Advancements in Point-of-Care Testing

The evolution of point-of-care testing technologies is transforming the landscape of the platelet aggregation-devices market. These innovations facilitate rapid and accurate testing, allowing healthcare professionals to make informed decisions at the bedside. The convenience and efficiency of point-of-care devices are particularly appealing in emergency settings, where timely diagnosis is crucial. As a result, the market for these devices is projected to grow significantly, with estimates suggesting a value of $1.5 billion by 2027. The integration of advanced technologies, such as microfluidics and biosensors, enhances the functionality of platelet aggregation devices, making them indispensable tools in clinical practice. This trend underscores the importance of technological advancements in driving the platelet aggregation-devices market.

Increasing Prevalence of Cardiovascular Diseases

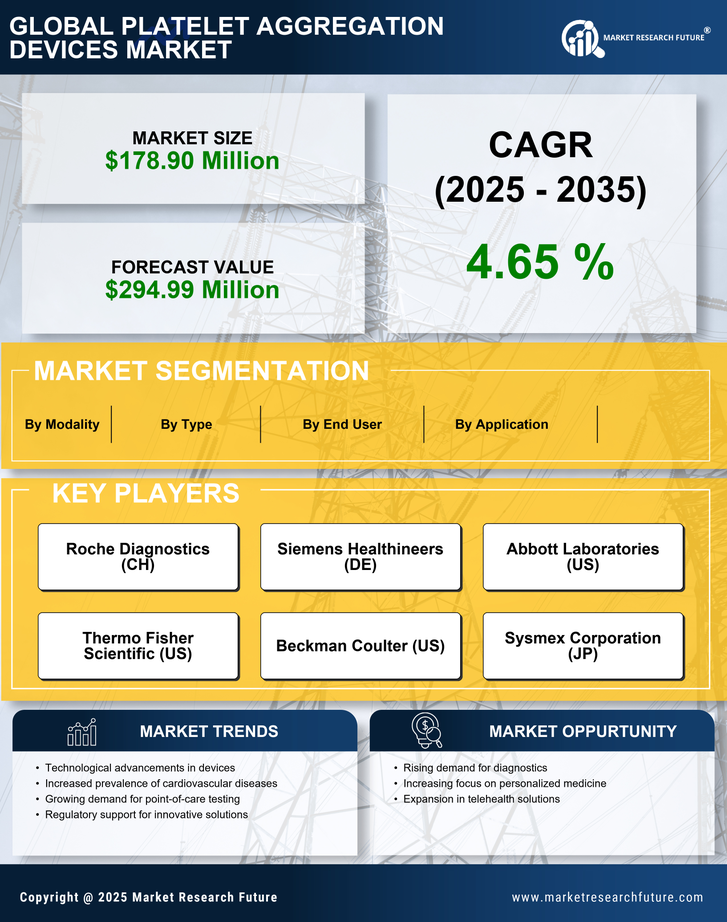

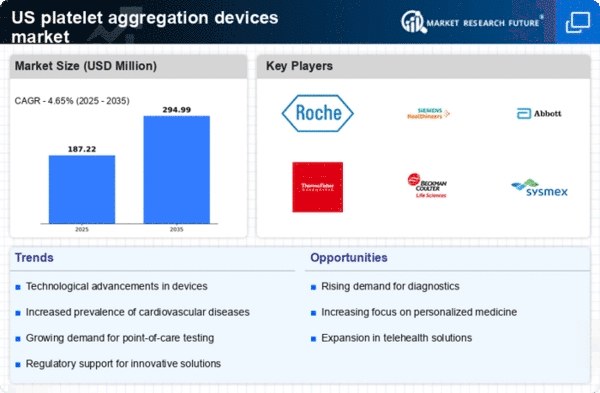

The rising incidence of cardiovascular diseases in the US is a primary driver for the platelet aggregation-devices market. As heart-related ailments continue to escalate, the demand for effective diagnostic tools becomes critical. According to recent data, cardiovascular diseases account for approximately 697,000 deaths annually in the US, highlighting the urgent need for advanced monitoring and treatment options. This trend is likely to propel the adoption of platelet aggregation devices, as healthcare providers seek to enhance patient outcomes through timely interventions. The platelet aggregation-devices market is expected to witness substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 4.65% over the next few years. Consequently, the increasing prevalence of these diseases is a significant factor driving market expansion.

Regulatory Support for Innovative Medical Devices

Regulatory bodies in the US are increasingly supportive of innovative medical devices, which is positively impacting the platelet aggregation-devices market. The Food and Drug Administration (FDA) has streamlined the approval process for novel diagnostic tools, encouraging manufacturers to invest in research and development. This regulatory environment fosters innovation, enabling the introduction of advanced platelet aggregation devices that meet the evolving needs of healthcare providers. As a result, the market is likely to experience a surge in new product launches, enhancing competition and driving growth. The platelet aggregation-devices market stands to gain from this supportive regulatory landscape, as it encourages the development of cutting-edge technologies that improve patient care.

Growing Awareness of Thrombosis and Its Implications

Increased awareness regarding thrombosis and its associated risks is contributing to the growth of the platelet aggregation-devices market. Educational initiatives and campaigns aimed at both healthcare professionals and the general public are fostering a better understanding of the importance of platelet function testing. As individuals become more informed about the potential dangers of thrombosis, there is a corresponding rise in demand for diagnostic tools that can assess platelet aggregation. This heightened awareness is likely to lead to an increase in testing rates, thereby driving market growth. The platelet aggregation-devices market is expected to benefit from this trend, as healthcare providers seek to implement effective screening and monitoring strategies for at-risk populations.

Rising Geriatric Population and Associated Health Issues

The increasing geriatric population in the US is a significant driver of the platelet aggregation-devices market. As individuals age, they become more susceptible to various health issues, including cardiovascular diseases and thrombotic disorders. This demographic shift necessitates the implementation of effective diagnostic and monitoring tools to manage these conditions. Projections indicate that by 2030, approximately 20% of the US population will be aged 65 and older, further amplifying the demand for platelet aggregation devices. Healthcare providers are likely to prioritize the use of these devices to ensure timely interventions and improve patient outcomes. Consequently, the aging population is a crucial factor influencing the growth trajectory of the platelet aggregation-devices market.