Rising Geriatric Population

The aging population in the US is a critical driver for the pulmonary function-testing-systems market. As individuals age, the risk of developing respiratory diseases increases, necessitating regular monitoring of lung function. The US Census Bureau projects that by 2030, one in five Americans will be of retirement age, leading to a higher prevalence of age-related respiratory conditions. This demographic shift is prompting healthcare providers to invest in pulmonary function testing systems to cater to the needs of older adults. Consequently, the market is expected to grow as healthcare systems adapt to the increasing demand for effective respiratory disease management among the elderly.

Growing Focus on Preventive Healthcare

The shift towards preventive healthcare in the US is a significant driver for the pulmonary function-testing-systems market. Healthcare providers are increasingly emphasizing early detection and management of respiratory diseases to reduce long-term healthcare costs. This proactive approach encourages regular screening and monitoring of lung function, particularly among high-risk populations such as smokers and individuals with a family history of respiratory conditions. As a result, the demand for pulmonary function testing systems is likely to increase, as these tools are essential for identifying potential issues before they escalate. The market is projected to expand as healthcare systems adopt more preventive measures.

Rising Prevalence of Respiratory Disorders

The increasing incidence of respiratory disorders in the US is a primary driver for the pulmonary function-testing-systems market. Conditions such as asthma, chronic obstructive pulmonary disease (COPD), and interstitial lung disease are becoming more prevalent, affecting millions of individuals. According to the CDC, approximately 25 million Americans have asthma, and COPD is projected to be the third leading cause of death by 2030. This growing patient population necessitates the use of advanced pulmonary function testing systems to facilitate accurate diagnosis and effective management of these diseases. As healthcare providers seek to improve patient outcomes, the demand for reliable and efficient testing systems is likely to rise, thereby propelling the market forward.

Technological Innovations in Testing Equipment

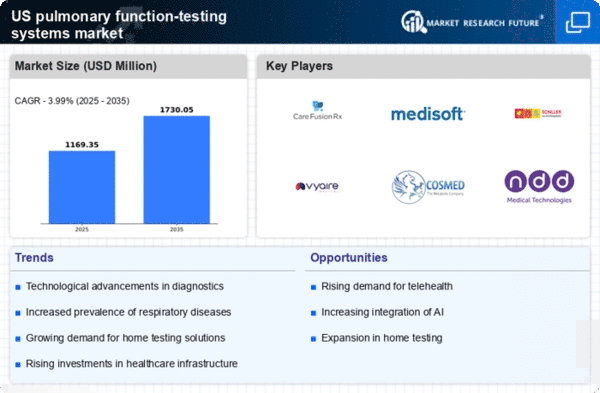

Technological advancements in pulmonary function-testing systems are significantly influencing the market landscape. Innovations such as portable spirometers, advanced software for data analysis, and integration with telehealth platforms are enhancing the capabilities of these systems. The introduction of mobile applications that allow patients to monitor their lung function at home is also gaining traction. These developments not only improve the accuracy of tests but also increase accessibility for patients. The market is expected to witness a compound annual growth rate (CAGR) of around 7% over the next few years, driven by these technological innovations that cater to both clinical and home settings.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in the US is positively impacting the pulmonary function-testing-systems market. Government initiatives and private sector funding are being directed towards enhancing healthcare facilities, particularly in underserved areas. This expansion includes the procurement of advanced pulmonary function testing equipment, which is crucial for accurate diagnosis and treatment of respiratory conditions. The US government has allocated substantial funds to improve healthcare access, which is expected to drive the demand for pulmonary function-testing systems. As more facilities are equipped with these systems, the market is likely to experience growth, reflecting the commitment to improving respiratory health outcomes.