Rising Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the non clinical-information-system market, as organizations strive to optimize their operational expenditures. With healthcare costs escalating, stakeholders are increasingly turning to non clinical information systems to automate processes and reduce manual labor. This shift is reflected in a market analysis indicating that organizations can save up to 20% in operational costs by implementing effective non clinical solutions. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning into these systems enhances their ability to analyze data and identify cost-saving opportunities. As a result, the non clinical-information-system market is likely to witness a growing influx of investments aimed at developing cost-effective solutions that deliver measurable returns on investment.

Emphasis on Regulatory Compliance

Regulatory compliance is a critical driver influencing the non clinical-information-system market. As healthcare regulations become increasingly stringent, organizations are compelled to adopt systems that ensure adherence to various standards, including HIPAA and HITECH. The market is projected to grow by approximately 10% annually as organizations invest in solutions that facilitate compliance and mitigate risks associated with non-compliance. This trend is particularly pronounced in sectors such as billing, coding, and patient data management, where the consequences of regulatory breaches can be severe. Consequently, vendors are focusing on enhancing their offerings to include features that support compliance, thereby addressing a pressing need within the non clinical-information-system market.

Growing Demand for Interoperability

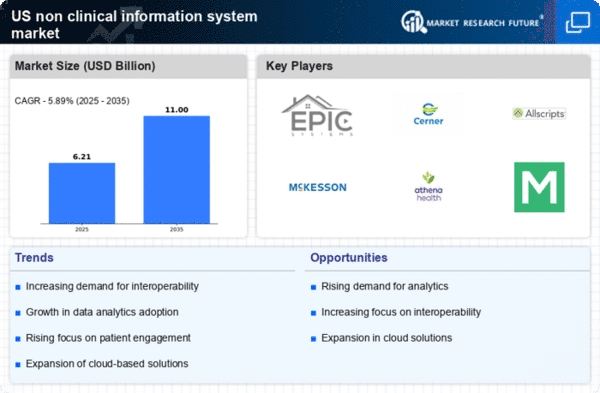

The non clinical-information-system market experiences a notable surge in demand for interoperability among various healthcare systems. As healthcare providers increasingly seek to streamline operations and improve patient care, the ability to share data seamlessly across platforms becomes essential. This trend is evidenced by a projected growth rate of approximately 15% annually in the adoption of interoperable systems. Such systems facilitate better communication between clinical and non-clinical departments, enhancing overall efficiency. The push for interoperability is further driven by regulatory requirements and the need for compliance with standards such as HL7 and FHIR. Consequently, vendors in the non clinical-information-system market are focusing on developing solutions that promote data exchange and integration, thereby positioning themselves competitively in a rapidly evolving landscape.

Increased Investment in Healthcare IT

Investment in healthcare IT is a prominent driver of growth in the non clinical-information-system market. As healthcare organizations recognize the importance of technology in enhancing operational efficiency and patient care, funding for IT solutions is on the rise. Reports indicate that healthcare IT spending is projected to reach $250 billion by 2026, with a substantial portion allocated to non clinical information systems. This influx of capital is likely to spur innovation and the development of new solutions tailored to meet the evolving needs of healthcare providers. Furthermore, as organizations seek to modernize their infrastructure, the demand for robust non clinical information systems that can support various functions, from billing to human resources, is expected to increase significantly.

Technological Advancements in Data Management

Technological advancements play a significant role in shaping the non clinical-information-system market. Innovations in data management technologies, such as cloud computing and big data analytics, are transforming how organizations handle non clinical information. The market is expected to grow by around 12% annually as organizations increasingly adopt these technologies to improve data storage, retrieval, and analysis. Enhanced data management capabilities enable organizations to derive actionable insights from vast amounts of information, thereby improving decision-making processes. Additionally, the integration of advanced security measures within these systems addresses concerns regarding data privacy and protection, further driving adoption in the non clinical-information-system market.

.png)