Rising Adoption of Smart Technologies

The rising adoption of smart technologies is a significant driver of the real time-locating-systems market. As businesses increasingly integrate smart devices and IoT solutions into their operations, the need for effective tracking and management systems becomes paramount. Smart technologies enable organizations to collect and analyze data in real-time, facilitating informed decision-making. The convergence of smart technologies with real time-locating-systems allows for enhanced visibility and control over assets and personnel. This trend is particularly evident in sectors such as retail and logistics, where real-time insights can lead to improved customer experiences and operational efficiencies. As the market for smart technologies continues to expand, the real time-locating-systems market is likely to benefit from this growing synergy.

Increased Focus on Operational Efficiency

The pursuit of operational efficiency is a primary driver of the real time-locating-systems market. Companies are increasingly recognizing that real-time data can lead to improved workflow, reduced downtime, and enhanced productivity. By implementing these systems, organizations can streamline processes, minimize waste, and optimize resource allocation. For instance, in the manufacturing sector, real time-locating-systems can help monitor equipment performance and predict maintenance needs, thus preventing costly interruptions. The potential for cost savings and improved service delivery is prompting more businesses to invest in these technologies. As operational efficiency becomes a key performance indicator, the real time-locating-systems market is likely to experience robust growth as organizations seek to leverage data-driven insights.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the real time-locating-systems market. Industries such as healthcare and logistics are subject to stringent regulations that mandate the tracking of assets and personnel to ensure safety and accountability. Compliance with these regulations often necessitates the adoption of real time-locating-systems, which provide the necessary data to meet legal requirements. For example, in healthcare, tracking medical equipment and personnel is essential for patient safety and operational compliance. As regulatory bodies continue to enforce these standards, the demand for real time-locating-systems is expected to rise, driving market growth. Organizations that prioritize compliance are likely to invest in these systems to mitigate risks and enhance their operational integrity.

Growing Demand for Asset Tracking Solutions

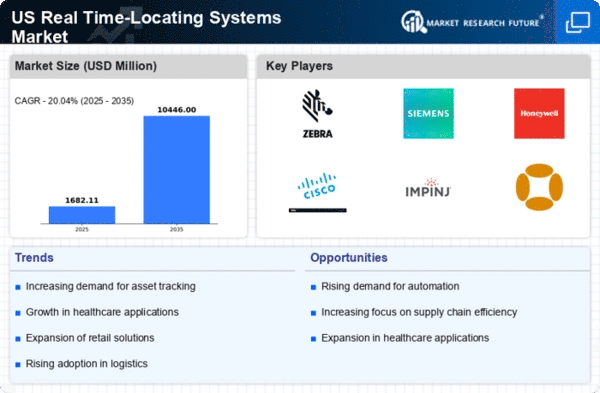

The increasing need for efficient asset management is driving the real time-locating-systems market. Organizations across various sectors, including healthcare, manufacturing, and logistics, are seeking solutions to track assets in real-time. This demand is fueled by the need to reduce operational costs and improve asset utilization. According to recent estimates, the asset tracking segment is expected to grow at a CAGR of approximately 20% over the next five years. Companies are investing in real time-locating-systems to enhance visibility and accountability of their assets, which is crucial for maintaining competitive advantage. As businesses recognize the value of real-time data in decision-making, the adoption of these systems is likely to accelerate, further propelling the market forward.

Advancements in Wireless Communication Technologies

Technological advancements in wireless communication are significantly impacting the real time-locating-systems market. The proliferation of 5G technology is expected to enhance the performance of locating systems, providing faster data transmission and improved connectivity. This advancement allows for more accurate and reliable tracking of assets and personnel in various environments. Furthermore, the integration of low-power wide-area networks (LPWAN) is facilitating the deployment of real time-locating-systems in previously challenging scenarios. As organizations increasingly rely on real-time data for operational efficiency, the demand for these advanced communication technologies is likely to grow, thereby driving the market. The ability to transmit data seamlessly across devices and platforms is becoming a critical factor for businesses aiming to optimize their operations.