Supportive Reimbursement Policies

Supportive reimbursement policies are emerging as a key driver for the plasma therapy market. As insurance companies begin to recognize the value of plasma therapy, more treatment options are becoming covered under various plans. This shift is likely to alleviate financial barriers for patients, making plasma therapy more accessible. With an increasing number of insurers providing coverage, the market could see a significant uptick in patient participation. The alignment of reimbursement policies with the growing body of evidence supporting plasma therapy's effectiveness may further enhance its adoption in clinical practice.

Expansion of Clinical Applications

The plasma therapy market is benefiting from the expansion of clinical applications across diverse medical specialties. Initially popular in orthopedics, plasma therapy is now being explored for use in dermatology, dentistry, and sports medicine. This diversification is likely to attract a wider range of patients and healthcare providers, thereby driving market growth. As research continues to validate the efficacy of plasma therapy in treating various conditions, the market could see an increase in investment and innovation. The potential for new applications may further solidify plasma therapy's position in the healthcare landscape.

Growing Awareness of Regenerative Medicine

Awareness surrounding regenerative medicine is on the rise, significantly impacting the plasma therapy market. Educational initiatives and media coverage are informing both healthcare professionals and patients about the benefits of plasma therapy. This increased awareness is fostering a more informed patient base that actively seeks out these innovative treatments. As a result, the market is expected to witness a surge in demand, with projections indicating a potential market value exceeding $5 billion by 2030. The growing recognition of plasma therapy as a viable treatment option is likely to enhance its adoption across various medical fields.

Increasing Demand for Non-Surgical Treatments

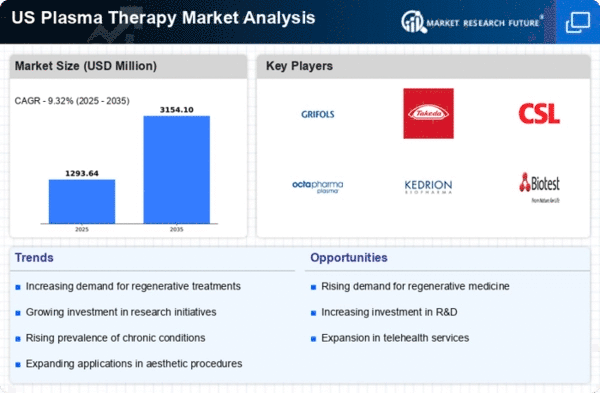

The plasma therapy market is experiencing a notable increase in demand for non-surgical treatment options. Patients are increasingly seeking alternatives to invasive procedures, which can entail longer recovery times and higher risks. Plasma therapy, known for its regenerative properties, offers a minimally invasive solution that appeals to a broad demographic. According to recent estimates, the market is projected to grow at a CAGR of approximately 10% over the next five years. This shift towards non-surgical interventions is likely to drive the plasma therapy market, as healthcare providers expand their offerings to meet patient preferences and improve outcomes.

Technological Innovations in Treatment Delivery

Technological innovations are playing a crucial role in enhancing the efficacy and accessibility of plasma therapy. Advances in equipment and techniques for extracting and administering plasma are improving treatment outcomes and patient experiences. For instance, the development of automated systems for plasma extraction is streamlining procedures, making them more efficient. This trend is likely to bolster the plasma therapy market, as healthcare facilities adopt these technologies to provide better care. The integration of technology into treatment protocols may also lead to increased patient satisfaction and higher rates of therapy adoption.

.png)