Regulatory Support for Automation

Regulatory bodies are increasingly recognizing the benefits of automation in the pharmaceutical sector, which is positively impacting the pharmaceutical robots market. Initiatives aimed at streamlining regulatory processes for automated systems are emerging, encouraging companies to adopt robotic solutions. For example, the FDA has issued guidelines that facilitate the approval of automated drug manufacturing systems, thereby reducing the time and resources required for compliance. This regulatory support is likely to foster innovation and investment in robotic technologies, as companies seek to align with evolving standards. Consequently, the pharmaceutical robots market stands to gain from this favorable regulatory environment, which promotes the integration of automation in drug production.

Advancements in Robotic Technology

Technological advancements play a pivotal role in shaping the pharmaceutical robots market. Innovations in robotics, such as improved sensors, artificial intelligence, and machine learning, are enhancing the capabilities of pharmaceutical robots. These advancements enable robots to perform complex tasks with greater accuracy and speed, thereby increasing overall efficiency in pharmaceutical manufacturing. For instance, the integration of AI algorithms allows robots to learn from previous operations, optimizing their performance over time. As a result, the market is witnessing a shift towards more sophisticated robotic systems that can adapt to various production environments. This trend is expected to drive growth in the pharmaceutical robots market, as companies invest in cutting-edge technology to stay ahead in a competitive landscape.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver in the pharmaceutical robots market. As healthcare costs continue to rise, pharmaceutical companies are under pressure to optimize their operations and reduce expenses. Automation through robotics offers a viable solution, enabling companies to streamline production processes and minimize labor costs. Reports indicate that implementing robotic systems can lead to a reduction in operational costs by up to 30%. Furthermore, the ability to operate 24/7 without the need for breaks enhances productivity, allowing for higher output levels. This focus on cost efficiency is likely to propel the adoption of robotic solutions within the pharmaceutical sector, as companies seek to maintain competitiveness while ensuring quality and compliance.

Growing Emphasis on Quality Control

Quality control is becoming increasingly critical in the pharmaceutical industry, driving the demand for automation solutions within the pharmaceutical robots market. The need for consistent product quality and adherence to stringent regulatory standards necessitates the implementation of advanced quality control measures. Robotic systems equipped with sophisticated monitoring and inspection capabilities can significantly enhance quality assurance processes. By automating these tasks, companies can reduce the risk of contamination and ensure compliance with Good Manufacturing Practices (GMP). As a result, the pharmaceutical robots market is likely to expand as organizations prioritize quality control and seek to leverage robotic technologies to maintain high standards in their production processes.

Rising Demand for Precision in Drug Delivery

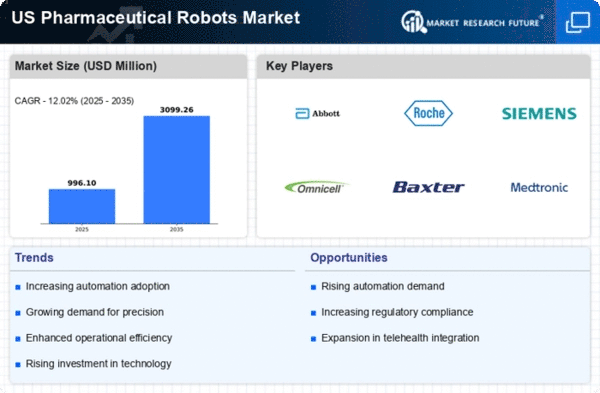

The pharmaceutical robots market is witnessing a notable surge in demand for precision in drug delivery systems. As the complexity of drug formulations increases, the need for accurate dispensing and compounding becomes paramount. This trend is driven by the growing prevalence of chronic diseases, which necessitate tailored medication regimens. According to industry reports, the market for automated drug delivery systems is projected to grow at a CAGR of approximately 15% over the next five years. This growth is likely to be fueled by advancements in robotic technology that enhance the accuracy and efficiency of drug dispensing processes, thereby reducing human error and improving patient outcomes. Consequently, The pharmaceutical robots market stands to benefit significantly from this rising demand for precision in drug delivery.