Rising Vehicle Ownership Rates

The motor insurance market is experiencing growth driven by rising vehicle ownership rates in the United States. As more individuals acquire vehicles, the demand for motor insurance coverage increases correspondingly. Recent statistics indicate that vehicle ownership has risen by approximately 5% over the past year, leading to a larger pool of insured vehicles. This trend is particularly pronounced among younger demographics, who are increasingly purchasing cars as they enter the workforce. Consequently, insurers are likely to see an uptick in policy sales, which could enhance competition within the motor insurance market, ultimately benefiting consumers through more options and potentially lower premiums.

Economic Factors and Consumer Spending

The motor insurance market is significantly impacted by economic factors that influence consumer spending behavior. In a robust economy, individuals are more inclined to purchase new vehicles, which in turn drives demand for motor insurance. Conversely, during economic downturns, consumers may opt for lower coverage options or delay purchasing new vehicles. Recent economic indicators suggest a steady growth in consumer confidence, which could lead to increased vehicle sales and, subsequently, higher demand for motor insurance. This relationship between economic conditions and consumer behavior is crucial for insurers as they strategize to capture market opportunities.

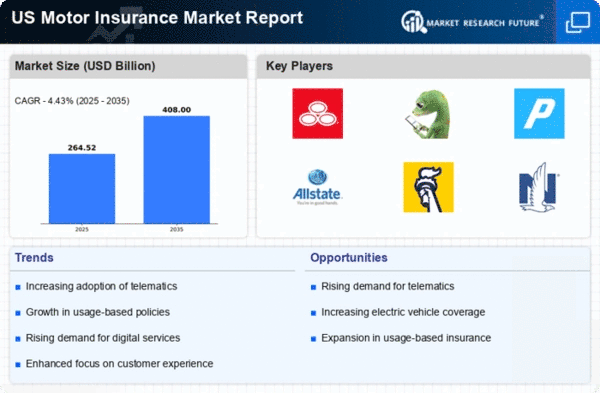

Increased Focus on Customer Experience

The market is witnessing a shift towards enhanced customer experience as insurers strive to differentiate themselves in a competitive landscape. Companies are investing in user-friendly digital platforms that facilitate seamless policy management and claims processing. This focus on customer satisfaction is reflected in the growing adoption of mobile applications, which allow policyholders to access their information and file claims with ease. Data suggests that insurers prioritizing customer experience may see retention rates improve by as much as 20%. As customer expectations evolve, the motor insurance market is likely to adapt, emphasizing service quality alongside traditional coverage.

Emergence of Usage-Based Insurance Models

The market is evolving with the emergence of usage-based insurance (UBI) models, which offer premiums based on actual driving behavior. This innovative approach utilizes telematics technology to monitor driving patterns, allowing insurers to tailor policies to individual risk profiles. As consumers become more aware of their driving habits, UBI may appeal to those seeking cost-effective insurance solutions. Data indicates that UBI can lead to savings of up to 30% for safe drivers, thereby attracting a broader customer base. The adoption of UBI is likely to reshape the motor insurance market, fostering a more personalized insurance experience.

Technological Advancements in Vehicle Safety

The motor insurance market is increasingly influenced by advancements in vehicle safety technology. Innovations such as automatic braking systems, lane departure warnings, and collision avoidance systems are becoming standard in new vehicles. These technologies not only enhance driver safety but also reduce the frequency and severity of accidents. As a result, insurers may adjust their pricing models, potentially leading to lower premiums for consumers. According to recent data, vehicles equipped with advanced safety features can reduce accident rates by up to 30%. This shift towards safer vehicles is likely to reshape the motor insurance market, as insurers adapt to the changing risk landscape.