Emergence of Smart Devices

The system on-module market is significantly influenced by the emergence of smart devices across various applications. As the Internet of Things (IoT) continues to expand, the demand for system on-modules that can support smart functionalities is likely to increase. These modules enable seamless connectivity and integration of smart features in devices ranging from home appliances to industrial equipment. Recent projections suggest that the smart device market is expected to exceed $1 trillion by 2027, highlighting the potential for growth in the system on-module market. This trend indicates a shift towards more intelligent and interconnected systems, where system on-modules serve as the backbone for enabling smart capabilities.

Rising Demand for Compact Solutions

The system on-module market is witnessing a growing demand for compact and integrated solutions across various sectors. As devices become smaller and more powerful, the need for system on-modules that offer high performance in limited space is becoming increasingly critical. This trend is particularly evident in consumer electronics, automotive, and healthcare applications, where space constraints are prevalent. Market analysis indicates that the compact electronics market is projected to grow by 25% over the next five years, which may further propel the system on-module market. The ability of these modules to deliver robust functionality in a small footprint positions them as essential components in modern electronic designs.

Increased Adoption of Edge Computing

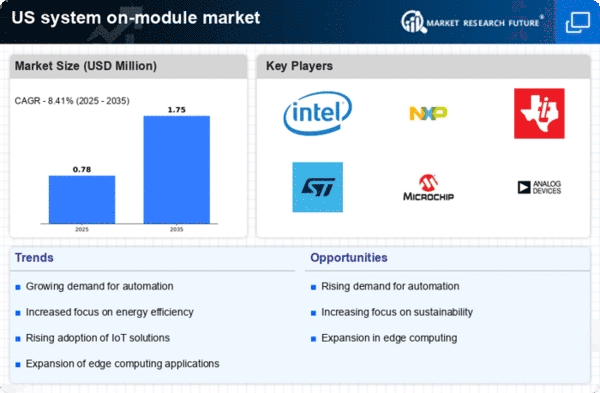

The system on-module market is experiencing a notable surge in the adoption of edge computing technologies. This trend is driven by the need for real-time data processing and reduced latency in various applications, including industrial automation and smart cities. As organizations increasingly seek to process data closer to the source, the demand for compact and efficient system on-modules is likely to rise. According to recent estimates, the edge computing market is projected to grow at a CAGR of approximately 30% over the next five years, which could significantly impact the system on-module market. This growth indicates a shift towards decentralized computing solutions, where system on-modules play a crucial role in enabling efficient data handling and analytics at the edge.

Growing Focus on Automation in Manufacturing

The system on-module market is poised to benefit from the growing emphasis on automation within the manufacturing sector. As manufacturers strive to enhance productivity and reduce operational costs, the integration of advanced technologies, including system on-modules, becomes increasingly vital. These modules facilitate the deployment of automation solutions, enabling real-time monitoring and control of manufacturing processes. Recent data suggests that the automation market in the US is expected to reach $200 billion by 2026, indicating a robust demand for system on-modules that support automation initiatives. This trend underscores the importance of system on-modules in driving efficiency and innovation in manufacturing operations.

Advancements in Wireless Communication Technologies

The system on-module market is benefiting from advancements in wireless communication technologies, which are essential for modern applications. As the demand for high-speed connectivity and reliable communication increases, system on-modules that incorporate advanced wireless capabilities are becoming more prevalent. Technologies such as 5G and Wi-Fi 6 are driving the need for modules that can support these high-performance standards. Market forecasts indicate that the 5G infrastructure market is projected to reach $300 billion by 2030, suggesting a substantial opportunity for the system on-module market. This growth reflects the increasing reliance on wireless communication in various sectors, further emphasizing the importance of system on-modules in facilitating seamless connectivity.