US TV Analytics Market Overview:

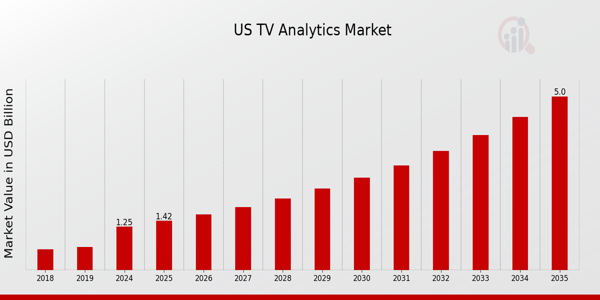

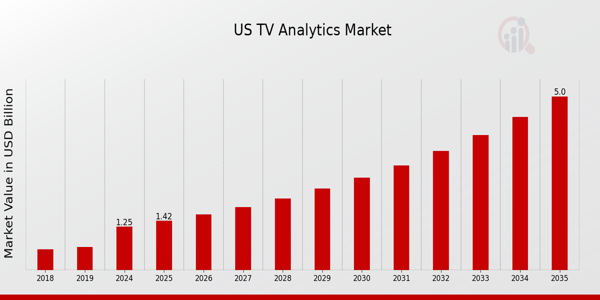

As per MRFR analysis, the US TV Analytics Market Size was estimated at 0.99 (USD Billion) in 2023. The US TV Analytics Market Industry is expected to grow from 1.25(USD Billion) in 2024 to 5 (USD Billion) by 2035. The US TV Analytics Market CAGR (growth rate) is expected to be around 13.431% during the forecast period (2025 - 2035).

Key US TV Analytics Market Trends Highlighted

The US TV Analytics Market is witnessing significant trends driven by the evolution of media consumption patterns and technological advancements. One key market driver is the increasing demand for detailed audience insights, which is being fueled by the growth of streaming services and the decline of traditional cable TV. As consumer preferences shift towards on-demand content, advertisers and broadcasters are seeking robust analytics tools to understand viewership habits and optimize their strategies accordingly.

The rise of smart TVs and connected devices plays a substantial role in this transformation, providing the necessary data for comprehensive analysis.Recent times have seen a surge in the adoption of AI and machine learning technologies within TV analytics, allowing for real-time data processing and improved predictive capabilities. This trend enables stakeholders to make informed decisions quickly and refine their advertising strategies effectively.

Additionally, integration of social media analytics with TV viewership data is becoming more prevalent, offering a fuller picture of audience engagement across multiple platforms. Opportunities for growth within the US TV Analytics Market include leveraging advanced analytics in programmatic advertising, which has gained traction as a more efficient way to reach target audiences.Another area to explore is harnessing the data generated from user-generated content and interactive TV experiences, which are increasingly popular among younger audiences.

Overall, the convergence of technology, changing consumer behavior, and the need for precise marketing strategies are driving innovation and growth in the market, positioning it for further advancement in the coming years.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

US TV Analytics Market Drivers

Rising Demand for Personalized Content

The increasing demand for personalized content in the US TV Analytics Market Industry is significantly driving market growth. According to a report by the Federal Communications Commission, approximately 80% of viewers express a preference for personalized recommendations when consuming television content, highlighting the importance of tailoring experiences to individual viewers. Companies like Netflix and Hulu leverage advanced analytics to capture viewer preferences, improving customer satisfaction and retention rates.The United States Census Bureau also indicates that the shift towards personalized content aligns with the demographic trends toward a younger audience, who are more inclined to engage with tailored programming.

This trend is expected to significantly enhance the US TV Analytics Market Industry as media companies focus on integrating analytics to provide customized viewer experiences, thereby boosting their audience engagement and revenue.

Technological Advancement in Data Analytics

Technological advances in data analytics tools are fueling the growth of the US TV Analytics Market Industry. The Government Accountability Office reported that investments in technology by media companies have increased by over 40% in recent years, leading to improved processes for collecting and analyzing viewer data.

Premier companies such as Adobe and Google have developed sophisticated analytics tools that allow networks to gather comprehensive data on viewer behaviors in real-time.This has transformed the way content is produced and marketed in the United States, as networks utilize data-driven strategies to optimize their programming and ad placements, ultimately enhancing profitability in a competitive marketplace.

