US Internet of Things IOT Insurance Market Overview

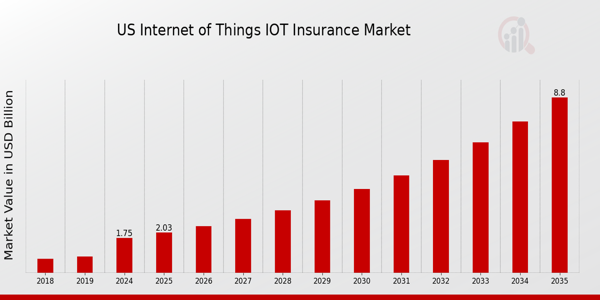

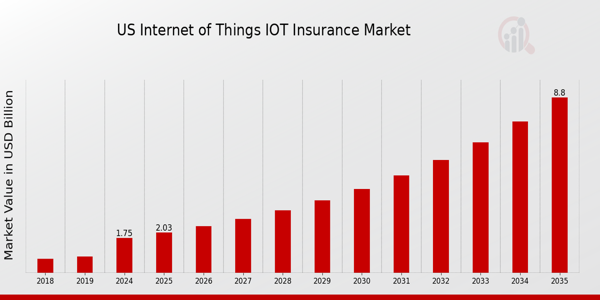

As per MRFR analysis, the US Internet of Things IOT Insurance Market Size was estimated at 1.43 (USD Billion) in 2023.The US Internet of Things IOT Insurance Market Industry is expected to grow from 1.75(USD Billion) in 2024 to 8.8 (USD Billion) by 2035. The US Internet of Things IOT Insurance Market CAGR (growth rate) is expected to be around 15.816% during the forecast period (2025 - 2035).

Key US Internet of Things IOT Insurance Market Trends Highlighted

There are a number of major changes in the US Internet of Things (IoT) insurance business that are changing the way the industry works. More and more industries, like healthcare, cars, and smart homes, are using IoT devices. This is raising the need for insurance policies that are specifically designed to cover these technologies. More connected gadgets are also making it easier to analyse and manage risks, which lets insurers offer more personalized insurance based on data that is always up to date.

This move toward making decisions based on data is a major industry driver since insurers see how IoT can help them make better underwriting decisions and cut down on losses.

Also, there are many chances to be had in fields like cyber risk insurance since people are becoming more worried about data security and privacy. Many IoT devices are at risk of cyber-attacks; thus, insurers can create special coverage plans to protect against these risks. The US government's trend of supporting regulations that promote technology and innovation makes the market even more promising. Regulatory frameworks are changing to make sure that IoT is used safely and responsibly.

This is a good time for insurance solutions that work with new technologies to come out. Recently, there has been a noteworthy rise in cooperation between digital businesses and insurance companies. The goal is to produce solutions that combine IoT features with classic insurance models.

This development shows that more and more people are realizing how important partnerships are for making the most of IoT technologies. Overall, the US IoT insurance industry is about to change a lot because of new technologies, new ways to manage risk, and changing customer expectations.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

US Internet of Things IOT Insurance Market Drivers

Integration of Advanced Technology in Insurance Practices

The US Internet of Things IOT Insurance Market Industry is being significantly driven by the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics within the insurance sector. Established companies like Allstate and State Farm have adopted IoT technology to efficiently collect and analyze data from policyholders' devices.

This trend leads to more personalized insurance products and allows insurers to enhance risk assessment and pricing strategies effectively.For instance, the deployment of telematics by insurance firms has been shown to decrease claim costs by approximately 10% to 15%, as reported by the Insurance Information Institute's latest data releases. This technology enables insurers to leverage real-time data for better decision-making, thus stimulating growth in the US Internet of Things IOT Insurance Market as consumer preferences shift towards customized insurance solutions powered by data.

Increase in Connected Devices and Smart Homes

The proliferation of connected devices and smart home technologies is a major driver for the US Internet of Things IOT Insurance Market Industry. There are over 300 million connected devices in the US, and this number is projected to continue growing as more households adopt smart technology. As reported by the Consumer Technology Association, 85% of US households are expected to own at least one smart home device by 2025.

This creates a larger pool of data that insurers can utilize to assess risk more accurately and create innovative coverage options.Companies like Progressive Insurance are already capitalizing on this trend by offering discounts for homeowners who install smart devices. This shift towards connected living enhances the market for IoT insurance, emphasizing the need for tailored insurance products.

