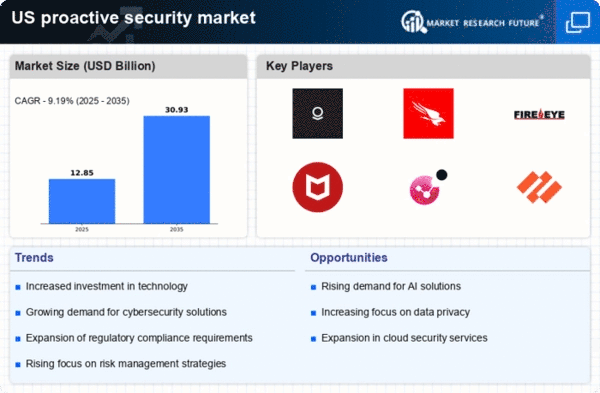

The proactive security market in the US is characterized by a dynamic competitive landscape, driven by the increasing demand for advanced cybersecurity solutions amid rising threats. Key players such as Palantir Technologies (US), CrowdStrike (US), and Palo Alto Networks (US) are strategically positioned to leverage innovation and technological advancements. Palantir Technologies (US) focuses on integrating AI and machine learning into its security offerings, enhancing threat detection capabilities. Meanwhile, CrowdStrike (US) emphasizes cloud-native solutions, which allow for rapid deployment and scalability, catering to a diverse range of clients. Palo Alto Networks (US) is also investing heavily in automation and AI, aiming to streamline security operations and improve response times. Collectively, these strategies foster a competitive environment that prioritizes technological superiority and adaptability.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets and optimize supply chains. The proactive security market appears moderately fragmented, with several key players exerting substantial influence. This structure allows for a variety of solutions and approaches, enabling customers to select offerings that best meet their specific needs. The collective actions of these companies contribute to a robust competitive framework, where innovation and customer-centric strategies are paramount.

In October 2025, CrowdStrike (US) announced a strategic partnership with a leading cloud service provider to enhance its threat intelligence capabilities. This collaboration is expected to bolster its existing offerings by integrating advanced analytics and machine learning, thereby improving the overall security posture of its clients. Such partnerships are indicative of a broader trend towards collaborative innovation in the industry, where companies seek to combine strengths to address complex security challenges.

In September 2025, Palo Alto Networks (US) launched a new suite of AI-driven security tools aimed at small to medium-sized enterprises (SMEs). This initiative reflects a strategic pivot to capture a growing segment of the market that has historically been underserved. By tailoring solutions to the unique needs of SMEs, Palo Alto Networks (US) positions itself as a leader in democratizing access to advanced security technologies, potentially reshaping market dynamics.

In August 2025, FireEye (US) rebranded itself as Trellix, signaling a shift towards a more integrated approach to cybersecurity. This rebranding effort is accompanied by a renewed focus on providing comprehensive security solutions that encompass threat detection, response, and recovery. The strategic importance of this move lies in its potential to unify FireEye's (US) offerings under a cohesive brand, enhancing customer recognition and loyalty in a crowded marketplace.

As of November 2025, the proactive security market is increasingly defined by trends such as digitalization, AI integration, and a heightened focus on sustainability. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in addressing evolving threats. Looking ahead, competitive differentiation is likely to shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This evolution suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex security landscape.

Leave a Comment