Increase in Streaming Services

The surge in streaming services is a major driver for the US TV Analytics Market Industry. The US has seen a nearly 50% increase in streaming platform subscriptions over the past three years, supported by data from the Motion Picture Association, which noted that subscription-video-on-demand has rapidly outpaced traditional TV viewing.

Companies like Disney+ and Amazon Prime Video are utilizing analytics to track viewer engagement and content preferences, enabling them to deliver more targeted advertising and programming.This shift towards streaming presents a significant opportunity for the US TV Analytics Market Industry, as networks adapt their strategies to include deeper analytics insights to cater to evolving consumer behaviors.

US TV Analytics Market Segment Insights:

TV Analytics Market Application Insights

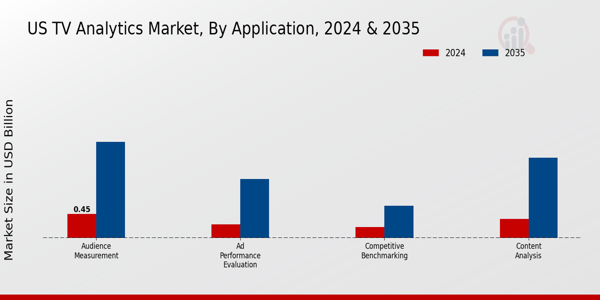

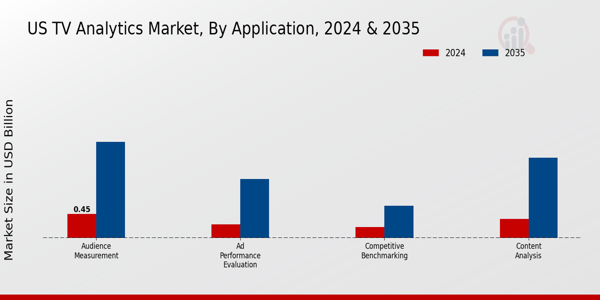

The Application segment of the US TV Analytics Market encompasses crucial functions that result in enhanced decision-making for stakeholders across the industry. As the industry evolves, the Application segment is set to play an instrumental role in transforming TV viewership data into actionable insights, catering to a diverse range of requirements. Content Analysis stands as a significant aspect, helping networks and producers understand viewer preferences and trends, thus driving programming decisions and content development strategies.

This analytics process becomes essential as the market adapts to the changing consumption patterns of audiences, particularly with the rise of on-demand services. On the other hand, Audience Measurement challenges industry players to refine their engagement strategies by providing detailed insights into viewing habits and demographic specifics. This allows advertisers and content creators to target their desired audience effectively, maximizing their return on investment.

Audience insights enable a deeper understanding of viewer interaction across various platforms, allowing key players to keep pace with the rapid technological advancements and shifting viewing preferences that characterize the current landscape.Ad Performance Evaluation holds paramount significance in determining the effectiveness of advertising campaigns.

In a competitive landscape where advertising budgets are scrutinized, this evaluation process provides indispensable data regarding viewer engagement and conversion rates. Advertisers leverage this information to fine-tune their strategies, ensuring that campaigns resonate well with audiences while promoting brand recall and loyalty.Lastly, Competitive Benchmarking serves as an essential tool for networks and advertisers striving to maintain a competitive edge.

By analyzing how different offerings fare against each other in terms of viewership and engagement levels, industry players can identify growth opportunities and innovate accordingly. Understanding the competitive landscape ensures that stakeholders remain agile and responsive to market dynamics, which is vital in an industry marked by rapid changes and technological innovations. Together, these elements of the Application segment significantly contribute to the overall performance and strategy formulation within the US TV Analytics Market, paving the way for growth and evolution as consumer behaviors continue to shift toward increasingly tailored viewing experiences.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

TV Analytics Market Deployment Type Insights

The Deployment Type segment of the US TV Analytics Market is crucial in determining how analytics solutions are implemented and utilized across various platforms. With the growth of digital media consumption in the US, deployment models such as On-Premises and Cloud-Based have gained significant traction among broadcasters and content providers.

