Growth in the Construction Sector

The ongoing expansion of the construction sector serves as a crucial driver for the polished concrete market. With a robust increase in both residential and commercial construction projects, the demand for durable and aesthetically pleasing flooring options rises correspondingly. Recent statistics indicate that the construction industry in the US is projected to grow by approximately 5% annually, creating a favorable environment for polished concrete applications. This growth is particularly evident in urban areas, where new developments often incorporate polished concrete for its modern appeal and functionality. Consequently, the polished concrete market stands to gain significantly from the overall growth trajectory of the construction sector.

Cost-Effectiveness of Polished Concrete

Cost-effectiveness remains a pivotal driver for the polished concrete market, as it offers a durable and low-maintenance flooring solution. Compared to traditional flooring materials, polished concrete typically incurs lower installation and maintenance costs, making it an attractive option for budget-conscious consumers. Market analysis reveals that the average cost of polished concrete installation ranges from $3 to $12 per square foot, depending on the complexity of the design. This affordability, combined with its longevity, positions polished concrete as a financially viable choice for both residential and commercial applications. As a result, the polished concrete market is poised for growth as more consumers recognize the long-term savings associated with this flooring option.

Rising Demand for Aesthetic Flooring Solutions

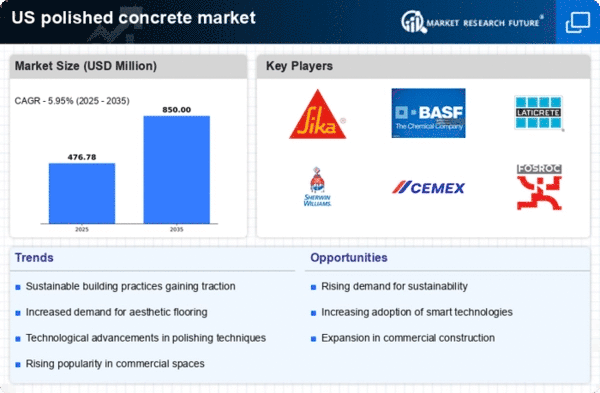

The polished concrete market experiences a notable surge in demand for aesthetic flooring solutions, particularly in commercial and residential sectors. As consumers increasingly prioritize design and visual appeal, polished concrete emerges as a preferred choice due to its versatility and ability to mimic various materials. The market data indicates that the aesthetic appeal of polished concrete contributes to a projected growth rate of approximately 7% annually. This trend is particularly pronounced in urban areas, where modern architecture and interior design trends favor sleek, polished surfaces. Consequently, the polished concrete market is likely to benefit from this growing consumer preference for visually striking flooring options.

Technological Innovations in Polishing Techniques

Technological innovations in polishing techniques are transforming the polished concrete market, enhancing both efficiency and quality. Advances in machinery and materials have led to improved polishing processes, resulting in higher gloss finishes and greater durability. The introduction of automated systems and diamond polishing tools has reduced labor costs and time, making polished concrete more accessible to a broader range of consumers. Market Research Future suggest that these innovations could lead to a 10% increase in production efficiency within the next few years. As a result, the polished concrete market is likely to experience increased competitiveness and a wider adoption of polished concrete solutions across various sectors.

Environmental Regulations and Green Building Initiatives

The polished concrete market is significantly influenced by stringent environmental regulations and the rise of green building initiatives. As sustainability becomes a focal point in construction, polished concrete aligns well with eco-friendly practices due to its low VOC emissions and recyclability. The market data suggests that buildings utilizing polished concrete can achieve higher LEED certification levels, appealing to environmentally conscious developers and consumers. This alignment with green building standards not only enhances the market's reputation but also drives demand as more projects seek sustainable flooring solutions. Thus, the polished concrete market is likely to see increased adoption as regulatory frameworks continue to promote environmentally responsible construction practices.