Advancements in Technology

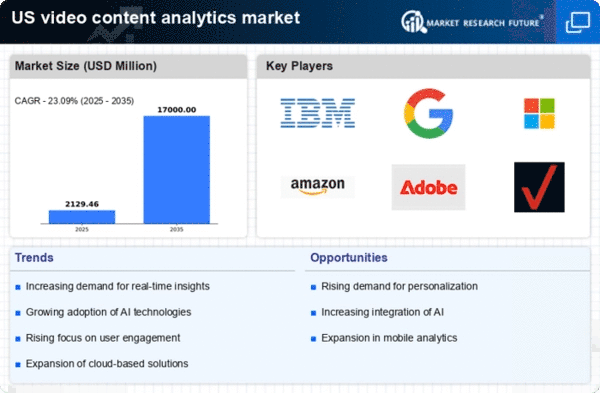

Technological advancements play a significant role in shaping the video content-analytics market. Innovations in cloud computing, big data, and artificial intelligence are enabling more sophisticated analytics capabilities. These technologies allow for the processing of vast amounts of video data in real-time, providing actionable insights to businesses. In 2025, the market for cloud-based video analytics solutions is projected to grow by approximately 25%, driven by the need for scalable and efficient analytics tools. As organizations increasingly adopt these technologies, the video content-analytics market is likely to expand, offering enhanced features such as automated reporting, predictive analytics, and improved data visualization.

Rising Demand for Video Content

The increasing consumption of video content across various platforms is a primary driver for the video content analytics market. As more businesses and individuals turn to video for marketing, education, and entertainment, the need for analytics to measure engagement and effectiveness becomes critical. In 2025, it is estimated that video will account for over 80% of all internet traffic in the US, highlighting the necessity for robust analytics solutions. Companies are seeking to understand viewer behavior, preferences, and trends to optimize their content strategies. This demand for insights is propelling the growth of the video content-analytics market, as organizations invest in tools that provide detailed analytics to enhance viewer engagement and content performance.

Regulatory Compliance and Data Privacy Concerns

Regulatory compliance and data privacy concerns are emerging as significant drivers for the video content-analytics market. With the implementation of stricter data protection regulations, businesses are compelled to adopt analytics solutions that ensure compliance while still providing valuable insights. In 2025, it is expected that over 60% of organizations will prioritize data privacy in their analytics strategies. This focus on compliance is likely to influence the development of video content-analytics tools that incorporate robust security features and transparent data handling practices. As companies navigate these regulatory landscapes, the demand for compliant analytics solutions will likely propel the growth of the video content-analytics market.

Growing Importance of Data-Driven Decision Making

The shift towards data-driven decision making is a crucial factor influencing the video content-analytics market. Organizations are recognizing the value of leveraging data to inform their strategies and improve outcomes. In 2025, it is anticipated that over 70% of companies in the US will prioritize data analytics in their operational processes. This trend is pushing businesses to invest in video content-analytics solutions that provide insights into viewer engagement, content performance, and ROI. By utilizing these analytics, companies can make informed decisions regarding content creation, distribution, and marketing strategies, thereby enhancing their competitive edge in the market.

Increased Investment in Marketing and Advertising

The surge in investment in digital marketing and advertising is significantly impacting the video content-analytics market. As businesses allocate larger portions of their budgets to video advertising, the need for effective analytics to measure campaign success becomes paramount. In 2025, it is projected that video advertising spending in the US will exceed $30 billion, underscoring the importance of analytics in optimizing ad performance. Companies are increasingly seeking analytics solutions that can provide insights into viewer demographics, engagement rates, and conversion metrics. This trend is likely to drive the growth of the video content-analytics market as organizations strive to maximize their advertising ROI.