Rising Cyber Threat Landscape

The security operation-center market is experiencing heightened demand due to the escalating cyber threat landscape in the US. Organizations are increasingly targeted by sophisticated cyber attacks, which have surged by approximately 30% in recent years. This alarming trend compels businesses to invest in robust security measures, leading to a significant uptick in the establishment of security operation centers. The need for real-time threat detection and response capabilities is paramount, as companies seek to safeguard sensitive data and maintain operational integrity. Consequently, the security operation center market is projected to grow at a significant rate over the next five years, reflecting the urgency to address these evolving threats.

Regulatory Compliance Pressures

The security operation-center market is significantly influenced by the increasing pressures of regulatory compliance. Organizations are required to adhere to a myriad of regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Non-compliance can result in severe penalties, prompting businesses to invest in security operation centers to ensure they meet these stringent requirements. This trend is likely to drive market growth, as companies recognize the necessity of implementing comprehensive security measures to avoid legal repercussions. The market is expected to expand as organizations prioritize compliance-driven security strategies.

Shift Towards Remote Work Security

The shift towards remote work has transformed the security operation-center market landscape. As more employees work from home, organizations face new security challenges, necessitating the establishment of robust security operation centers to protect remote access points. This trend has led to an increased focus on securing endpoints and ensuring data integrity across distributed networks. The market is projected to grow as companies invest in solutions that facilitate secure remote work environments. Analysts estimate that the demand for security operation centers will rise by approximately 25% in response to this ongoing shift, highlighting the need for adaptive security strategies.

Advancements in Security Technologies

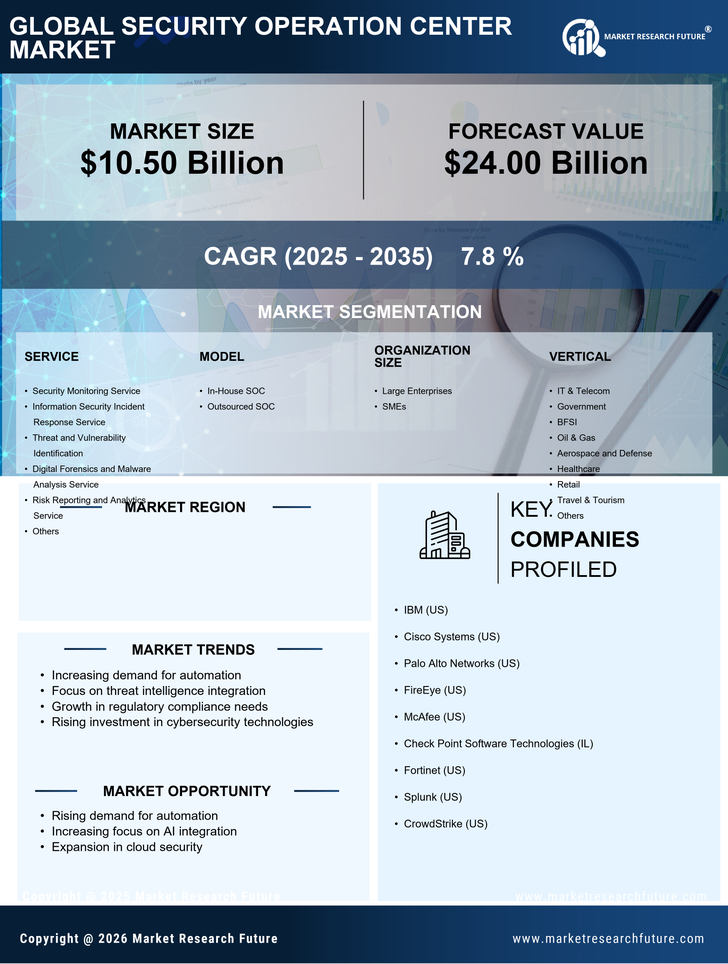

Technological advancements play a crucial role in shaping the security operation-center market. Innovations such as machine learning, behavioral analytics, and threat intelligence platforms are revolutionizing how organizations approach cybersecurity. These technologies enhance the ability to detect anomalies and respond to incidents swiftly, thereby improving overall security posture. As organizations increasingly adopt these advanced solutions, the market is expected to witness substantial growth. In fact, the integration of cutting-edge technologies is anticipated to contribute to a market expansion of approximately $15 billion by 2027. This trend underscores the importance of staying ahead in the security operation-center market to effectively combat emerging threats.

Increased Investment in Cybersecurity

The security operation-center market is benefiting from a surge in investment in cybersecurity initiatives across various sectors in the US. Organizations are allocating larger portions of their budgets to enhance their security frameworks, with an estimated increase of 20% in cybersecurity spending over the past year. This trend is driven by the recognition of cybersecurity as a critical business priority, prompting companies to establish or upgrade their security operation centers. As a result, the market is projected to reach a valuation of $40 billion by 2026, reflecting the growing commitment to protecting digital assets and ensuring compliance with regulatory requirements.