Regulatory Support for IoT Insurance Initiatives

Regulatory support is increasingly becoming a critical driver in the growth of the US Internet of Things IOT Insurance Market Industry. Various states in the US have started implementing guidelines and regulations that favor the adoption of IoT insurance technologies. The National Association of Insurance Commissioners has been particularly proactive in creating a framework to assist insurers with the transition towards data-driven business models.They have noted a significant increase in the adoption of IoT in underwriting and claims processes, helping to streamline operations.

With government initiatives supporting such technologies, the market for IoT insurance is expected to expand as more industry players come on board, encouraged by supportive regulatory environments.

US Internet of Things IOT Insurance Market Segment Insights

Internet of Things IOT Insurance Market End User Insights

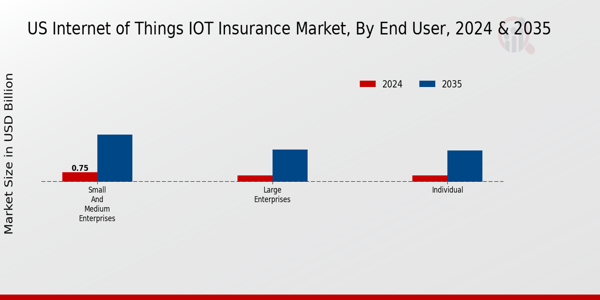

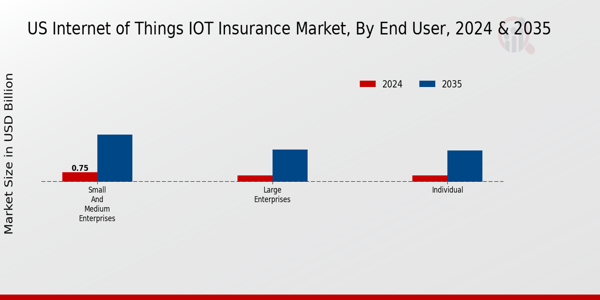

The US Internet of Things (IoT) Insurance Market is experiencing considerable growth, driven by the increasing integration of connected devices across various industries. Focusing on the End User segment, this market is significantly influenced by Individuals, Small and Medium Enterprises, as well as Large Enterprises, each contributing uniquely to the overall dynamics. Individuals are increasingly recognizing the value of insurance products that offer protection for IoT-enabled devices, enhancing personal security and asset protection. This growing adoption is a response to the increasing number of smart devices in households, which creates new risks and necessitates tailored insurance solutions.

Small and Medium Enterprises (SMEs) also play a critical role, as they leverage IoT technologies to enhance operational efficiencies and risk management. SMEs benefit from IoT insurance packages that can help mitigate risks associated with data breaches, equipment failure, and liability issues, thus ensuring business continuity. As SMEs embrace digital transformation, the demand for tailored IoT insurance solutions is anticipated to surge, highlighting a significant opportunity for market participants to develop competitive offerings catering to this sector's unique needs.

Large Enterprises dominate the market due to their extensive deployment of IoT devices in their operations, ranging from supply chain management, manufacturing to customer engagement. The scale at which these enterprises operate results in higher risk exposure, making IoT insurance essential to safeguard against potential losses and liabilities. Moreover, large enterprises often have the resources to invest in advanced IoT solutions, which can lead to a higher dependency on comprehensive insurance coverage to manage complex risks effectively.

The interplay between these End User segments illustrates a transformative shift in the insurance landscape, as both individuals and businesses become more aware of the implications of digital connectivity. This awareness is essential as it drives the development of innovative insurance solutions that are increasingly critical in our interconnected world. The US IoT Insurance Market is well-positioned to capitalize on these trends, offering tailored insurance products that align with the specific needs of each segment, thereby facilitating widespread adoption and securing future market growth.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Internet of Things IOT Insurance Market Type of Insurance Insights

The US Internet of Things IOT Insurance Market is experiencing significant growth across various types of insurance, each playing a crucial role in addressing the evolving risks associated with connected devices. Health Insurance is becoming increasingly relevant as wearable technologies and health monitoring devices proliferate, leading to new ways of assessing and managing health risks.

