Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the intelligent document-processing market. As organizations migrate to cloud infrastructures, the demand for scalable and flexible document processing solutions is on the rise. Cloud-based platforms offer enhanced accessibility, allowing teams to collaborate seamlessly regardless of location. This transition is particularly beneficial for remote work environments, which have become more prevalent. Market data suggests that cloud adoption in document processing can reduce operational costs by approximately 25%, making it an attractive option for businesses aiming to optimize their resources while maintaining high levels of efficiency.

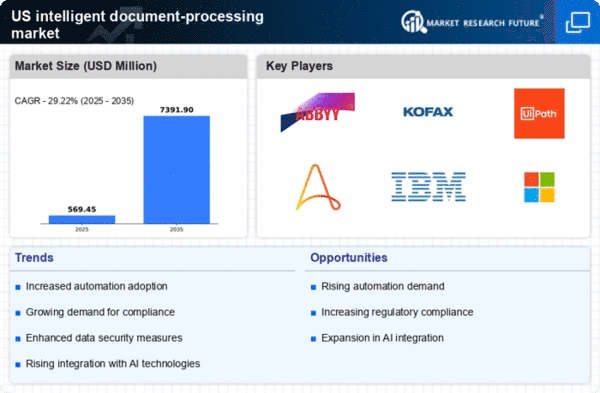

Growing Demand for Automation Solutions

The intelligent document-processing market is experiencing a surge in demand for automation solutions across various sectors. Organizations are increasingly recognizing the need to streamline operations and reduce manual intervention in document handling. This trend is particularly evident in industries such as finance and healthcare, where efficiency and accuracy are paramount. According to recent data, the automation of document processing can lead to a reduction in processing time by up to 70%, thereby enhancing productivity. As businesses strive to remain competitive, the adoption of intelligent document-processing technologies is likely to accelerate, driving growth in the market.

Rising Need for Enhanced Data Analytics

In the intelligent document-processing market, the rising need for enhanced data analytics is becoming a pivotal driver. Organizations are seeking to extract valuable insights from vast amounts of unstructured data contained in documents. This demand is fueled by the increasing importance of data-driven decision-making in business strategies. The ability to analyze and interpret data effectively can lead to improved operational efficiency and customer satisfaction. Market analysis indicates that companies leveraging advanced analytics in document processing can achieve a 30% increase in data utilization, thereby reinforcing the relevance of intelligent document-processing solutions in today's data-centric environment.

Increased Regulatory Compliance Requirements

The intelligent document-processing market is being shaped by increased regulatory compliance requirements across various industries. Organizations are under pressure to adhere to stringent regulations regarding data privacy and security, necessitating the implementation of robust document processing solutions. This trend is particularly pronounced in sectors such as finance and healthcare, where compliance failures can result in substantial penalties. As a result, businesses are investing in intelligent document-processing technologies that ensure compliance while enhancing operational efficiency. It is estimated that companies focusing on compliance-driven document processing can reduce the risk of regulatory breaches by up to 40%, underscoring the importance of this driver.

Emergence of Advanced Machine Learning Techniques

The emergence of advanced machine learning techniques is a key driver in the intelligent document-processing market. These techniques enable systems to learn from data patterns and improve their accuracy over time, leading to more effective document classification and data extraction. As machine learning algorithms become more sophisticated, organizations are increasingly adopting these technologies to enhance their document processing capabilities. This trend is expected to contribute to a projected growth rate of 20% in the market over the next few years. The integration of machine learning into document processing not only improves efficiency but also reduces the likelihood of human error, making it a vital component of modern business operations.