On-Premises solutions are often preferred by organizations requiring stringent data security and compliance measures, catering to the needs of enterprises that prioritize control over their infrastructure.On the other hand, Cloud-Based analytics are increasingly dominating the market due to their flexibility, scalability, and cost-effectiveness, enabling users to adapt to the rapidly evolving media landscape.

Trends indicate a shift towards cloud adoption, as businesses seek to leverage advanced analytics capabilities and real-time data processing. Furthermore, the rising demand for personalized viewer experiences and data-driven insights is driving the adoption rates of cloud solutions. As organizations in the US continue to focus on enhancing operational efficiency and gaining a competitive edge, both deployment types will play significant roles, addressing different user needs within the overarching TV Analytics Market.

TV Analytics Market End Use Insights

The End Use segment of the US TV Analytics Market encompasses various critical components that drive the industry forward. Broadcasters have increasingly embraced TV analytics to gain insights into viewing habits, enhancing content delivery and audience engagement, thus ensuring they remain competitive in a saturated market. Advertisers rely on comprehensive analytics data to tailor their campaigns, significantly improving targeting effectiveness and return on investment. Media agencies benefit from this data by optimizing advertising strategies, effectively bridging clients and broadcasters, while developing advertising initiatives based on audience behaviors.

Content Providers utilize analytics to evaluate the performance of their programming, allowing for adaptive content creation that addresses viewer preferences. The interplay between these entities fosters a dynamic ecosystem where data-driven decisions enhance market efficiency. With the growing significance of digital platforms and an ongoing shift in viewer consumption patterns, utilizing TV analytics to inform strategy is becoming increasingly paramount for these stakeholders in the US market. This holistic approach not only enhances user experience but also drives market growth, as businesses can make informed decisions based on real-time analytics data.

TV Analytics Market Analytics Type Insights

The US TV Analytics Market has shown significant growth in the Analytics Type segment, driven by the increasing need for data-driven decisions in the television industry. Descriptive Analytics plays a crucial role in providing comprehensive insights into historical trends and performance metrics, enabling broadcasters to understand viewer behavior and optimize content delivery. Predictive Analytics has gained prominence due to its ability to forecast audience preferences, thus allowing networks to tailor their programming more effectively and enhance viewer engagement.Meanwhile, Prescriptive Analytics offers strategic recommendations based on data analysis, supporting decision-makers in allocating resources and maximizing return on investment.

As the demand for personalized experiences rises, these analytics types become essential tools for companies looking to stay competitive in the evolving landscape of the US TV market. This continuous evolution reflects the industry's shift towards data-centric methodologies, positioning analytics as a cornerstone of strategic planning and execution.

US TV Analytics Market Key Players and Competitive Insights:

The US TV Analytics Market has evolved significantly in recent years, driven by advancements in technology, increasing demand for data-driven insights, and the continuous growth of streaming services. This market is marked by intense competition among key players who strive to harness data analytics to optimize advertising strategies, viewership analysis, and content performance metrics. Companies in this sector deploy sophisticated analytical tools to collect, analyze, and interpret viewer behavior, enabling broadcasters and advertisers to make informed decisions.

As the landscape continues to shift with changing consumer preferences and technological innovations, understanding the competitive dynamics within the US TV analytics space is essential for stakeholders aiming to capture market share and enhance their service offerings.Nielsen remains a dominant player in the US TV Analytics Market, leveraging its extensive experience and comprehensive data resources to provide insights into audience behavior and media consumption trends. Strengthened by its long-standing reputation, the company offers a wide range of analytics solutions designed to help broadcasters and advertisers understand viewers' preferences and optimize their content accordingly.

Nielsen's established methodologies in audience measurement and ratings provide advertisers essential insights for effective targeting and campaign strategies.

The company's vast network and partnerships within the media sector further solidify its market presence, allowing it to maintain its position as a key contributor to TV analytics. With a focus on accuracy and reliability, Nielsen continuously adapts its methodologies to meet the evolving needs of the television landscape, ensuring it remains relevant in an increasingly competitive environment.Roku has emerged as a significant player in the US TV Analytics Market through its innovative platform that integrates streaming services and advertising solutions.