Property Insurance is adapting to protect smart homes as interconnected security systems and home automation contribute to a more integrated living environment.Liability Insurance is gaining importance in the context of potential third-party claims arising from IOT-related incidents, emphasizing the need for comprehensive coverage in an interconnected world. Additionally, Cyber Insurance has emerged as a critical segment, safeguarding organizations against data breaches and cyber threats linked to IOT devices.

This diverse segmentation highlights the necessity for tailored insurance products that evolve with technological advancements while addressing the specific risks that accompany the widespread adoption of IOT technologies in the US.The interplay between these various types of insurance is vital for both consumers and businesses, as they work to mitigate risks and leverage the benefits that the Internet of Things can offer.

Internet of Things IOT Insurance Market Technology Used Insights

The Technology Used segment in the US Internet of Things (IoT) Insurance Market is pivotal for enhancing risk assessment and personalized insurance solutions. Wearables, such as fitness trackers and health monitors, play a crucial role in collecting individual health data, which can lead to tailored insurance products and premium discounts based on actual usage behaviors.

Smart Home Devices encompass a wide array of technology, including security systems and smart appliances, significantly impacting homeowners' insurance by minimizing risks and providing real-time monitoring, hence influencing policy structures.Connected Vehicles are essential in transforming automotive insurance with telematics, offering insights into driving behaviors that enable more personalized and usage-based premium models. Lastly, Industrial IoT is reshaping the landscape through the implementation of IoT devices in manufacturing and logistics, enabling businesses to minimize losses through predictive maintenance and real-time monitoring.

Together, these technologies drive innovation in insurance products and services, aligning with the growing demand for customized coverage in the evolving market landscape.This segment's dynamic nature reflects the trends in risk management while presenting opportunities and challenges for insurers aiming to integrate these technologies into their offerings effectively.

Internet of Things IOT Insurance Market Application Insights

The US Internet of Things (IoT) Insurance Market, particularly in the Application segment, showcases significant growth avenues driven by advancements in technology and consumer demand. Telematics is crucial in refining auto insurance policies through real-time data analytics, leading to more personalized premiums based on actual driving behavior. Smart Home Monitoring has gained traction as homeowners increasingly seek protection against risks, utilizing connected devices that offer continuous surveillance and rapid alerts in emergencies.

Health Monitoring further drives market interest, with wearable devices providing valuable health data, thereby enabling insurers to offer proactive health management plans.Asset Tracking stands out as a key component in safeguarding against theft and loss, allowing businesses to monitor their assets efficiently in real time. The dynamic interplay of these applications is propelling the broader US Internet of Things IoT Insurance Market segmentation, influenced by growing safety concerns and technological advancements facilitating seamless data integration.

This evolution presents ample opportunities for innovation, aligning insurance products with the ever-changing landscape of digital connectivity and consumer expectations.The potential of these applications underlines their importance in shaping the future of the US Insurance landscape.

US Internet of Things IOT Insurance Market Key Players and Competitive Insights

The competitive landscape of the US Internet of Things (IoT) Insurance Market is marked by rapid technological advancements and an increasing demand for connectivity in various sectors such as automotive, healthcare, and home insurance. The emergence of IoT devices has created new opportunities and challenges for insurance providers, necessitating innovative approaches to risk assessment and management. As companies race to integrate IoT solutions into their offerings, competition intensifies, with a focus on developing tailored products that can effectively meet the complex risk profiles associated with IoT.

Insurers are exploring new business models and partnerships as they seek to capitalize on the data generated by IoT devices, which can enhance predictive analytics and enable more accurate underwriting processes. This surge in IoT adoption presents significant potential for growth, making it essential for providers to differentiate themselves through technology, customer-centric solutions, and comprehensive service offerings.AIG has established a notable presence in the US Internet of Things IoT Insurance Market by leveraging its expertise in risk management and data analytics.

The company focuses on offering tailored insurance solutions that address the unique risks associated with IoT deployments across various industries. AIG’s strengths lie in its ability to integrate data from IoT devices into its underwriting processes, providing enhanced risk assessment capabilities and enabling more accurate pricing for customers. The company’s commitment to innovation and adapting to technology trends allows it to stay ahead of competitors while meeting the evolving needs of clients in the rapidly changing insurance landscape.

AIG's strong brand recognition and long-standing market presence underscore its reputation as a reliable insurance provider capable of navigating the complexities presented by IoT technology.Chubb is a prominent player in the US Internet of Things IoT Insurance Market, offering a range of insurance products and services specifically designed to address the challenges posed by IoT solutions. The company has a solid market presence, leveraging its global reach and extensive experience across different sectors to effectively cater to the diverse needs of clients.

