US Recovered Carbon Black Market Summary

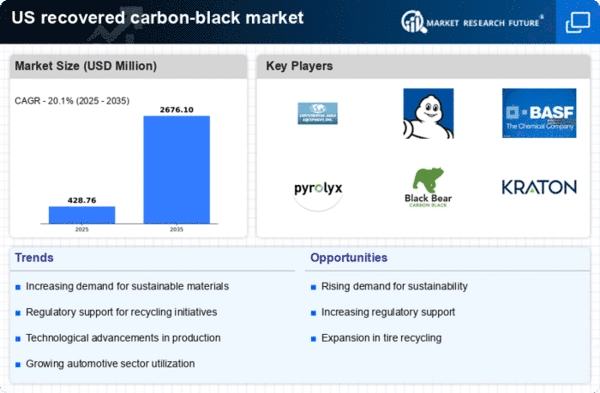

As per Market Research Future analysis, the US recovered carbon-black market size was estimated at 357.0 USD Million in 2024. The US recovered carbon-black market is projected to grow from 428.76 USD Million in 2025 to 2676.1 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 20% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US recovered carbon-black market is experiencing a robust shift towards sustainability and technological innovation.

- Sustainability initiatives are driving a notable transformation in the US recovered carbon-black market.

- Technological advancements in recycling processes are enhancing the efficiency of recovered carbon-black production.

- The automotive industry remains the largest segment, while the demand for sustainable materials is the fastest-growing segment.

- Increasing demand for sustainable materials and regulatory pressure for waste reduction are key market drivers influencing growth.

Market Size & Forecast

| 2024 Market Size | 357.0 (USD Million) |

| 2035 Market Size | 2676.1 (USD Million) |

| CAGR (2025 - 2035) | 20.1% |

Major Players

Continental AG (DE), Michelin (FR), BASF SE (DE), Pyrolyx AG (DE), Black Bear Carbon (NL), Kraton Corporation (US), Orion Engineered Carbons S.A. (LU), Tire Recycling Solutions (US)