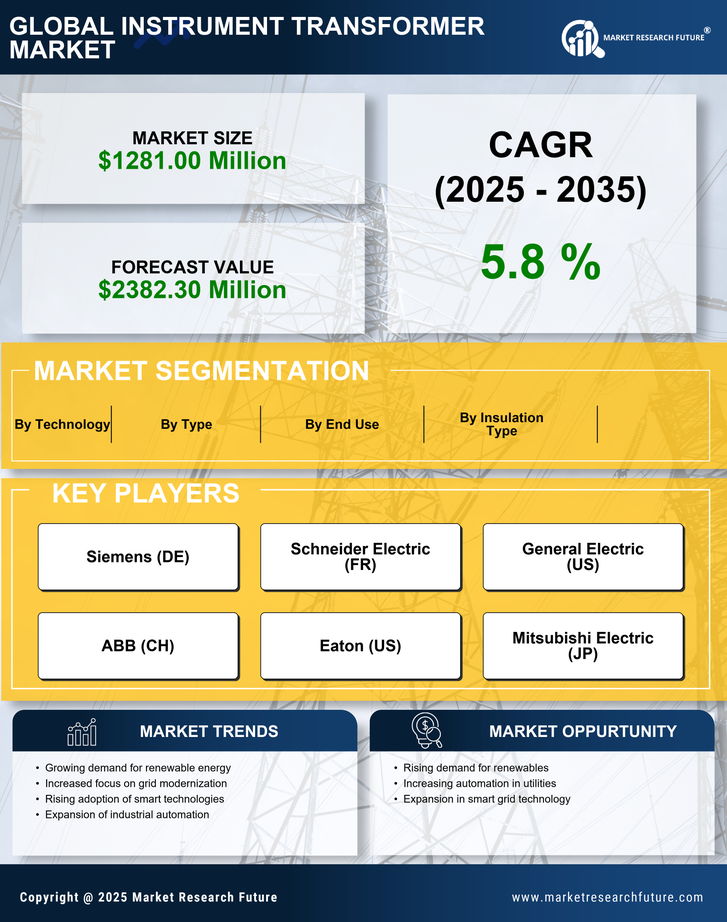

The increasing emphasis on energy efficiency in the US is driving the instrument transformer market. As utilities and industries seek to reduce energy consumption and operational costs, the demand for precise measurement and monitoring solutions has surged. Instrument transformers play a crucial role in ensuring accurate data collection for energy management systems. According to recent estimates, the energy efficiency market is projected to grow at a CAGR of approximately 8% through 2027. This growth is likely to enhance the adoption of instrument transformers, as they are essential for optimizing energy use and integrating renewable energy sources into the grid. The instrument transformer market is thus positioned to benefit from this trend, as more organizations prioritize energy-efficient technologies.

Expansion of Renewable Energy Projects

The ongoing expansion of renewable energy projects in the US is a key driver for the instrument transformer market. As the country transitions towards cleaner energy sources, the need for reliable measurement and monitoring solutions becomes paramount. Instrument transformers are essential for integrating renewable energy into the existing grid infrastructure. The US Department of Energy has reported that renewable energy sources accounted for approximately 20% of total electricity generation in 2023, a figure that is expected to rise. This growth in renewable energy projects necessitates the deployment of advanced instrument transformers to ensure efficient energy distribution and grid stability. Consequently, the instrument transformer market is poised for growth as investments in renewable energy continue to increase.

Infrastructure Upgrades and Modernization

The need for infrastructure upgrades and modernization in the US is a critical driver for the instrument transformer market. Aging electrical infrastructure poses challenges for reliability and efficiency, prompting utilities to invest in modern solutions. Instrument transformers are integral to these upgrades, providing accurate measurements and ensuring system stability. The US government has allocated substantial funding for infrastructure improvements, with an estimated $1 trillion earmarked for various projects over the next decade. This investment is likely to stimulate demand for instrument transformers as utilities seek to enhance their systems. The instrument transformer market stands to benefit from this trend, as modernization efforts create opportunities for new installations and replacements.

Technological Innovations in Measurement Solutions

Technological innovations are reshaping the instrument transformer market, particularly in the realm of measurement solutions. Advancements in digital technology and smart sensors are enhancing the accuracy and reliability of instrument transformers. These innovations enable real-time data collection and analysis, which is crucial for modern energy management systems. The integration of Internet of Things (IoT) capabilities into instrument transformers is also gaining traction, allowing for improved monitoring and control. As industries increasingly adopt these advanced technologies, the instrument transformer market is likely to experience significant growth. The demand for innovative measurement solutions is expected to rise, driven by the need for enhanced operational efficiency and data-driven decision-making.