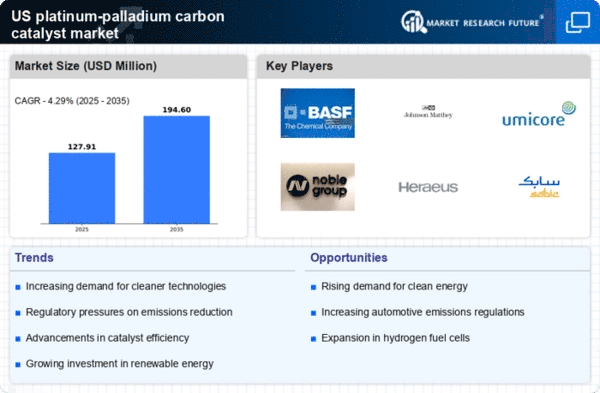

The platinum palladium-carbon-catalyst market is currently characterized by a dynamic competitive landscape, driven by increasing demand for cleaner technologies and stringent environmental regulations. Key players such as BASF SE (DE), Johnson Matthey PLC (GB), and Umicore SA (BE) are strategically positioned to leverage their extensive research and development capabilities. These companies focus on innovation and sustainability, which are pivotal in shaping their operational strategies. For instance, BASF SE (DE) emphasizes the development of advanced catalyst technologies that enhance efficiency and reduce emissions, thereby aligning with global sustainability goals.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like Noble Group Ltd (SG) and Heraeus Holding GmbH (DE) is significant, as they engage in strategic partnerships and collaborations to enhance their market presence and technological capabilities.

In October Johnson Matthey PLC (GB) announced a partnership with a leading automotive manufacturer to develop next-generation catalytic converters aimed at reducing nitrogen oxide emissions. This collaboration is strategically important as it not only reinforces Johnson Matthey's commitment to sustainability but also positions the company as a key player in the automotive sector's transition towards greener technologies.

In September Umicore SA (BE) unveiled a new production facility in the US dedicated to the manufacturing of high-performance catalysts. This move is indicative of Umicore's strategy to expand its operational footprint and meet the growing demand for efficient catalytic solutions in North America. The facility is expected to enhance supply chain reliability and reduce production costs, thereby strengthening Umicore's competitive edge.

In November Heraeus Holding GmbH (DE) launched a new line of carbon-supported catalysts designed for industrial applications. This innovation reflects Heraeus's focus on integrating advanced materials science with catalytic technology, potentially setting new benchmarks in performance and efficiency. Such advancements are likely to attract a broader customer base and enhance market penetration.

As of November current competitive trends indicate a strong shift towards digitalization, sustainability, and the integration of artificial intelligence in catalyst development. Strategic alliances are increasingly shaping the landscape, as companies recognize the need for collaborative innovation to stay ahead. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, innovation, and supply chain reliability, underscoring the importance of agility and responsiveness in a rapidly changing market.