- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

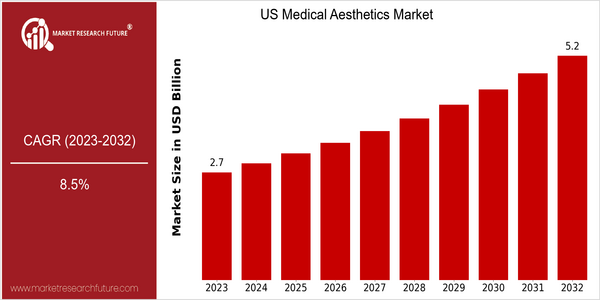

| Year | Value |

|---|---|

| 2023 | USD 2.71 Billion |

| 2032 | USD 5.209 Billion |

| CAGR (2023-2032) | 8.5 % |

Note – Market size depicts the revenue generated over the financial year

The US Medical Aesthetics Market is expected to reach $ 2.7 billion by 2023 and is projected to reach $ 5.1 billion by 2032, registering a CAGR of 8.5% between 2018 and 2032. This growth indicates the strong demand for aesthetic procedures and products driven by an increasing societal focus on physical appearance and self-care. The market is expected to grow significantly with the growing awareness of the public. The advancement of technology and the development of new methods of treatment are expected to contribute to the growth of the market. There are many reasons for this market growth. Among these, the growing prevalence of skin-related diseases, the increasing cosmetic needs of the aging population, and the growing acceptance of non-invasive treatments. In addition, the development of advanced laser systems and minimally invasive techniques is also expected to drive the market. Strategic initiatives by major players, such as Allergan, Galderma, and Merz Pharma, to enhance their market presence and cater to changing customer preferences. Allergan's recent efforts to expand its portfolio of fillers and neuromodulators, for example, illustrate the competition in the market and the efforts to meet the growing demand for medical aesthetics.

Regional Market Size

Regional Deep Dive

The U.S. Medical Aesthetics Market is characterized by a strong demand for non-surgical and minimally invasive procedures, fueled by an increased focus on personal appearance and health. The market is influenced by technological advances, an aging population, and increasing disposable incomes, which, combined, are increasing access to aesthetic treatments. Moreover, the cultural acceptance of cosmetic procedures is growing, which is a further driver of market growth. The market is highly competitive, with a large number of established players and many new entrants, which is driving innovation and expanding treatment options.

Europe

- The European market is witnessing a surge in demand for sustainable and organic aesthetic products, with companies like Galderma leading initiatives to develop eco-friendly formulations.

- Increased collaboration between aesthetic practitioners and dermatologists is shaping treatment protocols, enhancing patient outcomes and safety in procedures.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in medical tourism for aesthetic procedures, with countries like South Korea and Thailand becoming popular destinations due to their advanced technologies and competitive pricing.

- Innovations in laser technology and skin rejuvenation treatments are being spearheaded by local companies, such as Hada Labo, which are catering to the unique skin types and preferences of the regional population.

Latin America

- Brazil remains a leader in the medical aesthetics market in Latin America, with a strong cultural acceptance of cosmetic procedures and a high number of certified practitioners.

- The introduction of new financing options for aesthetic treatments is making procedures more accessible to a broader audience, driving market growth in countries like Mexico and Argentina.

North America

- The rise of telemedicine has significantly impacted the medical aesthetics market, with companies like Allergan Aesthetics launching virtual consultations to enhance patient access to aesthetic services.

- Regulatory changes, such as the FDA's recent approval of new dermal fillers and injectables, have expanded the range of available treatments, encouraging more practitioners to enter the market.

Middle East And Africa

- The Middle East is seeing a rise in demand for aesthetic procedures among younger demographics, with clinics in Dubai and Abu Dhabi offering luxury aesthetic experiences that cater to affluent consumers.

- Government initiatives promoting health and wellness, such as the UAE's Vision 2021, are encouraging investments in the medical aesthetics sector, leading to the establishment of new clinics and training programs.

Did You Know?

“Approximately 70% of patients seeking aesthetic procedures in the US are between the ages of 30 and 54, highlighting a significant market segment focused on both preventative and corrective treatments.” — American Society of Plastic Surgeons

Segmental Market Size

The US Medical Aesthetics Market is mainly driven by the non-invasive and minimally invasive procedures segment, which is currently experiencing robust growth. The market is characterized by an increasing focus on personal appearance, an increasing acceptance of aesthetic procedures by different populations, and the advancement of new and more effective treatments. These factors are further supported by regulatory policies, such as the FDA’s accelerated approval process for new devices. Non-invasive procedures are currently at a mature stage of development, and the leading companies in this area are Allergan and Galderma, with their well-known products Botox and Restylane. The main applications in this area are facial rejuvenation, body contouring, and skin tightening. Clinics and medical spas are the main touch points for consumers. The development of telemedicine and the influence of social media on beauty standards are accelerating the market’s development. The evolution of this segment is being driven by newer, more effective, and more accessible treatments, such as radiofrequency and laser treatments.

Future Outlook

The medical aesthetics market in the United States is projected to grow substantially between 2023 and 2032. The market value is expected to rise from $2.71 billion to about $5.209 billion, at a robust compound annual growth rate (CAGR) of 8.5%. This growth is driven by the increasing demand for non-invasive aesthetic procedures, which is driven by the growing importance of appearance and the rising level of disposable income. As social trends continue to evolve, the acceptance of aesthetic treatments is expected to spread across all age groups, especially among younger consumers who want to prevent the effects of aging. In 2032, it is expected that almost one-third of adults aged 18 to 45 will have undergone at least one medical aesthetic treatment, compared to only about one-fifth in 2023. This shows a significant increase in market penetration. In addition, the development of new lasers, minimally invasive procedures and individualized treatment plans based on artificial intelligence is expected to enhance the market. Also, the regulatory support for medical aesthetics and the increasing availability of treatments in both urban and suburban areas will contribute to the market's expansion. Telemedicine for aesthetic procedures and the integration of medical aesthetics with preventive health care are expected to have a major impact on shaping customer preferences and driving market growth. The market is evolving, and as it develops, the market players must remain agile to take advantage of the trends and technological developments to meet the growing demand for medical aesthetics.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.5 Billion |

| Market Size Value In 2023 | USD 2.71 Billion |

| Growth Rate | 8.50% (2023-2032) |

US Medical Aesthetics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.