Increased Healthcare Expenditure

the medical digital-imaging-devices market benefits from increased healthcare expenditure in the US. With a growing emphasis on improving healthcare infrastructure and patient services, investments in advanced medical technologies are on the rise. According to the Centers for Medicare & Medicaid Services, national health spending is projected to grow at an average rate of 5.4% annually, reaching nearly $6 trillion by 2027. This increase in funding is likely to facilitate the acquisition of state-of-the-art imaging devices, thereby enhancing diagnostic capabilities across healthcare facilities. As hospitals and clinics allocate more resources to medical imaging, the medical digital-imaging-devices market is poised for substantial growth, reflecting the broader trend of prioritizing advanced healthcare solutions.

Emphasis on Training and Education

The medical digital-imaging-devices market is also influenced by an emphasis on training and education for healthcare professionals. As imaging technologies evolve, there is a growing need for skilled personnel who can effectively operate and interpret advanced imaging devices. Educational institutions and healthcare organizations are increasingly investing in training programs to ensure that radiologists and technicians are well-versed in the latest imaging techniques. This focus on education is crucial for maximizing the potential of medical imaging technologies and improving diagnostic accuracy. As the workforce becomes more proficient, the medical digital-imaging-devices market is expected to benefit from enhanced utilization of imaging devices, ultimately leading to better patient outcomes.

Rising Incidence of Chronic Diseases

The medical digital-imaging-devices market is significantly influenced by the rising incidence of chronic diseases in the US. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming increasingly prevalent, necessitating advanced imaging solutions for effective diagnosis and management. The American Heart Association reports that cardiovascular diseases account for nearly 1 in 3 deaths in the US, highlighting the urgent need for reliable imaging devices. As healthcare systems strive to enhance early detection and treatment, the demand for medical imaging technologies is expected to rise. This trend suggests that the medical digital-imaging-devices market will continue to grow, driven by the need for innovative diagnostic tools that can address the complexities of chronic disease management.

Growing Demand for Point-of-Care Imaging

the medical digital-imaging-devices market is experiencing a growing demand for point-of-care imaging solutions. These devices enable immediate imaging and diagnosis at the site of patient care, which is particularly beneficial in emergency and outpatient settings. The convenience and efficiency of point-of-care imaging are driving its adoption among healthcare providers. Recent studies indicate that point-of-care imaging can reduce patient wait times and improve overall satisfaction. As healthcare systems increasingly prioritize patient-centered care, the medical digital-imaging-devices market is likely to expand, with a focus on developing portable and user-friendly imaging technologies that cater to the needs of both patients and providers.

Technological Advancements in Imaging Techniques

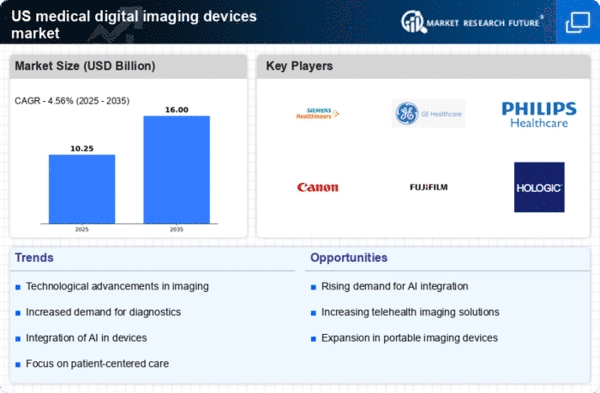

The medical digital-imaging-devices market is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, high-resolution MRI, and digital X-rays are enhancing diagnostic accuracy and patient outcomes. These advancements are not only improving the quality of images but also reducing the time required for diagnosis. According to recent data, the market for advanced imaging technologies is projected to grow at a CAGR of approximately 7.5% over the next five years. This growth is driven by the increasing demand for precise imaging solutions in various medical fields, including oncology and cardiology. As healthcare providers seek to adopt the latest technologies, the medical digital-imaging-devices market is likely to expand significantly, reflecting the ongoing commitment to improving patient care.