Growing Emphasis on Cost Efficiency

Cost efficiency remains a critical driver for the virtual networking market. As businesses strive to optimize their operational expenditures, they are increasingly turning to virtual networking solutions that offer scalable and cost-effective alternatives to traditional networking methods. A recent survey indicated that nearly 70% of organizations are prioritizing cost reduction in their IT budgets. This focus on financial prudence is likely to propel the adoption of virtual networking technologies, as companies seek to minimize infrastructure costs while maintaining high levels of connectivity and performance.

Increased Focus on Data Privacy Regulations

The virtual networking market is also being shaped by the heightened focus on data privacy regulations. With the implementation of stringent laws such as the California Consumer Privacy Act (CCPA), organizations are compelled to adopt networking solutions that ensure compliance with these regulations. This shift is driving demand for virtual networking technologies that incorporate advanced security features and data protection measures. As businesses navigate the complexities of regulatory compliance, the virtual networking market is expected to see growth as companies seek solutions that safeguard sensitive information while facilitating seamless communication.

Rising Demand for Remote Collaboration Tools

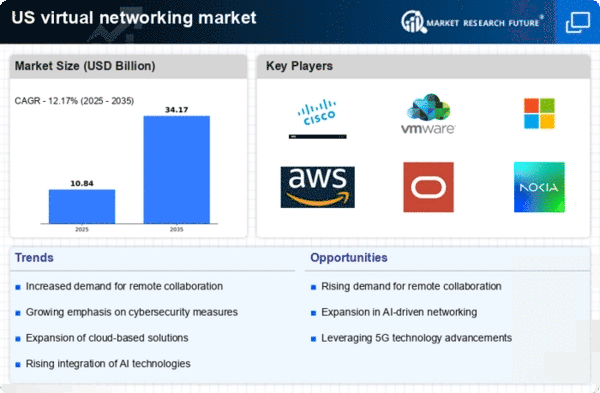

The virtual networking market is experiencing a notable surge in demand for remote collaboration tools. As organizations increasingly adopt flexible work arrangements, the need for effective virtual communication platforms has intensified. According to recent data, the market for collaboration software is projected to reach approximately $50 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This trend indicates that businesses are prioritizing tools that facilitate seamless interaction among remote teams. Consequently, the virtual networking market is likely to benefit from this shift, as companies seek solutions that enhance productivity and foster teamwork in a digital environment.

Expansion of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors are significantly influencing the virtual networking market. Organizations are increasingly investing in digital technologies to streamline operations and improve customer engagement. In the US, it is estimated that companies will allocate over $1 trillion to digital transformation efforts by 2025. This investment is expected to drive the demand for virtual networking solutions, as businesses require robust infrastructure to support their digital strategies. The virtual networking market is poised to capitalize on this trend, providing essential tools that enable organizations to adapt to the evolving digital landscape.

Advancements in Network Infrastructure Technologies

Technological advancements in network infrastructure are playing a pivotal role in the evolution of the virtual networking market. Innovations such as 5G technology and software-defined networking (SDN) are enhancing the capabilities of virtual networking solutions. The rollout of 5G is anticipated to provide faster and more reliable connectivity, which is crucial for the performance of virtual networking applications. As these technologies continue to mature, they are likely to drive the adoption of virtual networking solutions, enabling organizations to leverage enhanced bandwidth and reduced latency for their networking needs.