The company offers solutions that help advertisers reach potential customers through targeted marketing strategies, utilizing its analytics capabilities to enhance campaign effectiveness. Roku's strengths lie in its user-friendly interface and strong brand loyalty, allowing it to capture a substantial share of the streaming audience. The company has made strategic investments and acquisitions to bolster its technology and reach, including partnerships that enhance its data analytics offerings.

As Roku expands its services, the company remains focused on providing advertisers with comprehensive insights into viewer behavior across various platforms, thereby solidifying its role as a critical contributor to the evolving dynamics of the US TV Analytics Market.

Key Companies in the US TV Analytics Market Include:

US TV Analytics Market Industry Developments

The US TV Analytics Market is witnessing significant developments, with notable activities involving key players such as Nielsen, Roku, and Comscore. Nielsen has recently enhanced its TV measurement services, responding to the growing demand for comprehensive audience data as streaming platforms expand. In November 2023, Roku and Nielsen announced a partnership to integrate data for better advertising insights, allowing advertisers more precise targeting. Concurrently, Facebook has ramped up its video analytics capabilities, aiming to increase advertising efficiency on its platforms.

In the realm of acquisitions, in June 2023, Warner Bros Discovery acquired a stake in Kantar to boost its data-driven content strategies, marking a pivotal moment in the competitive landscape. Conviva's excellent performance in streaming analytics has led to a collaboration with Adobe to optimize real-time viewing experiences. Growth has been notably seen in companies like Amazon, which continues to expand its analytical tools for Prime Video, enhancing viewer engagement and satisfaction.

Over the past two years, the valuation of the US TV Analytics Market has grown significantly, reflecting increased investments and technological advancements, as seen in collaborations and innovations across various platforms.

US TV Analytics Market Segmentation Insights

TV Analytics Market Application Outlook

- Ad Performance Evaluation

TV Analytics Market Deployment Type Outlook

TV Analytics Market End Use Outlook

TV Analytics Market Analytics Type Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

0.99(USD Billion) |

| MARKET SIZE 2024 |

1.25(USD Billion) |

| MARKET SIZE 2035 |

5.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

13.431% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Nielsen, Roku, Conviva, Facebook, Warner Bros Discovery, Kantar, Thinknum, iSpot.tv, Comscore, Google, Adobe, TVision, Amazon, Verizon Media, Pivotal Research Group |

| SEGMENTS COVERED |

Application, Deployment Type, End Use, Analytics Type |

| KEY MARKET OPPORTUNITIES |

Real-time audience engagement insights, Advanced predictive analytics tools, Integration of AI-driven analytics, Enhanced cross-platform measurement solutions, Growth in connected TV advertising |

| KEY MARKET DYNAMICS |

growing demand for data-driven insights, increasing adoption of OTT platforms, rise in advertising spending, advancements in AI and machine learning, emphasis on audience engagement metrics |

| COUNTRIES COVERED |

US |

Frequently Asked Questions (FAQ):

The US TV Analytics Market is expected to be valued at approximately 1.25 billion USD in 2024.

By 2035, the US TV Analytics Market is projected to reach a valuation of about 5.0 billion USD.

The expected CAGR for the US TV Analytics Market from 2025 to 2035 is 13.431%.

The Audience Measurement application segment holds the largest market value at approximately 0.45 billion USD in 2024.

The Content Analysis application segment is expected to be valued at around 1.5 billion USD in 2035.

Major players in the US TV Analytics Market include companies such as Nielsen, Roku, and Adobe, among others.

The Ad Performance Evaluation segment is projected to reach a market size of approximately 1.1 billion USD by 2035.

The growth opportunities in the US TV Analytics Market stem from advancements in technology and increasing demand for data-driven decision-making.

In 2024, the US TV Analytics Market by application includes Content Analysis at 0.35 billion USD, Audience Measurement at 0.45 billion USD, Ad Performance Evaluation at 0.25 billion USD, and Competitive Benchmarking at 0.2 billion USD.

The US TV Analytics Market faces challenges related to data privacy regulations and the need for constant technological innovation.