Increasing Incidence of Stroke Cases

The rising incidence of stroke cases in the US is a significant driver for the stroke post-processing-software market. According to the Centers for Disease Control and Prevention (CDC), stroke remains a leading cause of death and long-term disability. With an estimated 795,000 strokes occurring annually, the demand for effective diagnostic and treatment solutions is paramount. This growing patient population necessitates the implementation of advanced post-processing software to ensure timely and accurate assessments. Healthcare facilities are investing in these technologies to improve patient outcomes and streamline workflows. The market is expected to expand as healthcare providers seek to enhance their capabilities in managing the increasing volume of stroke cases, thereby driving revenue growth in the industry.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is influencing the stroke post-processing-software market significantly. As healthcare moves away from a one-size-fits-all approach, there is an increasing emphasis on tailored treatment plans based on individual patient data. Post-processing software plays a crucial role in analyzing patient-specific imaging data, enabling clinicians to make informed decisions regarding treatment options. This trend is supported by advancements in data analytics and machine learning, which enhance the software's ability to provide personalized insights. The market is likely to see substantial growth as healthcare providers adopt these technologies to improve patient care and outcomes, aligning with the broader movement towards personalized healthcare solutions.

Technological Advancements in Imaging Techniques

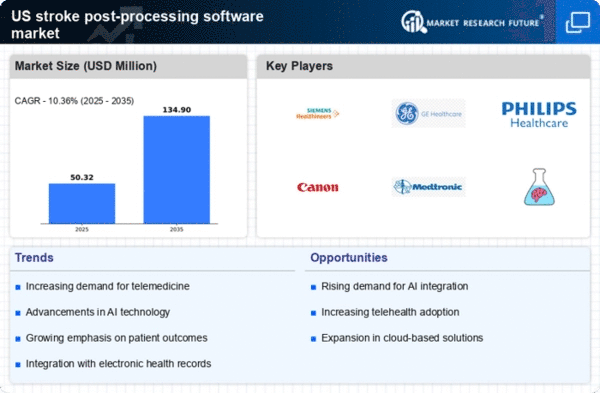

The stroke post-processing-software market is experiencing a surge due to rapid advancements in imaging technologies. Innovations such as high-resolution MRI and CT scans have enhanced the ability to detect and analyze strokes more effectively. These technologies facilitate the generation of detailed images, which are crucial for accurate diagnosis and treatment planning. As a result, healthcare providers are increasingly adopting sophisticated post-processing software to interpret these images. The market is projected to grow at a CAGR of approximately 8% over the next five years, driven by the need for improved diagnostic tools. This trend indicates a strong demand for software solutions that can integrate seamlessly with advanced imaging systems, thereby enhancing the overall efficiency of stroke management in clinical settings.

Rising Investment in Healthcare IT Infrastructure

Investment in healthcare IT infrastructure is a critical driver for the stroke post-processing-software market. As hospitals and clinics upgrade their technological capabilities, there is a growing need for software that can integrate with existing systems and enhance operational efficiency. The US healthcare sector is witnessing a shift towards digital transformation, with significant funding allocated to improve IT infrastructure. This trend is expected to continue, as organizations recognize the importance of data interoperability and real-time access to patient information. Consequently, the demand for advanced post-processing software is likely to increase, as healthcare providers seek solutions that can optimize workflows and improve the quality of care delivered to stroke patients.

Regulatory Support for Advanced Healthcare Solutions

Regulatory bodies in the US are increasingly supporting the adoption of advanced healthcare technologies, which positively impacts the stroke post-processing-software market. Initiatives aimed at improving patient care and outcomes have led to the establishment of guidelines that encourage the use of innovative software solutions. For instance, the Food and Drug Administration (FDA) has streamlined the approval process for software that aids in stroke diagnosis and treatment. This regulatory support fosters an environment conducive to innovation, allowing developers to bring new products to market more efficiently. As a result, healthcare providers are more likely to invest in cutting-edge post-processing software, anticipating that these solutions will meet regulatory standards and improve clinical practices.