Rising Demand for Energy Efficiency

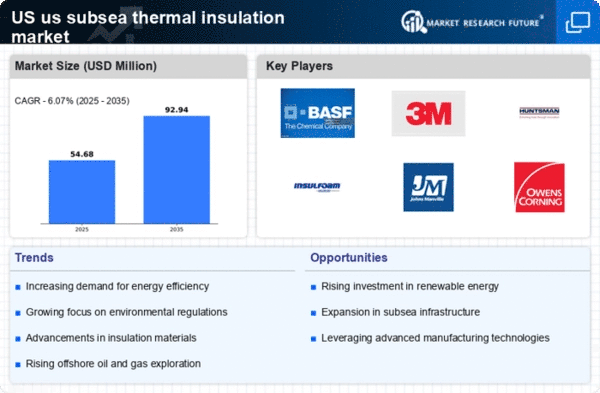

The US Subsea Thermal Insulation Market is experiencing a notable increase in demand for energy-efficient solutions. As energy costs continue to rise, operators are seeking ways to minimize thermal losses in subsea pipelines and equipment. This trend is further supported by the US government's initiatives aimed at promoting energy efficiency across various sectors. The implementation of energy-efficient thermal insulation can lead to significant cost savings, thereby enhancing the overall profitability of subsea operations. According to recent estimates, the market for subsea thermal insulation is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by this increasing focus on energy efficiency.

Environmental Regulations and Compliance

The US Subsea Thermal Insulation Market is increasingly shaped by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Regulatory bodies are enforcing guidelines that necessitate the use of environmentally friendly insulation materials in subsea applications. This shift towards compliance is compelling companies to invest in innovative thermal insulation solutions that not only meet regulatory standards but also enhance operational efficiency. The market is likely to see a rise in demand for bio-based and recyclable insulation materials, as companies strive to align with environmental policies while maintaining performance standards in subsea operations.

Growing Offshore Oil and Gas Exploration

The US Subsea Thermal Insulation Market is significantly influenced by the ongoing expansion of offshore oil and gas exploration activities. As companies venture into deeper waters, the need for effective thermal insulation becomes paramount to ensure the integrity and efficiency of subsea systems. The US has seen a resurgence in offshore drilling, particularly in regions like the Gulf of Mexico, where new technologies are being deployed to enhance extraction processes. This growth in exploration activities is expected to drive the demand for advanced thermal insulation solutions, with market analysts predicting a steady increase in insulation material requirements to support these operations.

Increased Investment in Renewable Energy Projects

The US Subsea Thermal Insulation Market is also being driven by the growing investment in renewable energy projects, particularly offshore wind farms. As the US government prioritizes the transition to renewable energy sources, there is a corresponding need for effective thermal insulation solutions to support the infrastructure of these projects. Offshore wind installations require robust thermal management systems to ensure optimal performance and longevity. This trend is likely to create new opportunities for thermal insulation manufacturers, as they develop products tailored to the unique requirements of renewable energy applications. Analysts predict that this shift towards renewables will contribute to a diversified growth trajectory for the subsea thermal insulation market.

Technological Innovations in Insulation Solutions

The US Subsea Thermal Insulation Market is benefiting from rapid technological advancements in insulation materials and application techniques. Innovations such as nanotechnology and advanced polymer composites are enhancing the thermal performance and durability of subsea insulation products. These developments are crucial for meeting the challenges posed by extreme underwater conditions, including high pressures and varying temperatures. As companies seek to improve the reliability and lifespan of their subsea systems, the adoption of these advanced insulation technologies is expected to rise. Market forecasts indicate that the integration of innovative insulation solutions could lead to a substantial increase in market share for manufacturers focusing on research and development.