Focus on Security Enhancements

Security remains a paramount concern in the aviation sector, driving the smart airport market towards innovative solutions. Airports are increasingly adopting biometric screening technologies and advanced surveillance systems to enhance security measures. These technologies not only improve passenger safety but also expedite the security process, thereby enhancing the overall travel experience. The market for security-related technologies within smart airports is anticipated to grow significantly, with estimates suggesting a growth rate of approximately 15% annually. This focus on security enhancements is essential for maintaining public trust and ensuring the safety of air travel.

Sustainability and Environmental Regulations

The smart airport market is also influenced by the growing emphasis on sustainability and compliance with environmental regulations. Airports are under pressure to reduce their carbon footprints and implement eco-friendly practices. This includes the adoption of renewable energy sources, waste reduction initiatives, and sustainable building practices. As a result, many airports are investing in smart technologies that facilitate energy efficiency and resource management. The market is projected to expand as airports align with sustainability goals, with estimates indicating a potential increase in investments in green technologies by over $5 billion by 2030.

Government Investments in Airport Infrastructure

Government initiatives play a crucial role in the development of the smart airport market. In the US, federal and state governments are allocating substantial funds towards upgrading airport infrastructure. This includes investments in smart technologies that enhance security, efficiency, and sustainability. For example, the Federal Aviation Administration (FAA) has proposed funding programs aimed at modernizing airport facilities. Such investments are likely to bolster the smart airport market, with projections indicating a potential increase in market size by over $10 billion by 2030, as airports adopt advanced technologies to meet regulatory standards and improve service delivery.

Technological Advancements in Airport Operations

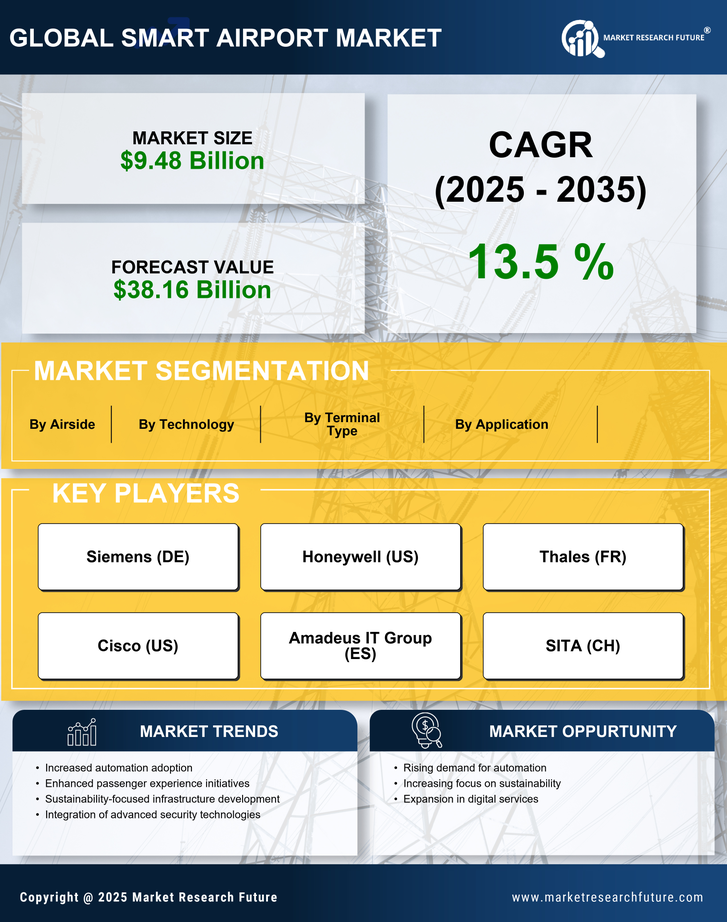

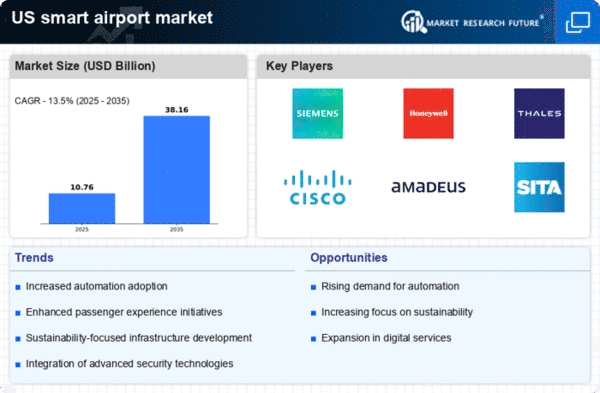

The smart airport market is experiencing a surge in technological advancements that enhance operational efficiency. Innovations such as automated baggage handling systems and advanced air traffic management solutions are being integrated into airport infrastructures. These technologies not only streamline processes but also improve passenger experiences. For instance, the implementation of Internet of Things (IoT) devices allows for real-time monitoring of airport operations, which can lead to a reduction in delays and increased safety. According to recent estimates, the smart airport market is projected to grow at a CAGR of approximately 25% from 2025 to 2030, driven by these technological enhancements.

Increased Passenger Demand for Enhanced Experiences

As air travel continues to rise, the smart airport market is driven by the increasing demand for enhanced passenger experiences. Travelers are seeking seamless and efficient processes, from check-in to boarding. Airports are responding by implementing smart technologies such as mobile check-in applications and self-service kiosks. These innovations not only reduce wait times but also provide personalized services, catering to the preferences of modern travelers. The market is expected to witness a growth rate of around 20% annually, as airports invest in technologies that prioritize customer satisfaction and operational efficiency.