Technological Integration in Farming

The integration of technology in farming practices is reshaping the microencapsulated pesticides market. Precision agriculture, which utilizes data analytics and IoT devices, is becoming more prevalent among US farmers. This technological shift allows for more efficient pesticide application, enhancing the effectiveness of microencapsulated products. As farmers increasingly adopt these technologies, the microencapsulated pesticides market is expected to see a growth rate of approximately 9% in the next five years. This trend indicates a strong alignment between technological advancements and the demand for innovative pesticide solutions.

Advancements in Agricultural Practices

The evolution of agricultural practices in the US is significantly impacting the microencapsulated pesticides market. Farmers are increasingly adopting integrated pest management (IPM) strategies that emphasize the use of advanced pesticide formulations. Microencapsulated products fit well within these strategies, offering prolonged efficacy and reduced application frequency. Market analysis suggests that the adoption of IPM is expected to rise by 10% in the coming years, further driving the demand for microencapsulated pesticides. The microencapsulated pesticides market is thus poised to capitalize on this trend, as it aligns with the need for more effective pest control solutions.

Growing Awareness of Health and Safety

There is a growing awareness among consumers and agricultural workers regarding health and safety issues related to pesticide use. This awareness is prompting a shift towards safer application methods, such as those offered by microencapsulated pesticides. These products are designed to minimize exposure risks, making them more appealing to both farmers and consumers. The microencapsulated pesticides market is likely to benefit from this trend, as it addresses the increasing demand for safer agricultural practices. Market projections indicate that the segment focusing on health-conscious formulations could grow by 7% over the next few years.

Rising Demand for Eco-Friendly Solutions

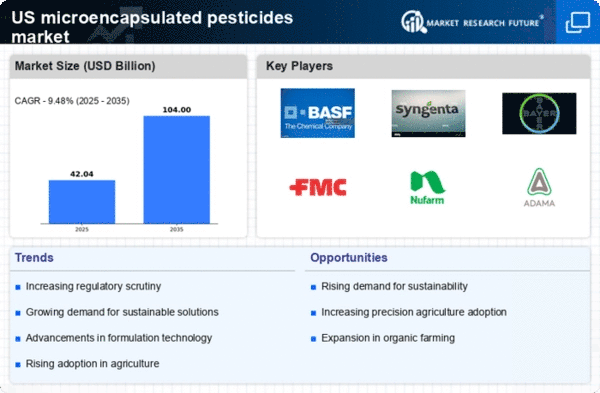

The microencapsulated pesticides market is experiencing a notable increase in demand for eco-friendly agricultural solutions. As consumers and regulatory bodies emphasize sustainable practices, farmers are seeking alternatives that minimize environmental impact. Microencapsulation technology allows for targeted delivery of pesticides, reducing the quantity needed and limiting exposure to non-target organisms. This shift is reflected in market data, indicating that the eco-friendly segment is projected to grow at a CAGR of approximately 8% over the next five years. The microencapsulated pesticides market is thus positioned to benefit from this trend, as it aligns with the broader movement towards sustainable agriculture.

Increased Regulatory Support for Innovative Products

Regulatory frameworks in the US are increasingly supportive of innovative agricultural products, including microencapsulated pesticides. The Environmental Protection Agency (EPA) has streamlined the approval process for new formulations that demonstrate reduced environmental risks. This regulatory support is crucial for the microencapsulated pesticides market, as it encourages manufacturers to invest in research and development. The market is expected to see a growth rate of around 6% annually, driven by the introduction of new products that meet stringent safety standards. The microencapsulated pesticides market is thus likely to thrive under these favorable conditions.