Corporate Sustainability Initiatives

The renewable energy-transition market is increasingly influenced by corporate sustainability initiatives. Many companies are committing to ambitious renewable energy targets, with over 50% of Fortune 500 companies pledging to achieve 100% renewable energy by 2030. This shift is driven by consumer demand for sustainable practices and the recognition that renewable energy can enhance brand reputation. As corporations transition to renewable energy sources, they contribute to the overall growth of the market, creating a ripple effect that encourages suppliers and partners to adopt similar practices. This trend not only supports the renewable energy-transition market but also fosters a culture of sustainability across various industries.

Investment in Renewable Infrastructure

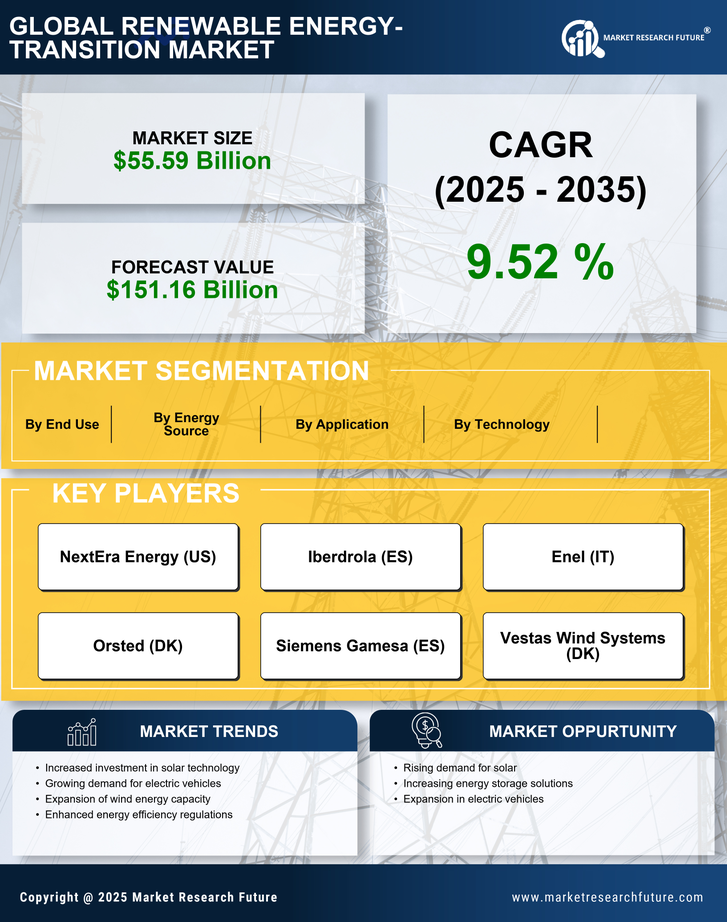

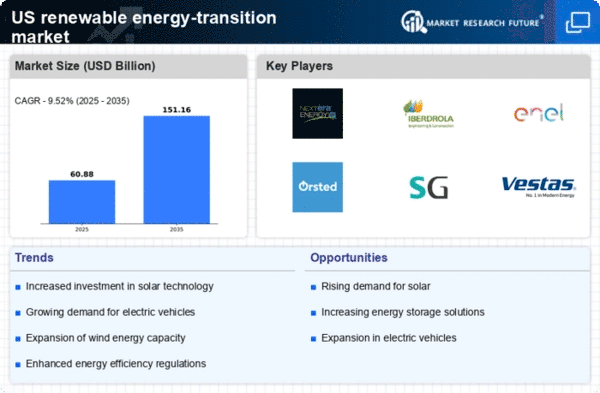

The renewable energy-transition market is experiencing a surge in investment, driven by both public and private sectors. In 2025, investments in renewable energy infrastructure in the US are projected to exceed $100 billion, reflecting a growing commitment to sustainable energy sources. This influx of capital is likely to enhance the development of solar, wind, and other renewable technologies, thereby accelerating the transition away from fossil fuels. Furthermore, the establishment of new renewable energy projects not only creates jobs but also stimulates local economies, contributing to a more resilient energy landscape. As financial institutions increasingly prioritize green investments, The renewable energy-transition market is poised for substantial growth. This indicates a robust future for clean energy initiatives.

Rising Energy Costs and Market Volatility

The renewable energy-transition market is being shaped by rising energy costs and market volatility associated with fossil fuels. As traditional energy prices fluctuate, consumers and businesses are increasingly seeking stable and predictable energy sources. The cost of renewable energy has decreased significantly, with solar and wind energy now often cheaper than fossil fuels in many regions. This economic advantage is prompting a shift towards renewable energy solutions, as stakeholders recognize the long-term financial benefits. Consequently, the renewable energy-transition market is likely to expand as more entities prioritize energy independence and cost stability, further driving the transition away from conventional energy sources.

Technological Innovations in Energy Generation

Technological advancements are playing a pivotal role in the renewable energy-transition market. Innovations in solar panel efficiency, wind turbine design, and energy generation methods are enhancing the viability of renewable sources. For instance, the efficiency of solar panels has improved by approximately 20% over the past few years, making solar energy more competitive with traditional energy sources. Additionally, the integration of smart grid technologies is optimizing energy distribution and consumption, further supporting the transition to renewable energy. These technological breakthroughs not only lower costs but also increase the reliability of renewable energy systems, thereby attracting more stakeholders to invest in the market.

Public Awareness and Education on Renewable Energy

Public awareness and education regarding renewable energy are crucial drivers of the renewable energy-transition market. As more individuals become informed about the environmental and economic benefits of renewable energy, there is a growing demand for clean energy solutions. Educational initiatives and community programs are fostering a better understanding of renewable technologies, which in turn encourages adoption at the consumer level. Surveys indicate that nearly 70% of Americans support increased investment in renewable energy, reflecting a shift in public sentiment. This heightened awareness is likely to influence policy decisions and market dynamics, ultimately propelling the renewable energy-transition market forward.