Chubb’s strengths include a robust portfolio of risk management services, which encompass cybersecurity coverage and IoT risk assessments, allowing businesses to mitigate potential threats associated with connected devices. The company has also pursued strategic mergers and acquisitions to enhance its capabilities within this space, enabling it to offer more comprehensive solutions. By focusing on innovation and maintaining strong partnerships, Chubb continues to bolster its position in the IoT insurance market, ensuring that it remains competitive amid the evolving demands of the industry.

Key Companies in the US Internet of Things IOT Insurance Market Include:

- AIG

- Chubb

- Liberty Mutual

- USAA

- Farmers Insurance

- Nationwide

- Progressive

- Hiscox

- American Family Insurance

- Allstate

- State Farm

- MetLife

- Travelers

US Internet of Things IOT Insurance Industry Developments

The US Internet of Things (IoT) Insurance Market has seen notable developments recently, particularly in the realm of technology integration and service expansion. Companies such as AIG and Chubb are actively enhancing their insurance offerings by incorporating IoT devices to provide data-driven risk assessments and tailor policies more effectively.

The market has also experienced significant financial growth; for instance, estimates suggest that by 2025, the IoT insurance sector could reach a valuation of over 35 USD Billion in the US, driven by increasing demand for personalized and real-time insurance solutions. In terms of mergers and acquisitions, in June 2023, Nationwide acquired a tech-driven startup specializing in IoT solutions, bolstering its capabilities in risk management.

Meanwhile, Progressive has been focusing on expanding its telematics programs to offer more competitive pricing models based on driver behavior analysis. Major players like Liberty Mutual and Hiscox are also investing heavily in Research and Development to create innovative products leveraging IoT technologies. As regulatory bodies increasingly recognize the potential of IoT in insurance, the market is expected to continue its upward trajectory in the coming years.

Internet Of Things IoT Insurance Market Segmentation Insights

Internet of Things IOT Insurance Market End User Outlook

- Individual

- Small and Medium Enterprises

- Large Enterprises

Internet of Things IOT Insurance Market Type of Insurance Outlook

- Health Insurance

- Property Insurance

- Liability Insurance

- Cyber Insurance

Internet of Things IOT Insurance Market Technology Used Outlook

- Wearables

- Smart Home Devices

- Connected Vehicles

- Industrial IoT

Internet of Things IOT Insurance Market Application Outlook

- Telematics

- Smart Home Monitoring

- Health Monitoring

- Asset Tracking

| Report Attribute/Metric |

Details |

| Market Size 2023 |

1.43 (USD Billion) |

| Market Size 2024 |

1.75 (USD Billion) |

| Market Size 2035 |

8.8 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

15.816% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

AIG, Chubb, Liberty Mutual, USAA, Farmers Insurance, Nationwide, Progressive, Hiscox, American Family Insurance, Allstate, State Farm, MetLife, Travelers |

| Segments Covered |

End User, Type of Insurance, Technology Used, Application |

| Key Market Opportunities |

Telematics-based auto insurance, Smart home security integration, Cyber risk management solutions, Wearable devices for health tracking, Customized policies through data analytics |

| Key Market Dynamics |

Increased data utilization, Enhanced risk assessment, Growing customer demand, Advancement in technology, Regulatory compliance challenges |

| Countries Covered |

US |

Frequently Asked Questions (FAQ):

The US Internet of Things IoT Insurance Market is expected to be valued at 1.75 USD Billion in 2024.

By 2035, the US Internet of Things IoT Insurance Market is projected to reach a valuation of 8.8 USD Billion.

The CAGR for the US Internet of Things IoT Insurance Market from 2025 to 2035 is expected to be 15.816%.

The Small and Medium Enterprises segment is expected to have the highest market value at 3.75 USD Billion by 2035.

Major players in the market include AIG, Chubb, Liberty Mutual, USAA, and Farmers Insurance among others.

The Individual segment is valued at 0.5 USD Billion in 2024.

Challenges include evolving technology risks and regulatory changes affecting insurance practices.

The market for Large Enterprises is expected to reach 2.55 USD Billion by 2035.

Opportunities arise from advancements in AI and data analytics providing enhanced risk assessment.

The interest is significant with the Individual segment projected to grow to 2.5 USD Billion by 2035.