Rising Health Consciousness

The organic foods market is experiencing a notable surge in consumer health consciousness. As individuals become increasingly aware of the health implications associated with conventional food products, they are gravitating towards organic alternatives. This shift is reflected in the market data, which indicates that organic food sales reached approximately $62 billion in 2024, marking a growth of around 10% from the previous year. Consumers are prioritizing products that are free from synthetic pesticides and fertilizers, which they perceive as healthier options. This trend is particularly pronounced among millennials and Generation Z, who are more likely to invest in organic foods. The organic foods market is thus benefiting from this heightened awareness, as consumers seek to improve their overall well-being through dietary choices.

Innovative Marketing Strategies

The organic foods market is witnessing a transformation in marketing strategies that cater to the evolving preferences of consumers. Companies are increasingly leveraging digital platforms and social media to engage with their target audience. Innovative campaigns that highlight the benefits of organic foods, such as improved health and environmental sustainability, are gaining traction. Data indicates that brands utilizing influencer marketing have seen a 30% increase in engagement rates. This shift towards more personalized and relatable marketing approaches is likely to enhance brand loyalty and drive sales within the organic foods market. As consumers seek authenticity and transparency, companies that effectively communicate their organic credentials are positioned to thrive.

Growing Interest in Plant-Based Diets

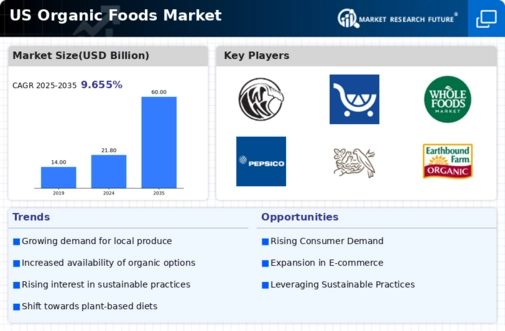

The organic foods market is experiencing a surge in interest surrounding plant-based diets. As more consumers adopt vegetarian and vegan lifestyles, the demand for organic plant-based products is on the rise. This trend is reflected in market data, which indicates that sales of organic plant-based foods have increased by over 20% in the last year. Consumers are increasingly seeking organic alternatives to meat and dairy products, driven by health, ethical, and environmental considerations. The organic foods market is thus poised to capitalize on this growing interest, as brands innovate to offer a wider range of organic plant-based options that cater to this expanding demographic.

Sustainability and Environmental Concerns

Sustainability has emerged as a pivotal driver within the organic foods market. As environmental issues gain prominence, consumers are increasingly opting for organic products that align with their values regarding sustainability. The organic farming practices, which emphasize biodiversity and soil health, resonate with eco-conscious consumers. Market data suggests that approximately 70% of consumers are willing to pay a premium for organic products that are sustainably sourced. This trend is not only fostering growth in the organic foods market but also encouraging retailers to expand their organic offerings. The emphasis on reducing carbon footprints and promoting sustainable agriculture practices is likely to continue influencing consumer purchasing decisions in the foreseeable future.

Increased Availability in Mainstream Retail

The organic foods market is benefiting from a significant increase in the availability of organic products in mainstream retail outlets. Major grocery chains are expanding their organic offerings, making it easier for consumers to access these products. This trend is supported by market data showing that organic food sales in conventional grocery stores have grown by approximately 15% in the past year. The convenience of purchasing organic foods alongside conventional items is likely to attract a broader consumer base. As retailers recognize the profitability of organic products, the organic foods market is expected to see continued growth as more consumers incorporate organic options into their daily shopping routines.

Leave a Comment