Growing Demand for Data Sovereignty

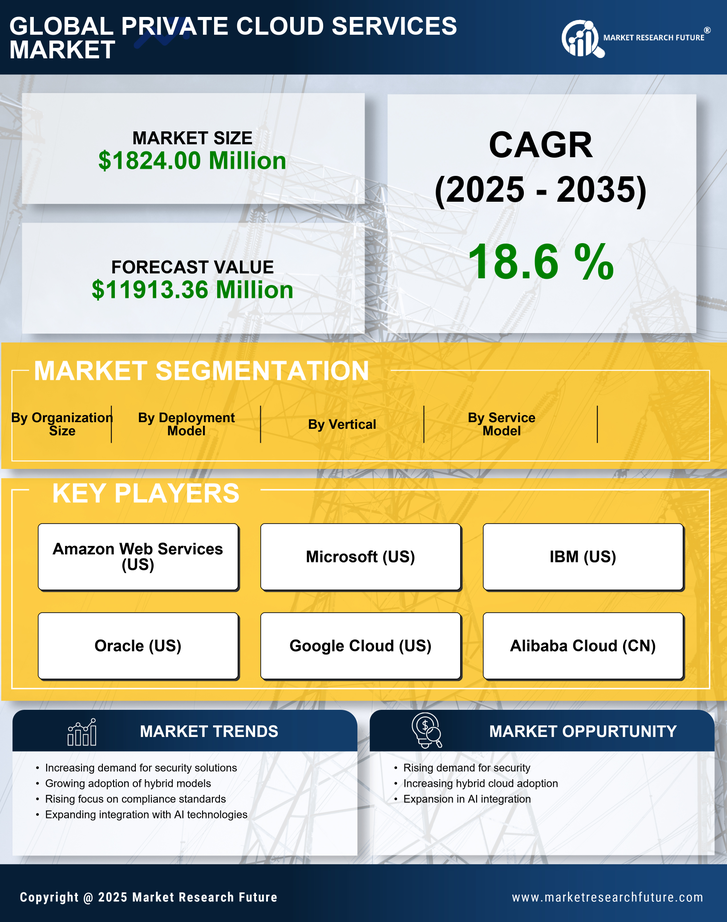

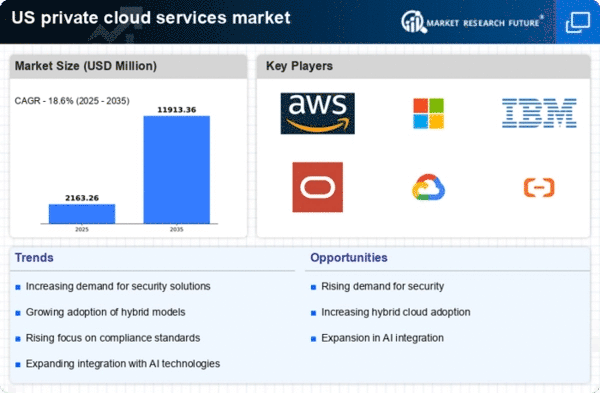

The private cloud-services market is experiencing a notable increase in demand for data sovereignty, driven by regulatory requirements and the need for organizations to maintain control over their data. In the US, businesses are increasingly concerned about data privacy and compliance with regulations such as the GDPR and CCPA. This trend is compelling organizations to adopt private cloud solutions that ensure data remains within national borders. As a result, the private cloud-services market is expected to grow at a CAGR of approximately 15% over the next five years, reflecting the heightened focus on data governance and security. Companies are investing in private cloud infrastructures to mitigate risks associated with data breaches and to comply with stringent regulations, thereby enhancing their operational resilience and trust with customers.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver in the private cloud-services market, as organizations seek to optimize their IT expenditures. By leveraging private cloud solutions, companies can reduce capital expenditures associated with hardware and maintenance while benefiting from scalable resources. The private cloud model allows for better allocation of resources, enabling businesses to pay only for what they use. According to recent studies, organizations that transitioned to private cloud environments reported a reduction in IT costs by up to 30%. This financial incentive is particularly appealing to small and medium-sized enterprises (SMEs) in the US, which are increasingly adopting private cloud services to enhance their operational efficiency and reduce overhead costs. As the market matures, the emphasis on cost-effective solutions is likely to drive further adoption of private cloud services.

Customization and Flexibility in IT Solutions

Customization and flexibility are becoming increasingly vital in the private cloud-services market, as organizations seek tailored solutions that meet their specific needs. Unlike public cloud offerings, private cloud environments allow businesses to configure their infrastructure according to unique operational requirements. This adaptability is particularly appealing to industries with stringent compliance and security needs, such as finance and healthcare. The ability to customize services can lead to improved performance and user satisfaction. As organizations in the US continue to prioritize personalized IT solutions, the private cloud-services market is likely to see sustained growth. Companies are investing in private cloud technologies that offer the flexibility to scale resources and modify configurations, thereby enhancing their competitive edge in a rapidly evolving digital landscape.

Integration of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation technologies is emerging as a key driver in the private cloud-services market. Organizations are increasingly leveraging AI to enhance operational efficiency, improve decision-making, and streamline processes. The private cloud model provides a conducive environment for deploying AI applications, enabling businesses to harness data analytics and machine learning capabilities. In the US, the market for AI in cloud services is projected to grow significantly, with estimates indicating a potential increase of over 25% annually. This trend is encouraging organizations to adopt private cloud solutions that facilitate the integration of advanced technologies, thereby enhancing their ability to innovate and respond to market demands. As AI continues to evolve, its impact on the private cloud-services market is expected to be profound, driving further adoption and investment.

Increased Need for Business Continuity and Disaster Recovery

the private cloud-services market is influenced by the growing need for business continuity and disaster recovery solutions. Organizations are increasingly recognizing the importance of having robust backup systems in place to safeguard against data loss and ensure operational continuity. The private cloud model offers enhanced disaster recovery capabilities, allowing businesses to quickly restore operations in the event of a disruption. In the US, the demand for such solutions is expected to rise, with estimates suggesting that the market for disaster recovery services could reach $10 billion by 2026. This trend is prompting organizations to invest in private cloud infrastructures that provide reliable and secure backup options, thereby enhancing their resilience against unforeseen events and ensuring compliance with industry regulations.