Increased Healthcare Expenditure

The rising healthcare expenditure in the US is significantly impacting the soft tissue-repair market. As healthcare budgets expand, there is a greater allocation of funds towards surgical procedures and rehabilitation services. In 2025, healthcare spending in the US is projected to reach approximately $4 trillion, with a substantial portion directed towards orthopedic and soft tissue repair procedures. This financial commitment indicates a robust market environment, fostering the development of new technologies and treatment options. Furthermore, increased insurance coverage for surgical interventions enhances patient access to necessary treatments, thereby stimulating demand within the soft tissue-repair market.

Rising Incidence of Sports Injuries

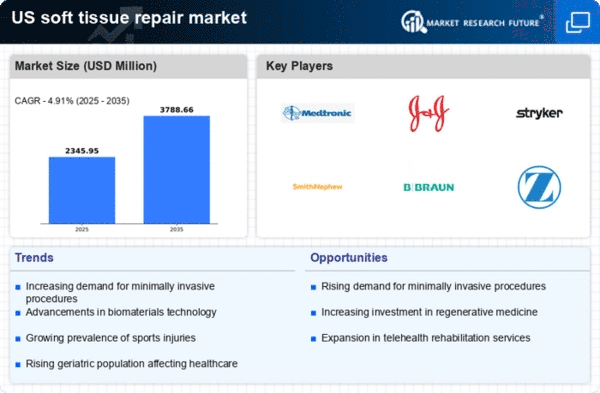

The increasing prevalence of sports-related injuries in the US is a notable driver for the soft tissue-repair market. With more individuals participating in various sports and physical activities, the demand for effective repair solutions is on the rise. According to recent data, sports injuries account for approximately 20% of all injuries in the US, leading to a growing need for surgical interventions and rehabilitation products. This trend is likely to propel the soft tissue-repair market, as athletes and active individuals seek advanced treatments to recover swiftly and return to their activities. The market is expected to witness a compound annual growth rate (CAGR) of around 6% over the next few years, driven by innovations in repair techniques and materials.

Rising Incidence of Chronic Conditions

The increasing prevalence of chronic conditions, such as diabetes and obesity, is emerging as a significant driver for the soft tissue-repair market. These conditions often lead to complications that necessitate surgical interventions for soft tissue repair. In the US, the prevalence of diabetes is projected to reach 34 million individuals by 2025, creating a substantial demand for effective repair solutions. Additionally, obesity rates continue to rise, contributing to a higher incidence of related injuries and conditions requiring soft tissue repair. This trend suggests that the soft tissue-repair market will likely expand as healthcare providers seek to address the needs of this growing patient population.

Growing Awareness of Advanced Treatment Options

There is a notable increase in awareness regarding advanced treatment options available for soft tissue injuries among both healthcare professionals and patients. Educational initiatives and marketing efforts by manufacturers are contributing to this trend, leading to a more informed patient population. As individuals become more knowledgeable about the benefits of innovative repair techniques, such as tissue engineering and regenerative medicine, the demand for these solutions is likely to rise. This heightened awareness is expected to drive growth in the soft tissue-repair market, as patients actively seek out the latest advancements to enhance their recovery outcomes.

Technological Innovations in Surgical Procedures

Technological innovations in surgical procedures are playing a crucial role in shaping the soft tissue-repair market. The introduction of advanced surgical instruments, imaging technologies, and minimally invasive techniques has revolutionized the way soft tissue injuries are treated. These innovations not only improve surgical outcomes but also reduce recovery times, making them appealing to both patients and healthcare providers. As hospitals and surgical centers adopt these cutting-edge technologies, the soft tissue-repair market is likely to experience significant growth. The integration of robotics and artificial intelligence in surgical procedures further enhances precision and efficiency, potentially leading to a more favorable market landscape.