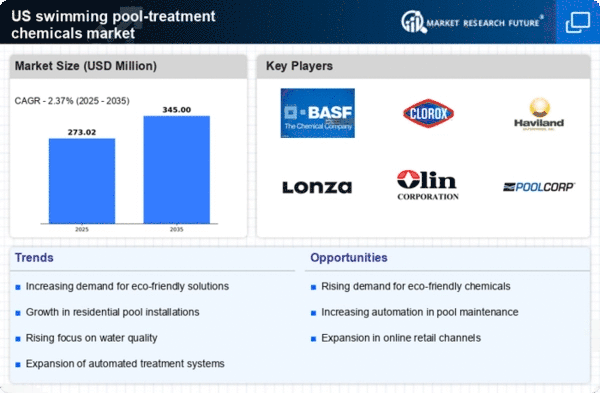

The swimming pool-treatment-chemicals market in the US is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Clorox Company (US), Pool Corporation (US), and BASF SE (DE) are actively pursuing strategies that emphasize product differentiation and technological advancements. Clorox Company (US) has focused on enhancing its product portfolio with eco-friendly solutions, which aligns with the growing consumer demand for sustainable products. Meanwhile, Pool Corporation (US) has been expanding its distribution network, thereby increasing its market reach and operational efficiency. BASF SE (DE) appears to be investing heavily in research and development to innovate new chemical formulations that improve water quality and reduce environmental impact, collectively shaping a competitive environment that prioritizes sustainability and innovation.The market structure is moderately fragmented, with a mix of large multinational corporations and smaller regional players. Key business tactics such as localizing manufacturing and optimizing supply chains are prevalent among major companies. For instance, Pool Corporation (US) has localized its manufacturing processes to reduce lead times and enhance responsiveness to market demands. This strategy not only improves operational efficiency but also allows for better alignment with local consumer preferences, thereby strengthening its competitive position.

In October Clorox Company (US) announced the launch of a new line of biodegradable pool chemicals aimed at reducing environmental impact. This strategic move is significant as it positions Clorox as a leader in sustainability within the market, catering to the increasing consumer preference for eco-friendly products. The introduction of these biodegradable options may enhance brand loyalty and attract environmentally conscious consumers, thereby potentially increasing market share.

In September Pool Corporation (US) expanded its distribution capabilities by acquiring a regional distributor in the Midwest. This acquisition is strategically important as it not only broadens Pool Corporation's geographic footprint but also enhances its ability to serve a growing customer base more effectively. The move is likely to improve supply chain efficiencies and reduce costs, further solidifying its competitive advantage in the market.

In August BASF SE (DE) unveiled a new line of advanced water treatment chemicals designed to improve the efficiency of chlorine use in pools. This innovation is crucial as it addresses the ongoing challenges of chemical management and water quality, potentially leading to cost savings for pool owners. By focusing on technological advancements, BASF is likely to strengthen its market position and appeal to a broader customer base seeking effective and efficient solutions.

As of November the competitive trends in the swimming pool-treatment-chemicals market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing product offerings. The shift from price-based competition to a focus on technology, innovation, and supply chain reliability is evident. Companies that prioritize these aspects are likely to differentiate themselves in a crowded market, ensuring long-term success and resilience.