Innovation in Product Development

Innovation plays a crucial role in the microbiome cosmetic products market, as brands strive to differentiate themselves in a competitive landscape. Companies are investing in research and development to create novel formulations that harness the power of probiotics and prebiotics. This innovation is not limited to skincare but extends to haircare and body care products as well. The introduction of new technologies, such as encapsulation methods that enhance the stability and efficacy of active ingredients, is becoming commonplace. As a result, the market is witnessing a surge in product launches that cater to diverse consumer needs. In 2025, the microbiome cosmetic products market is expected to see a significant increase in the number of innovative products, with an estimated 30% of new launches featuring microbiome-centric formulations.

Sustainability and Ethical Consumerism

Sustainability and ethical consumerism are increasingly influencing the microbiome cosmetic products market. Consumers are becoming more conscious of the environmental impact of their purchases, leading to a demand for eco-friendly and sustainably sourced ingredients. Brands that prioritize sustainable practices, such as biodegradable packaging and cruelty-free testing, are likely to resonate with this growing demographic. Market Research Future suggests that approximately 70% of consumers in the US are willing to pay a premium for products that align with their values regarding sustainability. This shift is prompting companies in the microbiome cosmetic products market to adopt more responsible sourcing and production methods, thereby enhancing their appeal to environmentally conscious consumers.

Rise of E-commerce and Digital Marketing

The rise of e-commerce and digital marketing is transforming the microbiome cosmetic products market. With the increasing prevalence of online shopping, brands are leveraging digital platforms to reach a wider audience and educate consumers about the benefits of microbiome-friendly products. Social media, in particular, plays a crucial role in shaping consumer perceptions and driving sales. Influencer marketing and targeted advertising campaigns are becoming essential strategies for brands looking to capture the attention of health-conscious consumers. Market data indicates that online sales of cosmetic products are expected to account for over 25% of total sales by 2026, highlighting the importance of digital channels in the microbiome cosmetic products market. This shift not only enhances accessibility but also allows for personalized marketing approaches that resonate with individual consumer preferences.

Growing Consumer Awareness of Skin Health

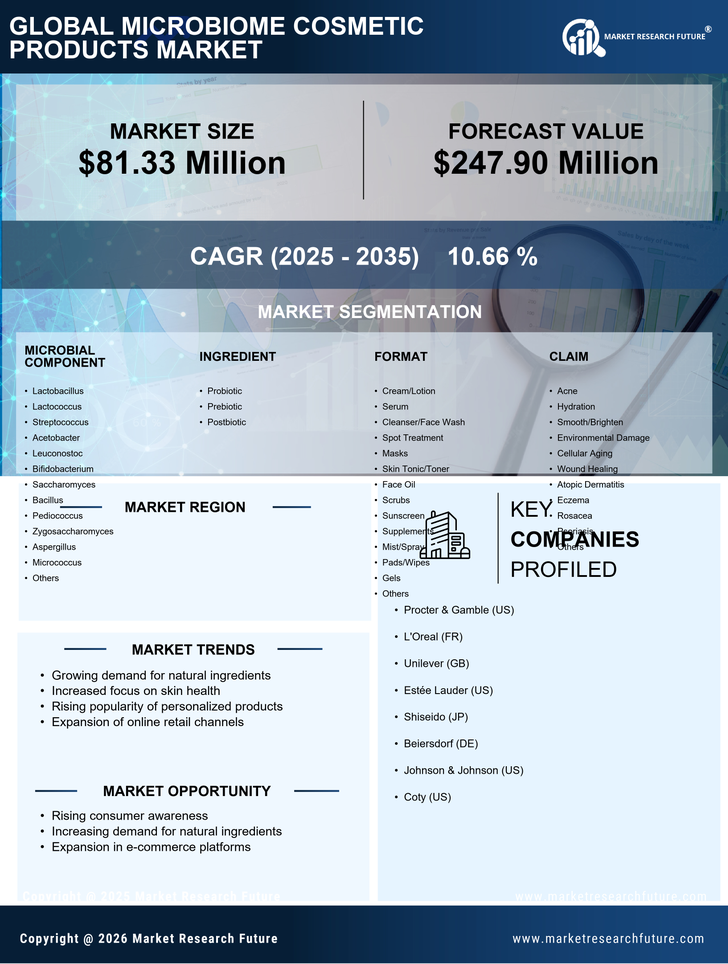

The increasing consumer awareness regarding skin health is a pivotal driver for the microbiome cosmetic products market. As individuals become more informed about the importance of maintaining a balanced skin microbiome, they are actively seeking products that support skin health. This trend is reflected in the rising demand for microbiome-friendly formulations, which are perceived as beneficial for skin conditions such as acne, eczema, and rosacea. Market data indicates that the microbiome cosmetic products market is projected to grow at a CAGR of approximately 10% over the next five years, driven by this heightened awareness. Consumers are increasingly prioritizing products that not only enhance appearance but also promote overall skin wellness, thereby influencing purchasing decisions and shaping product development in the industry.

Regulatory Support for Natural Ingredients

Regulatory support for natural ingredients is emerging as a significant driver for the microbiome cosmetic products market. As regulatory bodies increasingly recognize the benefits of natural and microbiome-friendly ingredients, there is a growing push for guidelines that promote their use in cosmetic formulations. This regulatory environment encourages manufacturers to innovate and incorporate these ingredients into their products, fostering consumer trust. The US Food and Drug Administration (FDA) has been actively working on frameworks that support the safe use of probiotics in cosmetics, which could potentially lead to a broader acceptance of microbiome-based products. This supportive regulatory landscape is likely to stimulate growth in the microbiome cosmetic products market, as brands feel more confident in developing and marketing these innovative solutions.